Idaho Champion Gold Mines Canada Inc. (CSE:ITKO; OTCQB:GLDRF; FSE:1QB1)("Idaho Champion" or the "Company") is pleased to announce the final round of assay results from the 2020 diamond core drilling program at its 100% controlled Baner Gold Project ("Baner") in the producing Elk City Mining District of Idaho

Drilling Highlights:

- ICGB2020-9 intersected 0.58 g/t gold ("Au") over 18.13 metres from 115.87 metres down hole

- including 3.21 g/t Au over 0.40 metre from 120.75 m

- also including 1.06 g/t over 5m from 125m down hole

- ICGB2020-10 intersected 0.73 g/t Au over 10.00 metres from 154 metres downhole.

- Including 12.90 g/t Au and 203 g/t silver ("Ag") over 0.30 m from 162.90 metres

- Drill holes ICBG2020-9 and ICBG2020-10 are the first known drill tests at the historic BL Mine, and the quartz-sulfide veins encountered are open along strike and at depth.

- 2020 core drilling at Baner increases the known north-south footprint of mineralization by approximately 1.75 kilometres ("km") to approximately 2.25 km.

"The latest drill results from the Baner Project extend our mineralized corridor by more than 400%. The new intercepts at the historic BL Mine included strong gold and silver grades, which are open along strike and at depth. It is early days yet, but this new stepout to the northeast clearly warrants more work," commented President and CEO, Jonathan Buick. "Baner drilling in 2020 showed us more of what we discovered in 2018. We continued to encounter near-surface gold in oxidized rocks, and this year we have seen strong gold values in sulfides as well. We had particularly good success within the central claim block, which will be a priority focus for us in the 2021 drill season."

Baner Drilling Technical Summary

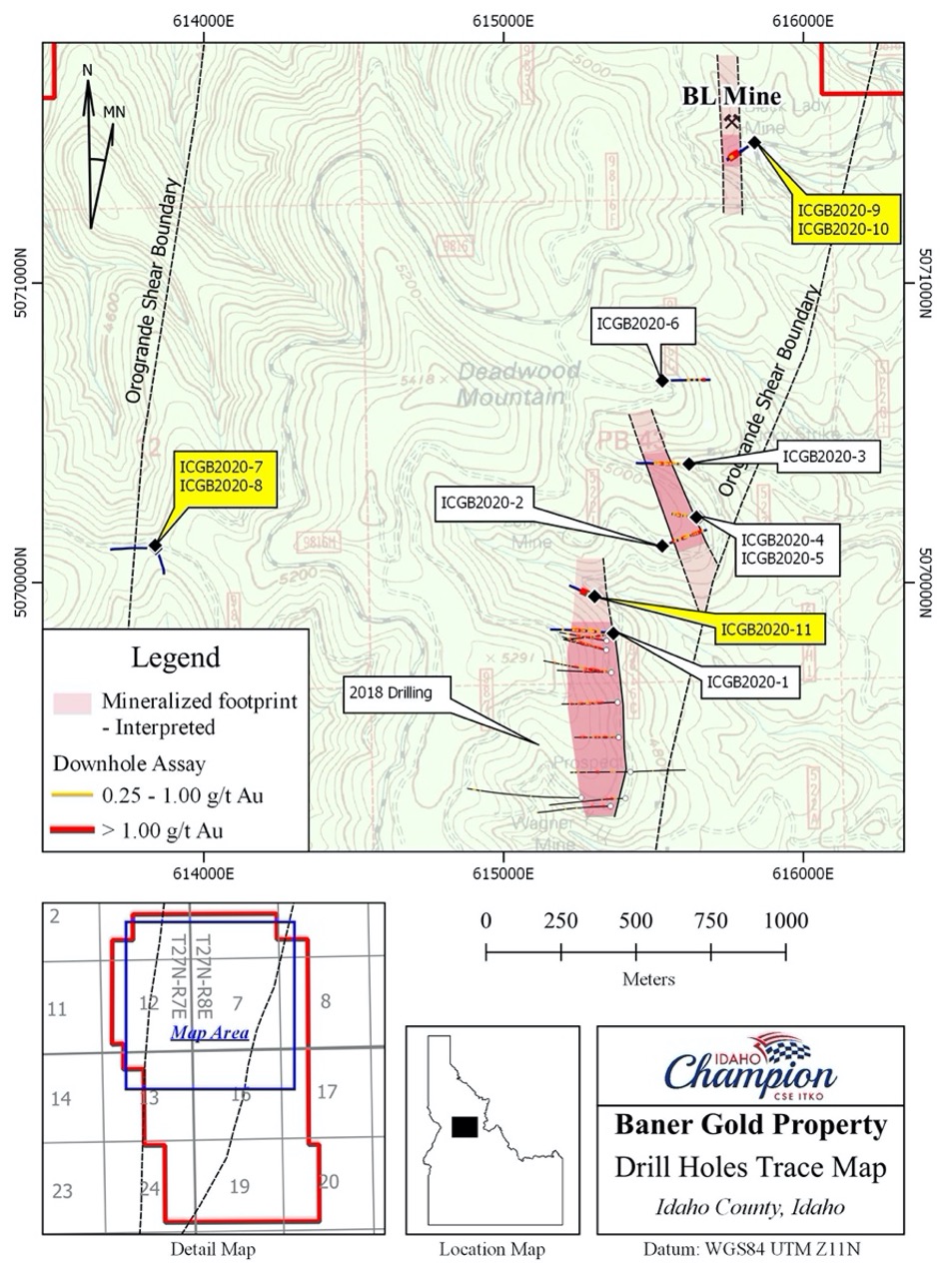

The 2020 drill program consisted of eleven (11) diamond drill holes totaling 2,190 metres (Figure 1). Seven core holes (ICGB2020-1 to 6, and 11) were placed centrally in the company's claim block, targeting the northern extension of the mineralization discovered in Idaho Champion's 2018 drill program (see press releases dated November 30, 2018). Core holes ICGB2020-7 and 8 were collared in the western area of the claim block, targeting strongly anomalous gold values in surface grab samples. Core holes ICGB20209 and 10 are within the northeast corner of the claim block, targeting the historical producing BL Mine.

Table 1: Summary of Significant Assay Results from 2020 Diamond Drill Hole Program Holes 8 to 11

Drill Hole | Style | From (m) | To(m) | Length (m)1 | Au (g/t) | Ag (g/t)2 |

ICGB2020-8 | NSV | |||||

ICGB2020-9 | Sulfide | 115.87 | 134.00 | 18.13 | 0.58 | - |

Including | ||||||

Sulfide | 125.00 | 130.00 | 5.00 | 1.06 | - | |

ICGB2020-10 | Sulfide | 154.00 | 164.00 | 10.00 | 0.73 | 7.25 |

Including | ||||||

Sulfide | 162.90 | 163.20 | 0.30 | 12.90 | 203.00 | |

ICGB2020-11 | NSV3 | |||||

11 Reported intervals are down-hole lengths and not true thickness. True thickness is estimated at 75-90% of reported down-hole length. No Au assays are cut and intervals are calculated using a 0.1 g/t Au cutoff and a maximum of 1.0 metres allowable waste internal to an interval and a minimum 5 gram-meters Au.

2Only Ag values greater than 5 g/t for any interval are reported.

3Hole ICGB2020-11 had multiple intercepts of anomalous Au which do not conform to the parameters established for reporting.

Drill hole ICGB2020-8 was collared near the western boundary of the Orogrande Shear Zone (Figure 1). It was drilled at an azimuth of 160° with an inclination of -45°. The drillhole encountered extensively sheared and fractured Belt Supergroup metamorphosed sedimentary rocks and younger quartz monzonite dikes associated with the major shear structure but no significant gold mineralization.

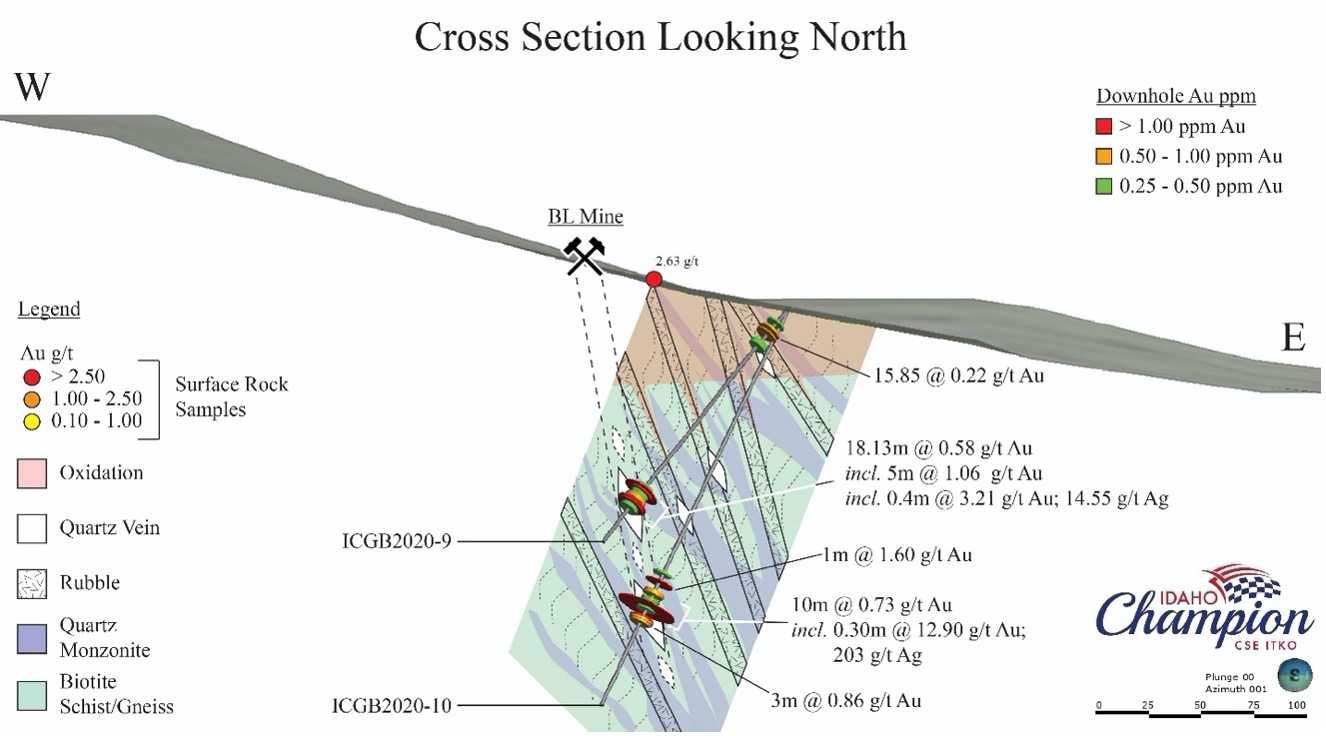

Drill holes ICGB2020-9 and ICGB2020-10 were collared from a shared drill pad (Figure 1) and are believed to be the first drill tests at the past producing BL Mine (1930s production). Both holes were drilled at a 240° azimuth, with -45° and -60° inclinations, respectively. ICGB2020-9 intersected 18.13m grading 0.58 g/t Au from 115.87m, including 0.40m grading 3.21 g/t Au and 14.55 g/t Ag from 120.75m and including 5.00m grading 1.06 g/t Au from 125.00m. ICGB2020-10 intersected 10.00m grading 0.73 g/t Au and 7.25 g/t Ag from 154.00m, including 0.30m grading 12.90 g/t Au and 203 g/t Ag from 162.90m (reported by fire assay - gravimetric finish for both gold and silver).

The mineralized intervals in holes ICGB2020-9 and -10 are characterized by quartz veins hosting pyrite and lesser quantities of chalcopyrite and galena. These veins may represent deeper intersections of sub-vertical veins mined historically in the BL Mine, as interpreted in Figure 2. Gold-silver mineralization intersected in holes ICGB2020-9 and ICGB2020-10 is open along both strike and dip.

Additionally, ICGB2020-9 intersected 15.85m of oxide mineralization grading 0.22 g/t Au from 10.06m and ICGB2020-10 intersected 4.0m of sulfide mineralization grading 0.70 g/t Au from 167.00m.

ICGB2020-11 was collared 100m to the north of hole ICGB2020-1 (Figure 1) and was drilled at an azimuth of 290° and a dip of -60°. The drillhole intersected 10.4m grading 0.18 g/t Au (oxide) from 7.3m and 3.60m grading 0.74 g/t Au (sulfide) from 39m, including 1.00m grading 1.89 g/t Au. The low-grade mineralization in ICGB2020-11 extends the mineralized trend identified by the 2018 drill program by approximately 150m, and the additional intercepts reported from the BL Mine extend the total N-S corridor of mineralization to approximately 2.25 km. However, it is too early to determine whether or how the new segments of mineralization discovered to the northeast in 2020 are connected.

Figure 1. Locations of 2020 diamond drill holes (blue lines) in the context of the Orogrande Shear Zone and 2018 drilling (black lines). Yellow text annotations indicate the locations of the drill holes reported in this news release.

Figure 2. Interpretive geological cross section showing Au intercepts from drillholes ICGB2020-9 and ICGB2020-10, plotted on interpreted geology. The size of red, orange, and green disks corresponds to logarithmically scaled Au grades. Additional surface rock grab samples were collected from waste dumps proximal to the BL Mine adit, with the highest gold value represented.

QA/QC Program

Idaho Champion Gold adheres to a regimented drill core handling and processing procedure. Core from the drill rig(s) is logged for lithology, mineralization, structure, alteration, and veining. During the logging process samples up to 1.5m core length are delineated by company geologists. Core is then photographed and sawn in half. Following sawing, individual samples are extracted from core boxes and inserted into individual sacks with a unique waterproof sample number tag and sealed. The remaining half-core is left in core boxes for storage. Sacks containing samples are kept securely indoors on site until they are transported to the assay lab.

Quality control (QC) samples are inserted into the sample stream such that there is one QC sample for every ten drill core samples. These QC samples consist of certified standards (known metallic content) and blanks (known barren of metals). Two styles of blank material were used: a coarse blank and a pulverized blank. QC sample insertions alternate between standard and blank.

Additional core duplicates were inserted into the sample stream where necessitated by geology, i.e. core samples containing wide veins were sawn in half, then one half sawn into quarters and submitted as two separate samples.

Samples were delivered to American Assay Labs (AAL) in Sparks, NV, with a small number of samples being analyzed at American Analytical Services (AAS) in Osburn, Idaho. Sample prep was conducted at AAS. AAL and AAS conform to ISO 17025 guidelines for specific methods. All drill samples and coarse blanks are crushed to 70% passing 2mm at the sample prep lab, and 1 kg material is split and pulverized to 85% passing 75 microns. Except for five samples, which were analyzed by fire assay - gravimetric finish for both gold and silver, all samples reported in this release were analyzed for gold by 30-gram fire assay- inductively coupled plasma - emission spectrometry (ICP-ES). Samples were additionally analyzed for 36 or 47 elements by a multi-acid digestion and ICP-ES and/or inductively coupled plasma - mass spectrometry (ICP-MS). Samples containing Au above maximum reporting limits by fire assay - ICP-ES are automatically re-analyzed by fire assay - gravimetric finish.

All drill intervals included in Table 1 in this release are calculated using a 0.10 g/t gold cut-off grade and a maximum of 1-metre consecutive waste and a minimum 5 gram-metres of gold.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About the Baner Project

The Baner Project is located within the Orogrande Shear Zone (OSZ), a 20-kilometre long and up to 1-kilometre wide regional shear zone located in Central Idaho. The OSZ is a transpressional shear zone composed of metamorphosed Proterozoic sedimentary rocks of the Belt Supergroup and granitic rocks of the Cretaceous Idaho Batholith, which is intruded by Tertiary rhyolites and dacitic dikes. Hydrothermal alteration is spatially associated with the OSZ consisting of: silicification, sericitization, and chloritization. Different types of mineral systems occur in the OSZ and along sympathetic structures in the area, most likely of Cretaceous or Tertiary ages. Mineralization may include disseminated bulk-mineable precious metal mineralization associated with sheeted or stockwork veins, hydraulic breccias and with extensive widespread alteration; but high-grade gold also occurs within discreet structurally controlled quartz veins and silicified zones.

The Baner Project is located 8 kilometers southwest of Elk City, Idaho, in the heart of the historical Orogrande-Elk City Mining District. Elk City is an historic gold mining region dating back to the 1860s that once supported more than 20 underground mines and extensive placer operations. During the 1930s there were three cyanide mills along the Crooked River processing open pit and underground sulfide ore. Exploration in the district was conducted by Cyprus Amax, Kinross Gold, and Bema during the 1980s and 1990s.

Premium Exploration conducted extensive soil sampling, airborne and surface geophysics, and drilling during the period around 2010. In 2020, Endomines AB brought the Friday Gold Project into production based on a reported measured plus indicated resource of 462,000 tonnes grading 6.54 g/t gold and mined 6,600 tonnes of ore with a 3.52 g/t head grade (Endomines AB Annual Reports for 2019, 2020). The Friday Gold Project is located within the OSZ approximately 8 kilometres south of the Baner Project.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100% owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO" and on the OTCQB under the trading symbol "GLDRF". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 477 7771 ext. 205

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/636739/Idaho-Champion-Extends-Footprint-of-Gold-System-at-the-Baner-Gold-Project-in-Idaho