6.80 gt Au over 51.1 Metres Oxide Mineralization below CX-Pit

RENO, Nev. , Aug. 30, 2021 /PRNewswire/ - i-80 Gold Corp. (TSX: IAU) (OTCQX: IAUCF) ("i-80", or the "Company") is pleased to announce that assay results for the first hole drilled at the Company's Granite Creek Property ("Granite Creek" or "the Property") located in Humboldt County, Nevada has returned high–grade results that confirm the high-grade open pit opportunity.

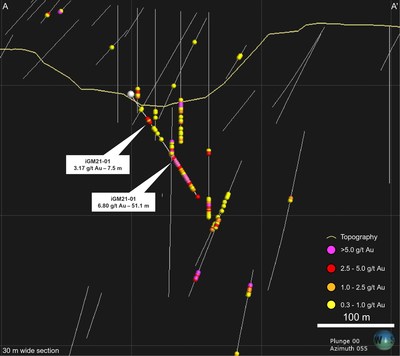

Hole iGM21-01, drilled from the bottom of the historic CX-Pit intersected two zones of mineralization grading 3.17 g/t Au over 7.5 m and 6.80 g/t Au over 51.1 m (see Table 1) . The hole was drilled for metallurgical purposes into the main structure below the pit (true widths unknown) and returned exceptional grades that appear to be oxide mineralization based on an average cyanide soluble to fire assay ratio of 0.94 over both intervals. The surface drill program targeting open pit mineralization at Granite Creek is complete (see Figure 2 below) and multiple assays remain pending. The drill program was focused on intersecting material to be used for metallurgical and geotechnical purposes in advance of initiating permitting for an open pit mine and on-site processing.

Table 1 – Highlight Assay Results from hole iGM21-01

| Table 1 New 2021 Drill Results from Granite Creek | |||||

| Drillhole ID | Type | From m | To m | Length m | Au g/t |

| iGM21-01 | Core | 33.8 | 41.3 | 7.5 | 3.17 |

| iGM21-01 | Core | 83.7 | 134.8 | 51.1 | 6.80 |

| including | Core | 86.1 | 125.7 | 39.6 | 8.42 |

| Table 1a Collar Coordinates | ||||||

| UTM | Drillhole ID | East m | North m | Elevation m | Azimuth | Dip |

| NAD83 Zone 11 | iGM21-01 | 478255 | 4553917 | 1452 | 145 | -56 |

Granite Creek is strategically located proximal to Nevada Gold Mines' Turquoise Ridge and Twin Creeks mines at the north end of the Battle Mountain-Eureka Trend, at its intersection with the Getchell gold belt in Nevada . The primary goal of the 2021 drill program is to advance underground and open pit opportunities to production.

Matt Gili , President and Chief Operating Officer of i-80 commented: "Advancing the Granite Creek Mine Project is the Company's primary focus for 2021. With more than 20,000 metres of drilling planned in the current program, our goal will be to increase resources, advance permitting to facilitate open pit mining, and prepare for underground test mining that is expected to be initiated this year."

The majority of the ongoing program, expected to consist of more than 20,000 metres of drilling, is focused on defining and expanding mineralization within several high-grade target areas proximal to existing underground mine workings at Granite Creek. i-80 has completed initial underground rehabilitation and has commenced underground drilling. As part of an aggressive plan to re-commence mining from underground, the Company is in the process of rehabilitating several areas for the purposes of commencing test mining in H2-2021. A Preliminary Economic Assessment for Granite Creek is nearing completion and expected to be released in the coming weeks.

Tim George, PE, is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101.

About i-80 Gold Corp.

i-80 Gold Corp is a Nevada-focused mining company with a goal of achieving mid-tier gold producer status. In addition to its producing mine, El Nino at South Arturo, i-80 is beginning to plan for future production growth through the potential addition of the Phases 1 & 3 projects at South Arturo and advancing underground development programs for the Granite Creek and McCoy-Cove Properties.

Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws, including but not limited to, commencement of trading of i-80 Gold on the Toronto Stock Exchange and completion of the acquisition of the Getchell Project. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the Company's current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-intersects-high-grade-gold-in-open-pit-drilling-at-granite-creek-301364927.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-intersects-high-grade-gold-in-open-pit-drilling-at-granite-creek-301364927.html

SOURCE i-80 Gold Corp