The Property adjoins First Mining Gold's Springpole Project one of the largest undeveloped gold deposits in Canada at 3.8Moz probable reserves

GoldON Resources Ltd. (TSXV: GLD) ("GoldON" or the "Company") is pleased to announce it has entered into an option agreement to acquire a 100% interest in the Springpole East property (the "Property") situated, primarily, in the Keigat Lake Area township of the Red Lake Mining District, Northwestern Ontario (See Figure 1).

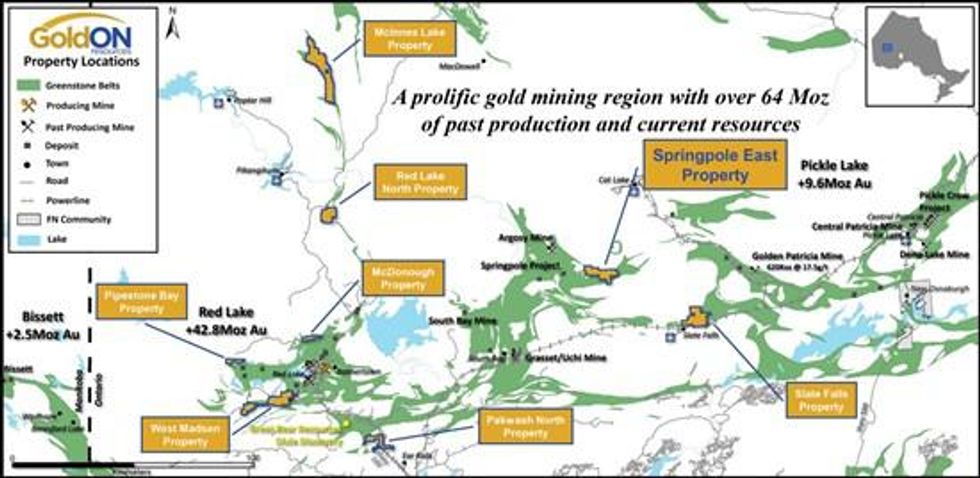

Figure 1: Regional map showing Springpole East location and GoldON's other projects

To view an enhanced version of this graphic, please visit:

https://goldonresources.com/images/Springpole-East/Springpole-East-Regional.jpg

The Property is comprised of 13 contiguous mining claims covering 5,186 hectares and is located approximately 40 kilometres (km) northwest of the Slate Falls First Nation community. Access is via a new all-weather road being built that has been completed to the southern claim boundary and is slated to run right through the claim block.

The Property is located within the Birch-Uchi Greenstone Belt of the northern Uchi Subprovince and consists of typical greenstone mafic to felsic volcanic sequences intercalated with clastic and chemical sediments which have been intruded by pre to syn-tectonic felsic to mafic intrusives and syn to post-tectonic mafic to ultra-mafic rocks. Very little is known about the Property's underlying geology with most of it inferred from airborne magnetics (MAG) that suggest a very active structural environment.

The western boundary of the Property adjoins the Springpole project owned by First Mining Gold Corp., with the Springpole deposit located 9 km to the west of the boundary and hosting reserves of 3.8 million ounces of gold and 20.5 million ounces of silver. The 2021 pre-feasibility study of Springpole is highlighted by a 30,000 tonnes per day mining operation with a life of mine of 11 years.

There is also potential for high-grade lode gold deposits as past-producing mines from the 1930s mined gold in excess of 10 grams per tonne proximal to the Property. One example is the Argosy gold mine that is situated 15 km northwest along strike from the Property and operated intermittently between 1934-1952 producing 102,000 ounces of gold at an average grade of 12.5 g/t Au.

Under the terms of the option agreement with Gravel Ridge Resources Ltd. and 1544230 Ontario Inc., GoldON can acquire a 100% interest in the Property for cash payments totaling $87,000 over three years ($17,000 upon regulatory acceptance, $15,000 on the first anniversary, $20,000 on the second anniversary, and a final payment of $35,000 on the third anniversary); and the issuance of 200,000 common shares (100,000 upon regulatory acceptance and 100,000 shares on the first anniversary). The optionors will retain a 1.5% net smelter returns royalty, of which the Company may repurchase 0.5% for $500,000.

"A key reason for acquiring the Springpole East Project is the new all-weather road, and we have already booked our exploration team for mapping and sampling as soon as the snow melts," said Mike Romanik, president of GoldON. "We have to thank our strategic advisor, Perry English, and Gravel Ridge for bringing us the Property."

Mike Kilbourne, P.Geo., an independent Qualified Person as defined in NI 43-101, has reviewed and approved the contents of this news release on behalf of the Company.

About GoldON Resources Ltd.

GoldON is an exploration company focused on discovery-stage properties located in the prolific gold mining belts of northwestern Ontario, Canada. Our current project portfolio includes seven properties in the Red Lake Mining District (West Madsen, Springpole East, Red Lake North, Pipestone Bay, Pakwash North, McInnes Lake, and McDonough) and an eighth property in the Patricia Mining District (Slate Falls).

For additional information: please visit our website at goldonresources.com, you can download our latest investor presentation by clicking here and you can follow us on Twitter at https://twitter.com/GoldONResources.

ON BEHALF OF THE BOARD

Signed "Michael Romanik"

Michael Romanik, President

GoldON Resources Ltd.

Direct line: (204) 724-0613

Email: info@goldonresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain "forward-looking statements" that involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107041