Golden Ridge Resources Ltd. ("Golden Ridge" or the "Company") (TSXV:GLDN) is pleased to announce the completion of a comprehensive Phase I soil sampling and prospecting program on the Williams Project, located strategically within New Found Gold Corps' Queensway Gold Project in the province of Newfoundland and Labrador

Highlights of the Phase I Williams Exploration Program

-A total of 44 rock1 samples were collected from various areas of interest

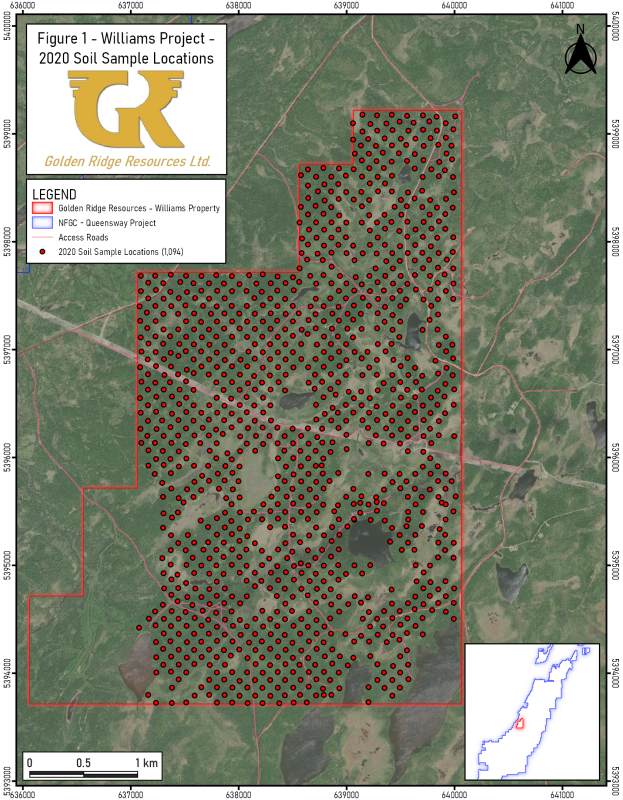

-A total of 1,094 soil samples were collected on a 100m x 100m grid covering the majority of the Williams project providing comprehensive geochemical coverage for further follow up prospecting and trenching (Fig. 1).

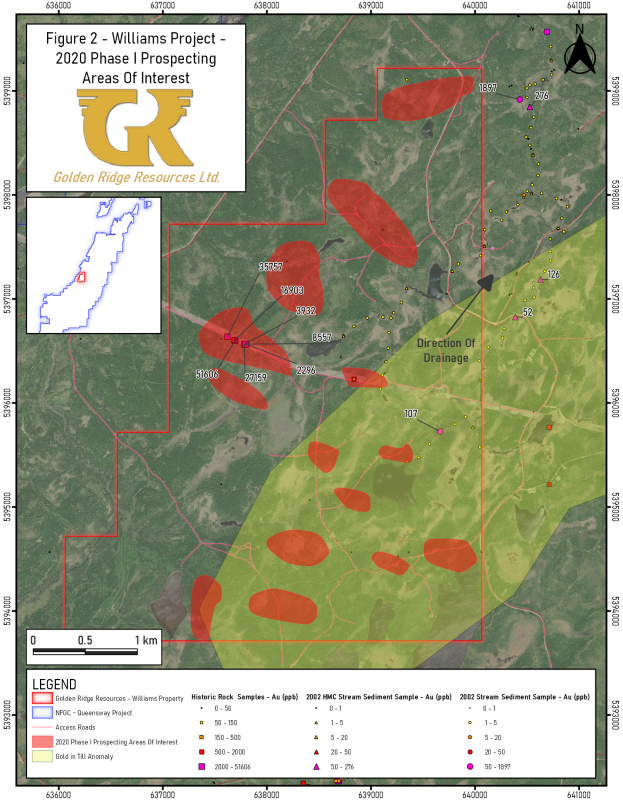

-Prospecting identified fourteen (14) distinct areas of altered and variably mineralized quartz veined outcrops (Fig. 2). The areas of interest correspond to current and previous rock, stream sediment, and till sampling Au anomalies*. These area's have been added into the Company's database for follow-up work.

All samples are currently at Eastern Analytical in Springdale, Newfoundland awaiting assays with results expected in the coming weeks. The Company will use these results to plan a Phase II program that will incorporate mechanical trenching and additional prospecting and mapping.

Michael Blady, President and CEO of Golden Ridge commented, "We are extremely encouraged by the mineralization and quartz veined outcrops discovered during the Phase I program on the underexplored Williams Project. Combined with the extensive soil grid completed, Golden Ridge will be well positioned to execute a Phase II trenching and prospecting program upon receiving assays from the Phase I work. We are also looking forward to kicking off our Phase I exploration program on the Heritage project as we continue to advance Golden Ridges' multiple Newfoundland exploration projects."

1 The reader is cautioned that rock grab samples are selective in nature and may not represent the true grade and or style of mineralization across the property. *Historical information contained in this news release and included figures regarding the Williams project is reported for historical reference only.

North Canol Property, Yukon

The TSX Venture Exchange(the "Exchange") has accepted an amending agreement between Fireweed Zinc Ltd. and Golden Ridge Resources Ltd., whereby terms to acquire a 100-per-cent interest in two claim groups aggregating 659 claims have been amended. The amendment changes the final two option payments to exercise the option from $150,000 due on or before Aug. 9, 2020, and $200,000 and 200,000 common shares due on or before May 9, 2021, to 900,000 common shares due within five days of Exchange acceptance. In all other respects, the original option agreement, dated April 24, 2018, and as amended on April 15, 2019, and May 6, 2020, remains unchanged.

Qualified Person:

Dr. Gerald G. Carlson, PhD, PEng, technical advisor to the Company, is the Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the technical data in this news release.

Acknowledgments:

Golden Ridge Resources acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

About Golden Ridge Resources:

Golden Ridge is a TSX-V listed exploration company engaged in acquiring and advancing mineral properties located in British Columbia and Newfoundland. Golden Ridge owns a 100% interest in the 1,700-hectare Hank copper-gold-silver-lead-zinc property located in the Golden Triangle district, approximately 140 kilometres north of Stewart, British Columbia and has a portfolio of exploration projects in Newfoundland.

Mike Blady

Chief Executive Officer

Tel: (250) 768-1168

Website: www.goldenridgeresources.com

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including: that the Company's financial condition and development plans do not change as a result of unforeseen events, that the Company obtains required regulatory approvals, that the Company continues to maintain a good relationship with the local project communities. Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Factors that could cause the forward-looking information in this news release to change or to be inaccurate include, but are not limited to, the risk that any of the assumptions referred to prove not to be valid or reliable, which could result in delays, or cessation in planned work, that the Company's financial condition and development plans change, delays in regulatory approval, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company's expectations, as well as the other risks and uncertainties applicable to mineral exploration and development activities and to the Company as set forth in the Company's Management's Discussion and Analysis reports filed under the Company's profile at www.sedar.com. There can be no assurance that any forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader should not place any undue reliance on forward-looking information or statements. The Company undertakes no obligation to update forward-looking information or statements, other than as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2020 TheNewswire - All rights reserved.