Canex Metals Inc. ("CANEX" or the "Company") is pleased to announce that a reverse circulation drill program is underway at the Gold Range Project, Arizona. Three holes have been completed at the Excelsior Zone and a fourth is in progress. The Company plans to drill up to 50 holes during the current drilling program

Dr. Shane Ebert, President of the Company stated, "We are very pleased to have started our third drill program at Gold Range and are excited to follow up our recent bulk tonnage discoveries and work to expand the zones and further test the underexplored mineralized trend that hosts mineralization. With continued success this program could provide a solid foundation for a larger resource definition program".

Drill Program

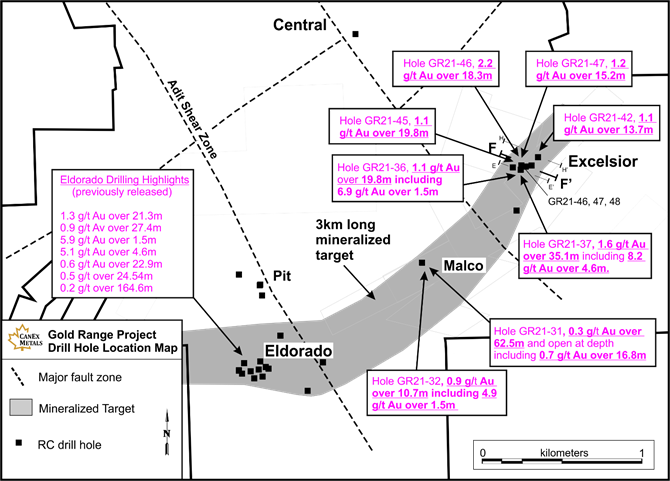

The current reverse circulation drill program will consist of up to 50 drill holes and a minimum of 3000 metres of drilling. The program will initially focus on expanding high grade near surface mineralization identified at the Excelsior Zone before expanding outward along the 3 kilometre long mineralized trend linking the historical Excelsior, Malco, and Eldorado Mines. The Excelsior Zone was first drill tested by the Company in February of this year and returned very strong grades such as 1.6 g/t gold over 35.1 metres including 2.2 g/t gold over 24.4 metres (previously released see June 14, 2021 news release). The program will also look to expand mineralization at the Eldorado and Malco zones and test multiple areas along the known trend. A few holes are planned to test larger targets in the central and northern part of the claim block. The drill program is expected to run into late October with assay results released in several batches as they become available.

The main exploration targets at Gold Range are near surface bulk tonnage gold zones hosted in metamorphic rocks and cretaceous intrusive dikes. Mineralization contains disseminated stockwork style quartz veinlets surrounding high grade gold veins. Free gold has been observed within high grade veins and within stockwork veinlets. Eight bottle roll samples from across the system achieved final cyanide soluble gold recoveries ranging from 94 to 99%, averaging 97% (previously released see September 8, 2021 news release). These exceptional cyanide soluble recoveries confirm the project as a valid heap leach type target. Numerous heap leach style mining operations are currently active in the Western United States and Northern Mexico, and these deposit types are sought after by mining companies as they are low cost to build and can be operated highly profitably at very low average gold grades.

Figure 1. Simplified target and drill hole location map, Gold Range Project.

Figure 2. Left, drill rig set up on the Excelsior Zone. Right, close up of track mounted drill rig drilling hole GR21-50.

About Canex Metals

Canex Metals (TSXV:CANX) is a Canadian junior exploration company focused on advancing its Gold Range Project in Northern Arizona. Led by an experienced management team, which has made three notable porphyry and bulk tonnage discoveries in North America, CANEX has identified and tested several targets which host the potential for bulk tonnage oxide gold mineralization at its Gold Range Project. Recent drilling has identified near surface bulk tonnage gold potential along a recently identified trend extending from the Eldorado to Excelsior Zones. Hole GR21-37 from Excelsior returned 1.6 g/t gold over 35.1 metres including 8.2 g/t gold over 4.6 metres. These new discoveries occur along a 3 kilometre long highly prospective mineralized trend that has seen limited modern exploration.

The Company remains focused on testing and advancing key exploration targets on the Gold Range Property through continued exploration and drilling.

Dr. Shane Ebert P.Geo., is the Qualified Person for Canex Metals and has approved the technical disclosure contained in this news release.

"Shane Ebert",

Shane Ebert

President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: https://www.canexmetals.ca

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "expects", "projects", "plans", "anticipates" and similar expressions, are forward-looking information that represents management of Canex Metals Inc. internal projections, expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: Canex Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/663938/Exploration-and-Expansion-Drilling-Is-Underway-at-the-Gold-Range-Project-Arizona