(TheNewswire)

Highlights of the Optioned Claims

-

- 41 mineral claims covering 1,025 hectares contiguous with the Company's existing option on 61,150 hectares of mineral claims in south-central Newfoundland, known as the Golden Baie Project.

- Canstar has the option to acquire 100% of the mineral claims, subject to an 1.5% NSR royalty, for aggregate cash consideration of $75,000 and share issuances worth $75,000 over a three-year period.

- Significant gold exploration work, including diamond drilling, was conducted in the 1980s that identified multiple gold occurrences.

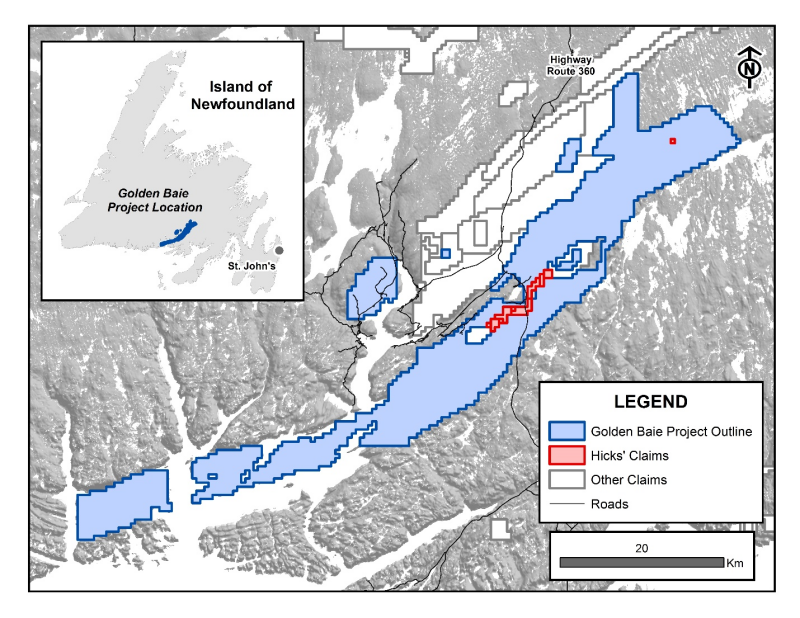

Toronto, Ontario - TheNewswire - November 25, 2020 - Canstar Resources Inc. (TSXV:ROX ) ( OTC:CSRNF) (" Canstar" or the "Company") is pleased to announce that it has entered into an option agreement (the "Option Agreement") with Altius Resources Inc. ("Altius"), a wholly owned subsidiary of Altius Minerals Corporation (TSX: ALS), David Hicks, Darrin Hicks, and Natalie Hicks (the "Hicks Family" or the "Optionors") . The Option Agreement gives the Company exclusive right and option (the "Option") to acquire, subject to retention by Altius and the Hicks Family of certain rights related to a 1.5% net smelter return royalty (the "Royalty"), a 100% interest in 41 mineral claims covering an area of 1,025 hectares contiguous with the Golden Baie Project (the "Hicks Claims") (Figure 1).

In consideration for the acquisition of the Option, Canstar shall, among other things: (i) pay to the Optionors an aggregate of such number of Canstar common shares ("Shares"), payable in installments as is equal to $75,000.00 divided by the prevailing 5-day volume weighted average price per Share on the TSX Venture Exchange ("Exchange"); and (ii) pay to the Optionors, an aggregate of $75,000.00 in cash, payable in installments over the three year option period. Additional details of the Option Agreement are provided below.

Rob Bruggeman, President & CEO of Canstar, stated: "We are very pleased to add to our mineral claims portfolio at Golden Baie. The claims announced today, which are intersected by a highway, have seen the most extensive historical exploration work completed on them of all claims in the area. Extensive soil sampling, geophysics, and diamond drilling on the claims delineated two significant mineralized zones that remain open along strike and at depth. The historic exploration work done on the newly optioned claims will advance our understanding of structural and lithological controls on gold mineralization in the area. Perhaps more importantly, these claims give us several new advanced gold exploration targets that have seen limited new exploration work in the past three decades."

Historical Exploration

Substantial exploration work on the Hicks Claims was conducted by Westfield Minerals Limited ("Westfield") between 1985 and 1988. Westfield completed an integrated exploration program of geological mapping, prospecting, lithogeochemical and soil geochemical sampling, ground geophysics, trenching and ultimately diamond drilling. This exploration work identified several gold occurrences on the Hicks Claims, including what are now known as the Wolf Pond and 22 West Prospects.

Drilling by Westfield at both the Wolf Pond and 22 West Prospects intersected significant gold mineralization in several holes. At Wolf Pond, a mineralized zone averaging 2-3 metres thick with grades of 3-5 g/t gold was delineated within a broader envelope 5-8 metres thick averaging 1-2 g/t gold over a strike length of 450 metres and to a depth of 165 metres. The zone is open both along strike and at depth. The best intersections reported by Westfield include 3.75 g/t gold over 4.6 metres including 6.52 g/t gold over 2.0 metres (DDH87-04) and 2.67 g/t gold over 7.2 metres including 6.11 g/t gold over 1.1 metres (DDH87-09).

The mineralized zone at the 22 West Prospect is between 1.5-2.5 metres thick and has a strike length of approximately 150 metres, delineated to a depth of 50-100 metres. The best intersections reported by Westfield included 4.46 g/t gold over 3.0 metres (DDH88-17), 7.08 g/t gold over 2.0 metres and 4.46 g/t gold over 3.0 metres (DDH88-21) and 10.97 g/t gold over 0.5 metres (DDH88-22). No further drilling has been done on these prospects since 1988.

The historical results are considered to be historical in nature and have not been independently verified by Canstar.

Figure 1 - Claims Map Showing the Existing Golden Baie Claims and Newly Optioned Hicks Claims

Option Terms for the Hicks Claims

In order for the Company to exercise the Option and to acquire a 100% interest in the Hicks Claims, subject to the retention by the Optionors of the Royalty, in accordance with the terms of the Option Agreement, it must:

-

1. On closing of the Option Agreement, issue to the Optionors an aggregate of $10,000 worth of Shares, which will be determined based on the 5-day volume weighted average price per Share on the Exchange ending on the day prior to the closing date;

-

2. On the first anniversary of the Option Agreement, pay to the Optionors an aggregate cash payment of $20,000 and issue to the Optionors an aggregate of $15,000 worth of Shares, which will be determined based on the 5-day volume weighted average price per Share on the Exchange ending on the day prior to the first anniversary of the Option Agreement;

-

3. On the second anniversary of the Option Agreement, pay to the Optionors an aggregate cash payment of $25,000 and issue to the Optionors an aggregate of $20,000 worth of Shares, which will be determined based on the 5-day volume weighted average price per Share on the Exchange ending on the day prior to the second anniversary of the Option Agreement;

-

4. On the third anniversary of the Option Agreement, pay to the Optionors an aggregate cash payment of $30,000 and issue to the Optionors an aggregate of $30,000 worth of Shares, which will be determined based on the 5-day volume weighted average price per Share on the Exchange ending on the day prior to the third anniversary of the Option Agreement.

Pursuant to the Option Agreement, the Company and the Optionors have also entered into a royalty agreement pursuant to which the Optionors shall retain the Royalty, namely a 1.5% net smelter return royalty. Altius shall have the right to purchase at any time from the Optionors one third of the Royalty (namely, a 0.5% net smelter return royalty) for the total sum of $1,000,000 (the "Buyback Right"). In addition to the Buyback Right, Altius shall have also have a right of first refusal on any sale by the Optionors of the remaining two thirds of the Royalty.

Qualified Person

Bob Patey, B.Sc., P.Geo., a contractor providing geological services to the Company, and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, is responsible for the scientific and technical data presented herein and has reviewed and approved this release.

About Canstar Resources Inc.

Canstar is focused on the discovery and development of economic mineral deposits in Newfoundland and Labrador, Canada. Canstar has an option to acquire a 100% interest in the Golden Baie Project, a large claim package (over 61,000 hectares) with recently discovered, multiple outcropping gold occurrences on a major structural trend in south-central Newfoundland. The Company also holds the Buchans-Mary March project and other mineral exploration properties in Newfoundland. Canstar Resources is based in Toronto, Canada, and is listed on the TSX Venture Exchange under the symbol ROX and trades on the OTCPK under the symbol CSRNF.

For further information, please contact:

Rob Bruggeman P.Eng., CFA

President & CEO

Email: rob@canstarresources.com

Phone: 1-416-884-3556

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions, as well as the anticipated size of the Offering, the Offering price, the anticipated closing date and the completion of the Offering, the anticipated use of the net proceeds from the Offering and the receipt of all necessary approvals. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to complete the Offering on the terms or on the timeline as announced or at all, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Copyright (c) 2020 TheNewswire - All rights reserved.