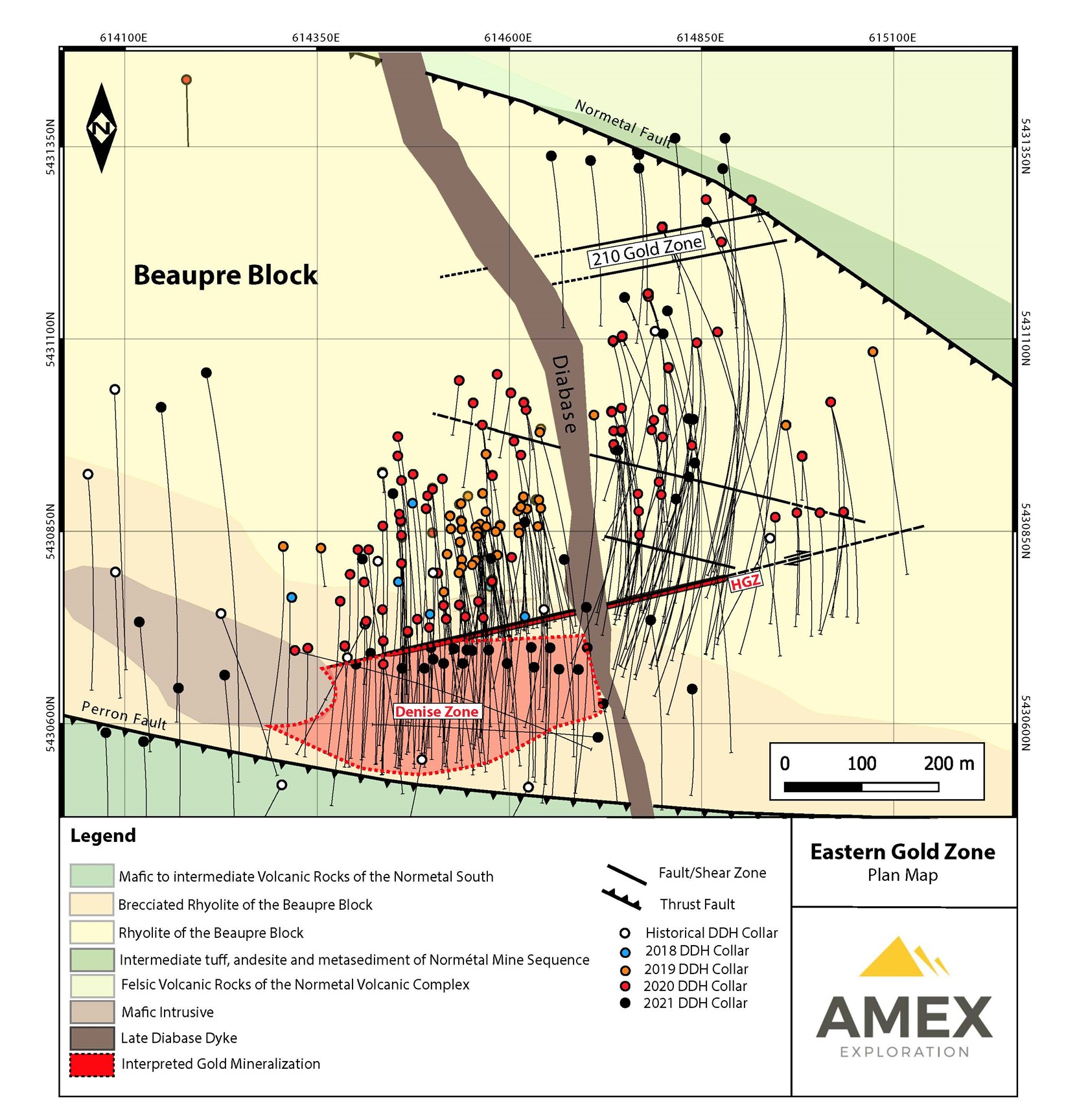

Amex Exploration Inc. ("Amex or the Company") (TSXV:AMX)(FRA:MX0)(OTCQX:AMXEF) is pleased to report a number of drill results focused on definition drilling of the High Grade Zone ("HGZ") of the Eastern Gold Zone ("EGZ") on the Perron Gold Project, Quebec. See Figure 1 for a plan view of the geology of the EGZ and the mineralized zones

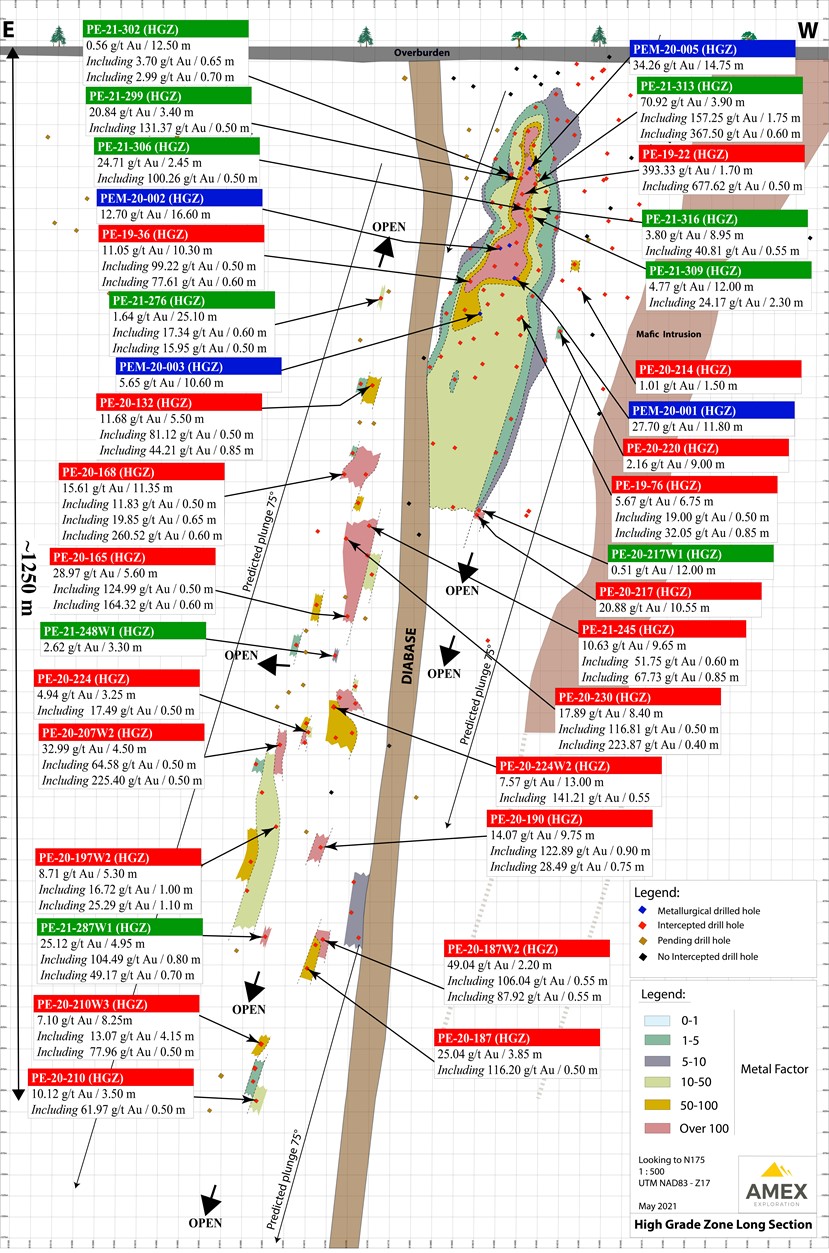

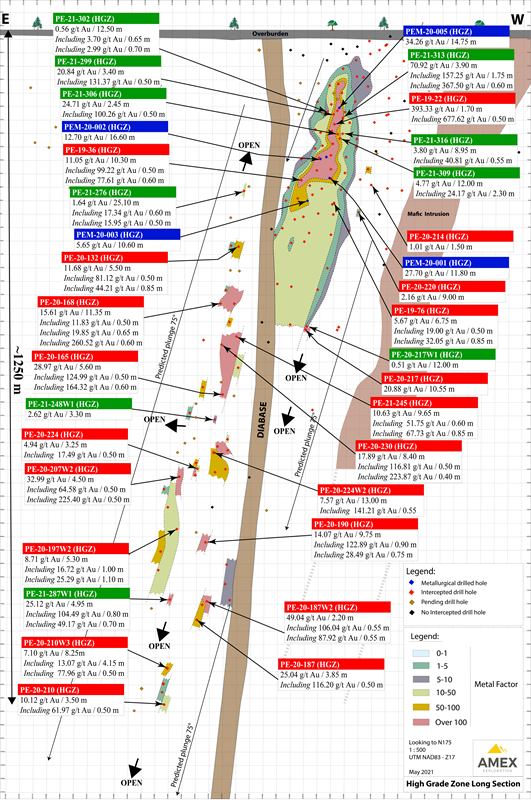

Today's results are focused on definition drilling of the High Grade Zone as the Company works towards its maiden resource on the Perron Project. Highlights are detailed below, and a complete list of results is available in Table 1 and presented in Figure 2. In addition to the results detailed below, Amex is awaiting results on over 21,000 samples at two labs from holes targeting the HGZ, Denise, and Grey Cat Zone, as well as regional exploration drilling.

Highlights:

- High Grade Zone - near surface

- 70.92 g/t Au over 3.90 metres, including 367.50 g/t Au over 0.60 metres, at a vertical depth of approximately 160 metres in hole PE-21-313.

- 24.71 g/t Au over 2.45 metres, including 100.26 g/t Au over 0.50 metres, at a vertical depth of approximately 190 metres in hole PE-21-306.

- 20.84 g/t Au over 3.40 metres, including 131.37 g/t Au over 0.50 metres, at a vertical depth of approximately 155 metres in hole PE-21-299.

- 4.77 g/t Au over 12.00 metres at a vertical depth of approximately 195 metres in hole PE-21-309.

- 3.80 g/t Au over 8.95 metres at a vertical depth of approximately 190 metres in hole PE-21-316.

- High Grade Zone - at depth

- 25.12 g/t Au over 4.95 metres, including 104.49 g/t Au over 0.80 metres, at a vertical depth of approximately 1,055 metres in hole PE-21-287W1.

Jacques Trottier, PhD Executive Chairman of Amex said, "Today's results are largely focused on definition drilling of the upper portion of the High Grade Zone. We continue to intercept very high grade gold mineralization over favourable widths at shallow depths, which both confirm and exceed upon our internal geological and mineralization model (Figure 3). We also continue to intercept high grade gold at depth as evidenced by hole PE-21-287W1 which intercepted 25.12 g/t Au over 4.95 m at a depth of over one kilometre vertically."

Figure 1: Plan Map of the Eastern Gold Zone that encompasses Denise and HGZ.

Figure 2: Longitudinal section of the High Grade Zone looking South, with today's results labelled in green.

Figure 3: Photos of Visible Gold (VG) from holes of the High Grade Zone

Table 1: Assay Results from the High Grade Zone at Perron

HGZ Results | ||||||

Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Zone | Vertical depth (m) |

PE-20-217W1 | 597.00 | 609.00 | 12.00 | 0.51 | HGZ | ~540 |

PE-21-248W1 | 804.60 | 807.90 | 3.30 | 2.62 | HGZ | ~720 |

Including | 804.60 | 805.10 | 0.50 | 13.68 | ||

PE-21-276 | 329.90 | 355.00 | 25.10 | 1.64 | HGZ | ~290 |

Including | 330.40 | 331.00 | 0.60 | 17.34 | ||

Including | 350.00 | 350.50 | 0.50 | 15.95 | ||

PE-21-287W1 | 1167.90 | 1172.85 | 4.95 | 25.12 | HGZ | ~1055 |

Including | 1167.90 | 1168.70 | 0.80 | 104.49 | ||

Including | 1172.15 | 1172.85 | 0.70 | 49.17 | ||

PE-21-299 | 170.60 | 174.00 | 3.40 | 20.84 | HGZ | ~155 |

Including | 171.90 | 172.40 | 0.50 | 131.37 | ||

PE-21-302 | 159.50 | 172.00 | 12.50 | 0.56 | HGZ | ~150 |

Including | 161.05 | 161.70 | 0.65 | 3.70 | ||

Including | 169.25 | 169.95 | 0.70 | 2.99 | ||

PE-21-306 | 206.55 | 209.00 | 2.45 | 24.71 | HGZ | ~190 |

Including | 207.20 | 207.70 | 0.50 | 100.26 | ||

PE-21-309 | 205.00 | 217.00 | 12.00 | 4.77 | HGZ | ~195 |

Including | 214.70 | 217.00 | 2.30 | 24.17 | ||

PE-21-313 | 180.00 | 183.90 | 3.90 | 70.92 | HGZ | ~160 |

Including | 182.15 | 183.90 | 1.75 | 157.25 | ||

Including | 183.30 | 183.90 | 0.60 | 367.50 | ||

PE-21-316 | 203.00 | 211.95 | 8.95 | 3.80 | HGZ | ~190 |

Including | 211.40 | 211.95 | 0.55 | 40.81 | ||

*Note that drill results are presented uncapped and lengths represent core lengths. True width is estimated to be ~70-80% in HGZ.

Qualified Person

Maxime Bouchard P.Geo. M.Sc.A., (OGQ 1752) and Jérôme Augustin P.Geo. Ph.D., (OGQ 2134), Independent Qualified Persons as defined by Canadian NI 43-101 standards, have reviewed and approved the geological information reported in this news release. The drilling campaign and the quality control program have been planned and supervised by Maxime Bouchard and Jérôme Augustin. Core logging and sampling were completed by Laurentia Exploration. The quality assurance and quality control protocol include insertion of blank or standard every 10 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples accredited by Laboratoire Expert during the analytical process. Gold values are estimated by fire assay with finish by atomic absorption and values over 3 ppm Au are reanalyzed by fire assay with finish by gravimetry by Laboratoire Expert Inc, Rouyn-Noranda. Samples containing visible gold mineralization are analyzed by metallic sieve. For additional quality assurance and quality control, all samples were crushed to 90% less than 2 mm prior to pulverization, in order to homogenize samples which may contain coarse gold. Core logging and sampling were completed by Laurentia Exploration.

About Amex

Amex Exploration Inc. is a junior mining exploration company, the primary objective of which is to acquire, explore, and develop viable gold projects in the mining-friendly jurisdiction of Quebec. Amex is focused on its 100% owned Perron gold project located 110 kilometres north of Rouyn Noranda, Quebec, consisting of 116 contiguous claims covering 4,518 hectares. A number of significant gold discoveries have been made at Perron, including the Eastern Gold Zone, the Gratien Gold Zone, the Grey Cat Zone, and the Central Polymetallic Zone. High-grade gold has been identified in each of the zones. A significant portion of the project remains underexplored. In addition to the Perron project, the company holds a portfolio of three other properties focused on gold and base metals in the Abitibi region of Quebec and elsewhere in the province.

For further information please contact:

Victor Cantore

President and Chief Executive Officer

Amex Exploration: +1-514-866-8209

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release contains forward-looking statements. All statements, other than of historical facts, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, the planned exploration program on the HGZ and Denise Zone, the expected positive exploration results, the extension of the mineralized zones, the timing of the exploration results, the ability of the Company to continue with the exploration program, the availability of the required funds to continue with the exploration and the potential mineralization or potential mineral resources are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "to earn", "to have', "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, failure to meet expected, estimated or planned exploration expenditures, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, general business and economic conditions, changes in world gold markets, sufficient labour and equipment being available, changes in laws and permitting requirements, unanticipated weather changes, title disputes and claims, environmental risks as well as those risks identified in the Company's annual Management's Discussion and Analysis. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described and accordingly, readers should not place undue reliance on forward-looking statements. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

SOURCE: Amex Exploration Inc.

View source version on accesswire.com:

https://www.accesswire.com/649095/Amex-Reports-High-Grade-Zone-Definition-Drilling-Results-Up-to-7092-GT-Au-Over-390-m-and-2512-GT-Au-Over-495-m