(TheNewswire)

TheNewswire - December 5 th 2021 Kiplin Metals Inc. (TSXV:KIP) (OTC:ALDVF) (the "Company" or "Kiplin") is pleased to announce that it has been granted an option to acquire a one-hundred percent interest in the Cluff Lake Road Uranium Project (the "CLR Project) from an arms-length third-party. The CLR Project covers ~531ha in the southwestern Athabasca Basin in northern Saskatchewan, where several new discoveries, including the Arrow and Tripe R Uranium deposits have been made. The CLR Project is 5km east of the Cluff Lake Road (Hwy 955), which leads to the historic Cluff Lake Mine, which historically produced approximately 62,000,000lbs of yellowcake uranium.

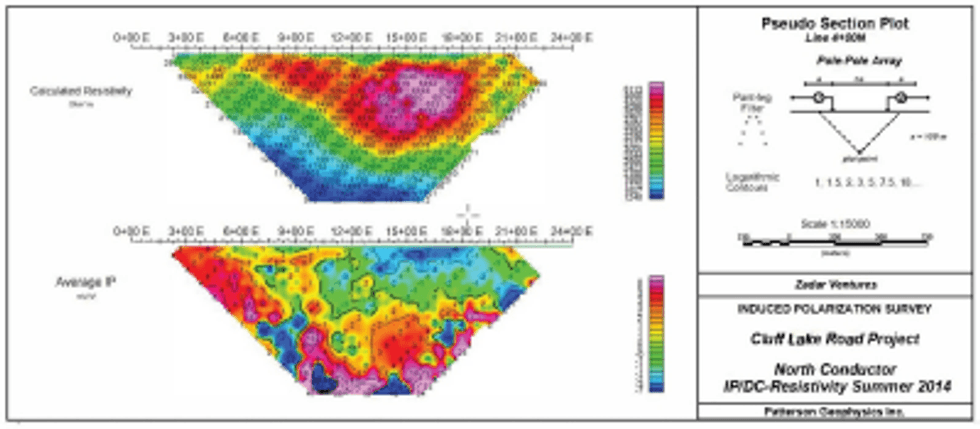

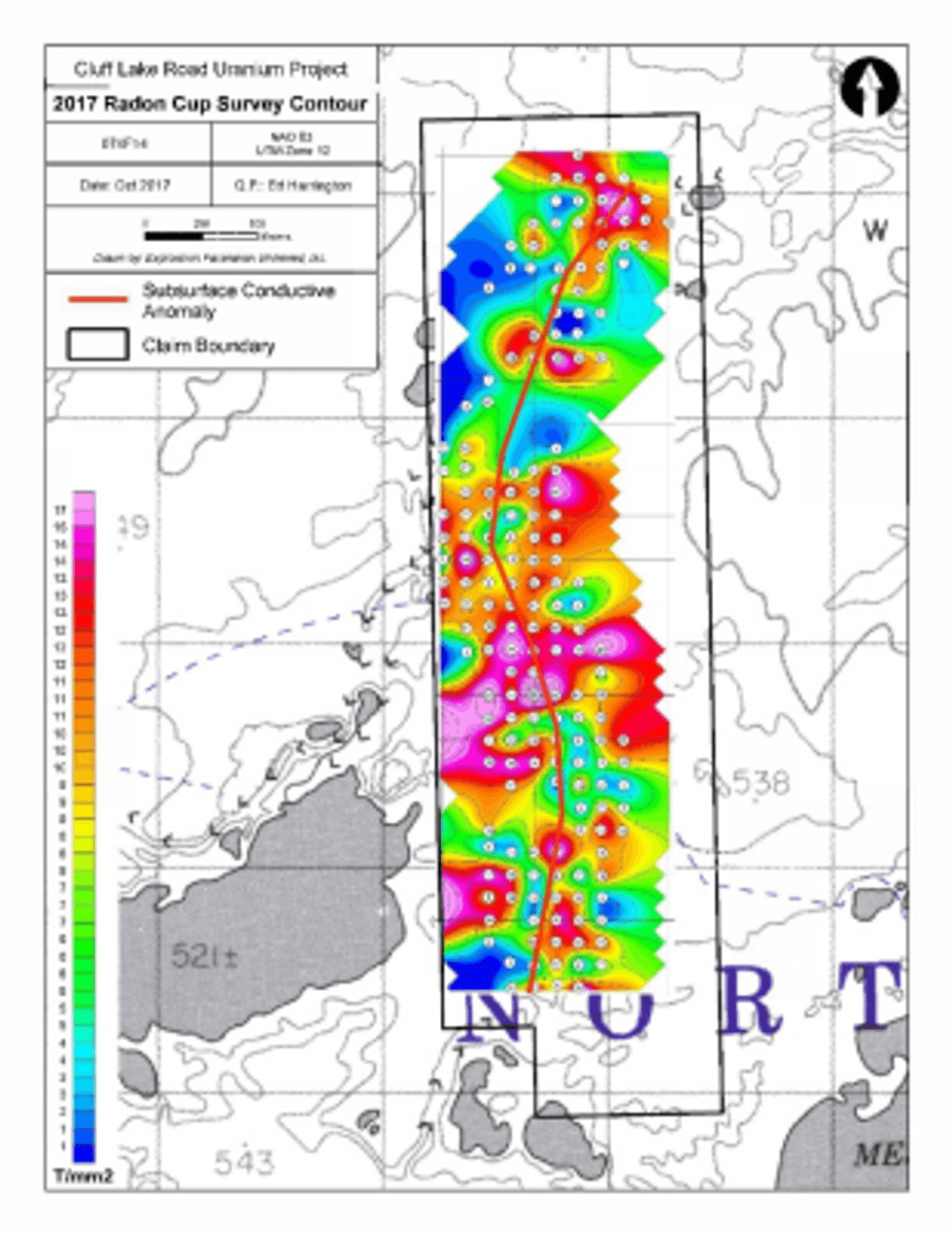

The CLR Project adjoins the eastern border of Fission 3.0's Patterson Lake North Project, which has a long history of exploration. In 2013 and 2017 Zadar Ventures Ltd. completed both a DC Resistivity Geophysical Survey and a Radon Cup Survey at the CLR Project and defined the primary exploration target: a resistive anomaly, approximately 4km long, trending generally north-south and which is concurrent with radon gas anomalies, the latter being a uranium decay product.

Click Image To View Full Size

At present, the Company is specifically reviewing similarities between the Shea Creek Deposit and the CLR Project. The Shea Creek Uranium Deposit is located ~30km northwest of the CLR Project and has an indicated mineral resource of 67.66 million pounds of uranium (2,067,900 tonnes grading 1.48% U3O8) and an inferred mineral resource of 28.19 million pounds of U3O8 (1,272,200 tonnes grading 1.01% U3O8) (Technical Report by Eriks P. Geo. 2013).

Click Image To View Full Size

Under the terms of the option, the Company can earn a 100% interest in the CLR Project by making total cash payments of $120,000 over a 2-year period and spending $50,000 on exploration within the first year. Following exercise of the option, the CLR Project will be subject to a one-percent net smelter returns royalty which can be purchased for a one-time cash payment of $1,000,000.

Further information on the CLR Project and planned exploration activities will be released in the coming weeks.

The Company announces that, effective December 1, 2021, the board of directors have elected Gil Schneider as President and CEO of the Company. Gil Schneider was with Aramark Corporation for 15 years as Vice President of New Business Development. Aramark at the time had 259,000 employees and annual revenues of over $13 billion. Since leaving Aramark, Gil has gone on to co-found a number of public companies and serve on the boards of several public and private companies. Clive Massey has resigned from the board to pursue other opportunities. The Company thanks Mr. Massey for his services.

Dr. Peter Born, P.Geo., is the designated qualified person as defined by National Instrument 43-101 and is responsible for, and has approved, the technical information contained in this release.

For further information, contact the Company at 604-622-1199.

On behalf of the Board of Directors,

"Peter Born"

Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

Copyright (c) 2021 TheNewswire - All rights reserved.