Vanstar Mining Resources Inc. (TSXV: VSR (OTCQX: VMNGF) ("Vanstar", or the "Company") is pleased to announce that it has signed a letter of intent ("LOI") with IAMGOLD Corporation ("IAMGOLD") to acquire a 75% interest in the Calder-Bousquet property (the "Property") also referred as the Bousquet-Odyno project. The Property consists of 37 contiguous mining claims covering approximately 1,490 ha and is located directly south of highway 117 between the towns of Rouyn-Noranda and Malartic. The Property lies within the Abitibi greenstone gold belt, along the Cadillac break, a prolific gold bearing regional structure that has produced 100 million ounces of gold since 1900. Historical drilling on the property prior to IAMGOLD has identified a number of gold zones, including the Calder-Bousquet Zones No. 2, No. 4 and No. 5. Historical drilling has been relatively shallow, down to approximately 250 metres ("m").

From 2010 to 2016, IAMGOLD engaged in successive exploration programs including surface geological mapping and outcrop stripping to develop and refine structural controls relating to the historical gold zones, geophysics and geochemistry surveys to guide drilling programs and the completion of just over 20,000 m of diamond drilling to test historical gold zones and other exploration targets. Selected results from IAMGOLD's drilling programs include:

- 27.9 g/t Au over 6.5 m (from 140.0 to 146.5 m depth in hole BO-16-56)

- 29.3 g/t Au over 3.3 m (from 389.0 to 392.3 m depth in hole BO-12-32)

- 9.6 g/t Au over 16.5 m (from 164.0 to 180.5 m depth in hole BO-11-06)

- 5.8 g/t Au over 4.4 m (from 135.3 m to 139.7 m depth in hole BO-13-40)

Note: the drilling results referenced above are historical and have not been independently verified and validated by the Company and should not be relied on.

Vanstar believes that there is good gold potential at depth, with the deepest intersection cutting an interval of 2.3 g/t Au over 14.0 m (core length) at a vertical depth of 600 m (Hole BO-15-49A). In addition, the Cadillac break extends another 1 km to the west on the property where only a few holes have been drilled.

Under the terms of the LOI, Vanstar can earn a 75% interest in the property by spending $4 million over 4 years and will be the operator. In the first earn-in period, the Company can earn a 25% interest by spending $2 million on or before the 2nd anniversary of signing a definitive agreement, with a minimum of $500,000 as firm expenditures to be spent in the first year. In the second option period, the Company may earn an additional 50% interest by spending a further $2 million prior to the 4th anniversary date. IAMGOLD will have a right to earn back a 50% interest in the property by spending 4 times the exploration expenditures made on the property since the completion of the second earn-in period within a time period of 3 to 5 years depending the amount to invest.

Figure 1: Calder-Bousquet location map

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/8185/105403_b82943dbf4282ba9_002full.jpg

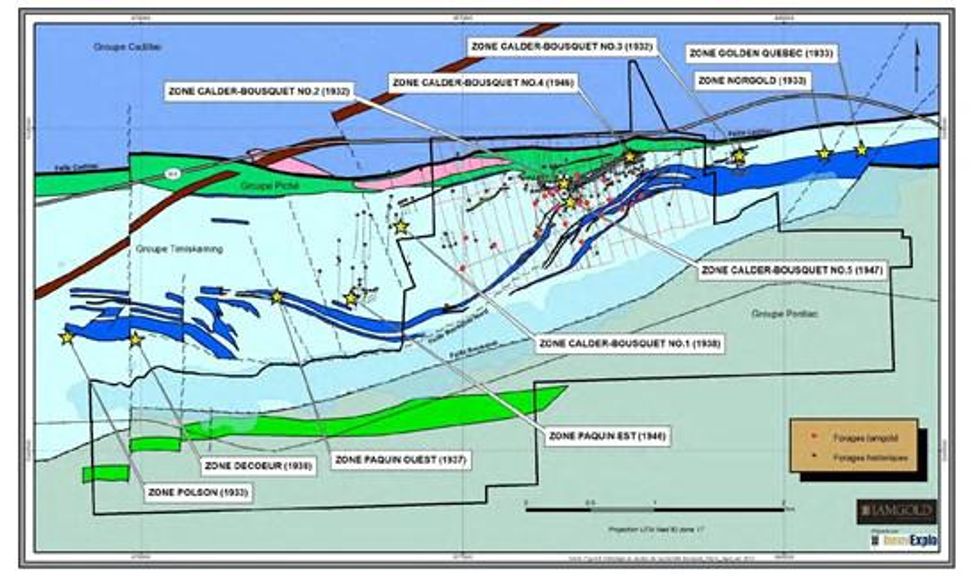

Figure 2: Calder-Bousquet Gold Zones

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/8185/105403_b82943dbf4282ba9_003full.jpg

Nelligan Update

The planned drilling program on the Nelligan Project has now finished and IAMGOLD is completing the logging and sampling of the last drill holes completed to evaluate the western extension of the Nelligan resources area. Results from the infill drilling are expected in the next few weeks and results from the west extension drilling phase will be available in the coming months. IAMGOLD is currently making preparations for a winter drilling program that will include a minimum of 5,000 m of drilling.

Qualified Person

Mr. Gilles Laverdière, consultant geologist and qualified person under NI 43-101 has read and approved this press release.

About Vanstar

Vanstar Mining Resources Inc. is a gold exploration company with properties located in Northern Québec at different stages of development. The Company owns a 25% interest in the Nelligan project (3.2 million inferred ounces Au, NI 43-101 October 2019) and 1% NSR. The Nelligan Project won the "Discovery of the Year" award at the 2019 Quebec Mineral Exploration Association Xplor Gala. Vanstar also owns 100% of the Felix property under development in the Chicobi Group (Abitibi mining camp, 65km East of Amex Perron property) and 100% of Amanda, a 7,679 ha property located on the Auclair formation with historic gold showings up to 12.1 g/t Au over 3 meters.

The TSX Venture Exchange and its Regulation Services Provider (as that term is defined in the TSX Venture Exchange Policies) do not accept any responsibility for the truth or accuracy of its content.

SOURCE :

JC St-Amour

President and CEO

+1 (647) 296-9871

jc@vanstarmining.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105403