TDG Gold Corp. (TSXV:TDG) (the "Company" or "TDG") is pleased to announce that it has received the exploration permit to drill its Drybrough target located north of TDG's former producing Baker mine in the historical "Toodoggone Production Corridor". Drybrough is a geophysical target that appears to be on strike to the 10 sq.km Baker "alteration zone" and is located on TDG's Oxide Peak earn-in property. A multi-year exploration permit for Oxide Peak was received after a consultation process that began in early June 2021 involving government, First Nations communities and their representatives. TDG thanks all stakeholders for their involvement and support

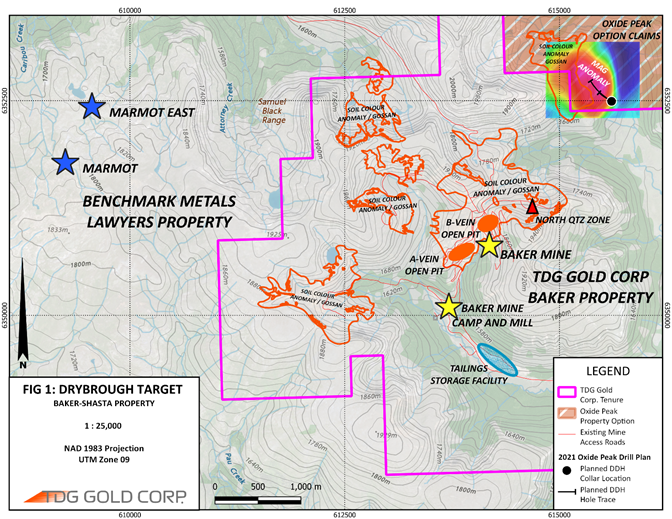

TDG's aim is to complete a minimum of 1,000 metres of diamond drilling at Drybrough as a key part of fulfilling its 2021 exploration obligations under its earn-in agreement for Oxide Peak (see TDG news release of December 23, 2019). TDG's camp at Baker is fully winterized and the Drybrough target is located approximately 3.5 kilometres ("km") to the northeast (Figure 1) with access via land or helicopter. Drilling is scheduled to take place within the next 2-3 weeks, subject to weather and safety considerations.

Figure 1: Location of the Drybrough geophysical anomaly to the north of TDG's former producing Baker mine.

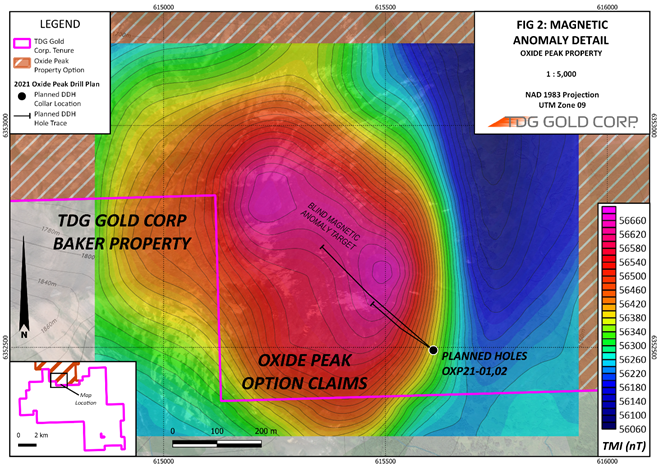

The Drybrough target is a conceptual target based on gossanous surface alteration (visible colour anomaly from air photos) with coincident geophysical anomaly (Figure 2). A magnetic anomaly (anomalous magnetic high, surrounded by a ‘moat' of magnetic low) was identified by a high-resolution combined airborne magnetic and radiometric survey (249 line-km) flown by Precision GeoSurveys in late August to early September of 2021. Geophysical data was post-processed by Todd Ballantyne, P.Geo., (in3D Geoscience). The magnetic VOXI inversion shows the anomaly broadens and persists at depth to -400 m (and potentially deeper). The Drybrough target is approximately 1 km by 1 km in size and is represented by a 600 nT variance in relation to the surrounding area.

Figure 2: Drybrough geophysical anomaly and planned diamond drill holes.

Drybrough represents a ‘blind' target with the source of the magnetic anomaly (potentially a buried porphyry intrusion, or mineralized centre) covered by surface rocks comprised of undifferentiated plagioclase-pyroxene phyric volcaniclastics. Drilling the Drybrough target will test the geographical centre of the anomaly and the southeastern lobe of the magnetic high, in two drill holes. The target area has been ground-truthed and work crews are mobilizing to complete the proposed work (Figure 3).

Figure 3: Drybrough target alteration zone (colour anomaly) clearly visible from the "North Quartz Zone" of TDG's former producing Baker mine (photo taken from the south of Drybrough, looking north).

Qualified Person

The technical content of this news release has been reviewed and approved by Steven Kramar, MSc., P.Geo., a qualified person as defined by National Instrument 43-101.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. In 2021, TDG has advanced the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and, for Shasta, drill testing of the known mineralization occurrences and their extensions. The Company has entered into a binding agreement to acquire the Nueva Esperanza silver-gold advanced exploration and development project located in the Maricunga Belt of northern Chile, subject to closing conditions being satisfied. TDG currently has 70,867,903 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words "ambition", "estimate", "concluded", "offers", "objective", "may", "will", "should", "potential" and similar expressions are intended to identify forward looking statements. In particular, this news release contains forward looking statements concerning the completion of the Acquisition, the completion of SR Offering and the Offering, the intended uses of the proceeds of the Offering, regulatory acceptance of the Acquisition, the SR Offering and the Offering, and the potential development of the Project and the Company's existing mineral properties, including the completion of feasibility studies or the making of production decisions in respect thereof. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the completion of other conditions precedent to the Acquisition, including the receipt of regulatory approvals, the state of equity financing markets, and results of future exploration activities by the Company. Management has provided the above summary of risks and assumptions related to forward looking statements in this news release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this news release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/673025/TDG-Gold-Corp-Prepares-To-Drill-Drybrough-Target-on-Oxide-Peak-Toodoggone-District-BC