TSXV:OGN) (OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce an update for its royalty portfolio including the Ermitaño 2% Net Smelter Return ("NSR") royalty in Sonora, Mexico and the Silicon 1% NSR royalty in Nevada, USA

The following disclosure is summarized from disclosure by the project owners and has not been independently verified by Orogen.

Ermitaño West Deposit

Project owner First Majestic Silver Corp. ("First Majestic") announced[1] that initial production at the Ermitaño deposit will begin in the coming months and represents a significant step-up in output at the Santa Elena processing facility. Development of the Ermitaño deposit and infrastructure have progressed well over 2021, with an initial 45,271 tonnes of ore grading 4.0 grams per tonne ("g/t") gold and 41 g/t silver (5,800 ounces gold and 59,640 ounces silver) stockpiled on surface. First Majestic intends to stockpile up to 60,000 tonnes of ore by the end of 2021.

Road construction connecting the Ermitaño West deposit to the processing plant is now 80% complete and upgrading Santa Elena's liquid natural gas ("LNG") facility for long term power requirements continues. Two drill rigs are presently exploring Ermitaño and a pre-feasibility study is expected to be released by the end of this quarter[2].

Current resources at Ermitaño West reported by First Majestic include the following[3]:

Resource Category | Tonnes (K) | Gold grade (g/t) | Silver grade (g/t) | Gold (K ounces) | Silver (M ounces) |

| Indicated | 2,452 | 4.25 | 64 | 335 | 36.1 |

| Inferred | 6,022 | 2.69 | 57 | 522 | 59.5 |

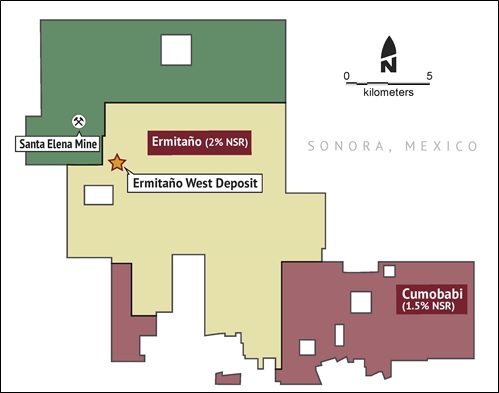

Orogen's 2% NSR royalty interest covers the Ermitaño deposit and 122 square kilometres of prospective ground within the Rio Sonora Valley in Mexico. (See Figures 1 and 2)

Figure 1 - Orogen's Ermitaño royalty interest (tan-coloured claims) in Sonora, Mexico

Figure 2 - Ermitaño east and west portals. (source: https://www.firstmajestic.com/projects/exploration-development/ermitano/ )

Silicon and Merlin Projects

Project owner AngloGold Ashanti N.A. ("AngloGold") has taken several significant and positive steps at the Silicon and Merlin projects and within the greater Beatty District over 2021. AngloGold began the year following up on approximately 28,000 metres of drilling completed at Silicon and Merlin and now are in excess of 70,000 metres in the area[4]. According to AngloGold, exploration results "indicate the potential for significant oxide orebodies at Silicon and Merlin, as well as additional sulphide potential at Silicon at depth." AngloGold announced plans to publish a mineral resource at Silicon and Merlin for the year ending December 31, 2021, with additional drilling and exploration ongoing.

AngloGold also recently announced it entered into an agreement with Corvus Gold Inc. ("Corvus") to acquire all the securities of Corvus for a total equity value of US$450 million. The acquisition of Corvus includes the North Bullfrog, Lynnda Strip and Mother Lode areas. These lands surround the Silicon and Merlin areas and collectively provide AngloGold the opportunity to develop a low-cost Tier 1 asset in one of the premier mining districts in the world. AngloGold anticipates mining production at North Bullfrog in the next three to four years, followed by Silicon and Merlin (where Orogen holds its 1% NSR royalty interest), Lynnda Strip and Motherlode.

Orogen's 1% NSR royalty covers 58.9 square kilometres of prospective ground in the Beatty District including the Silicon and Merlin areas. (See Figure 3)

Figure 3 - Claim map of Orogen's Silicon royalty interest (red box) in the Bare Mountain area of Nevada

Other Royalties

Orogen holds royalty interests in nine other exploration properties in Canada, United States and Mexico. In particular, Orogen holds a 2% NSR royalty on Kodiak Copper Corp.'s ("Kodiak") Axe project in south central British Columbia, a gold-rich copper porphyry target adjacent and on the same structural trend to Kodiak's MPD Project. Recent exploration results at MPD's Gate Zone include drill hole MPD-21-16 that intersected 105 metres grading 0.50% copper, 0.39 g/t gold and 1.57 g/t silver within a broader 504 metre interval of 0.37% copper, 0.15 g/t gold and 1.11 g/t silver[5]. Kodiak plans to explore the Axe project and other areas on the MPD Project in 2022.

In Mexico, Orogen holds a 1% NSR royalty on the Cumaro Project, a low sulpidation epithermal gold target in Sonora. Project owner Heliostar Metals Ltd. ("Heliostar") recently announced high-grade gold and silver results from a channel sampling from three closely spaced veins along the ‘Verde' vein corridor[6]:

- 10.3 g/t gold and 168 g/t silver over 5.0 metres

- 11.5 g/t gold and 125 g/t silver over 1.75 metres

- 8.35 g/t gold and 92 g/t silver over 2.1 metres

- 4.68 g/t gold and 61 g/t silver over 3.0 metres;

- 11.9 g/t gold and 130 g/t silver over 1.65 metres; and

- 2.65 g/t gold and 105 g/t silver over 5.9 metres;

Heliostar plans to drill up to 3,000 metres at Cumaro upon the completion of their recently announced private placement[7].

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Orogen relies on technical information and certain forward-looking statements that have been publicly disclosed by other mining and exploration companies. Additional information can be found at www.sedar.com, www.sec.gov, and on respective company websites.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

Orogen Royalties Inc.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

Forward-Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward-looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

[1] First Majestic Silver Corp. October 12, 2021. https://www.firstmajestic.com/investors/news-releases/first-majestic-produces-a-record-73m-silver-eqv-oz-in-the-third-quarter-consisting-of-33m-oz-silver-and-54525-oz-gold-suspended-silver-sales-and-held-14m-oz-of-silver-in-inventory-at-quarter-end

[2] Denver Gold Forum September 14, 2021. https://www.youtube.com/watch?v=_jEuO7TrrDE

[3] First Majestic Silver Corp. Santa Elena NI 43-101 Technical Report. March 17, 2021. https://www.firstmajestic.com/_resources/reports/Santa-Elena-Technical-Report-Final-2021-03-17.pdf

[4] AngloGold Ashanti N.A. September 13, 2021. https://www.anglogoldashanti.com/investors/media/news-releases/

[5] Kodiak Copper Corp. October 18, 2021. https://kodiakcoppercorp.com/news/news-releases/kodiak-drills-105-m-of-0.76-cueq-within-504-m-of-0.47-cueq-at-gate-zone-begins-drilling-dillard-copper-porphyry-target/

[6] Heliostar Metals Ltd.. September 28, 2021. https://www.heliostarmetals.com/news-articles/heliostar-hits-multiple-channels-up-to-12-6-gt-gold-equivalent-over-5-0-metres-defines-significant-drill-target-at-cumaro-mexico

[7] Heliostar Metals Corp. October 19, 2021. https://www.heliostarmetals.com/news-articles/heliostar-announces-closing-of-first-tranche-of-4-million-non-brokered-private-placement

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/669970/Orogen-Royalties-Royalty-Update