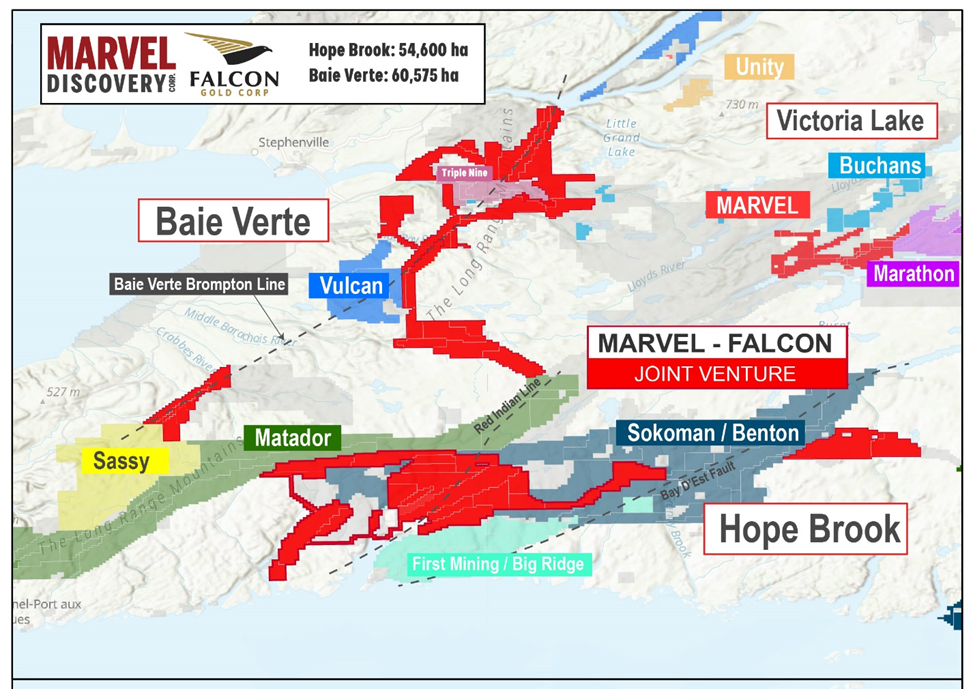

Falcon Gold Corp. (TSXV:FG)(Frankfurt:3FA)(OTCQB:FGLDF); ("Falcon" or the "Company") is pleased to announce the company has formed a strategic partnership with Marvel Discovery Corp. ("Marvel") with the goal of exploring prospective claims recently acquired in the Hope Brook and Baie Verte Brompton Districts. The combined total of both projects covers 115,175 hectares and will be explored together on 50-50 Joint Venture basis. This Alliance further empowers Falcon and Marvel to work together sharing in the potential upside of this impressive land package while reducing costs and capital. The Hope Brook Project will be renamed the Golden Brook JV ("the Property

Chief Executive Officer, Karim Rayani commented, "This alliance between Falcon and Marvel provides numerous upside potential to both companies. Synergies of shared capital, administration costs and common goals utilizing various exploration and vectoring tools won't be hampered by a property boundary line. This will enable the partnership to systematically explore this ground with a common goal of a Tier 1 discovery."

The Golden Brook JV lies at the northern western edge of the Hermitage Flexure, a predominant geological feature of the south Newfoundland Appalachians. The western Hermitage Flexure is a structurally complex region with a diverse metal breakdown. The structures on the property are linked to west verging thrust faults namely the Bay D'Est Fault Zone and the Gunlap Fault zone. These types of fault zones can be gold bearing evidenced by the most significant gold deposit in the area, the Hope Brook gold mine, which was in production from 1987 to 1997 producing 752,163 ounces of gold. The Hope Brook now owned by First Mining has since been optioned to Big Ridge Exploration which has outlined an additional 6.33 million tonnes at an average grade of 4.68 grams per tonne Au for 954,000 ounces of gold in the indicated and inferred categories (https://bigridgegold.com/projects/hope-brook-gold-project-newfoundland/).

The Golden Brook JV will also straddle both the eastern and western extents of recent land acquisitions by the Benton-Sokoman JV (joint venture) partnership. Benton-Sokoman made recent headlines with the discovery of the first lithium pegmatite discovery less 400 meters from the company's newly expanded property boundary. The highly prospective ground held by Falcon shows various lithium clusters that may extend onto the company's ground.

Other land positions within the Golden Brook JV include ground along the Baie Verte Brompton Line (BVBL). The BVBL project is strategically located in a peninsula that hosts all of Newfoundland's current gold production. Producing mines include Anaconda Mining Inc.'s Point Rousse gold mine and Rambler Metals Mining operations. Former producing mines include the Terra Nova mine and deposits of the Rambler mining camp. All of these mines are in close proximity to the BVBL. There are more than 100 gold prospects and zones, many of which are orogenic-style, related to major splays and related second-order structures linked to the BVBL. The Matador Mining Ltd. Cape Ray Project reporting 837,000 ounces of gold is also proximal to the BVBL (https://matadormining.com.au/cape-ray/resource/). The Falcon-Marvel partnership now control ground over a 70-kilometer corridor along the BVBL.

The newly formed JV also controls strategic ground 13km southwest of the Glover Island (GI) trend, an 11km mineralized corridor host to 17 base metal and polymetallic mineral prospects as well as numerous gold showings and anomalies. The GI trend also hosts the Lunch Pond South inferred resources of 120,000 ounces of gold. The GI trend and new property lies adjacent to the BVBL. The GI trend hosts numerous gold anomalies that crosscut several rock types.

The new land alliance is also proximal to the Four Corners project held by Triple Nine Resources. The Four Corners project consists of iron-titanium-vanadium-mineralized rock which has been outlined for 3,000m in strike with intercepts 200m wide and 600m vertically.

The Company has received a total of $ 540,000 in cash from the exercise of warrants since May 18th 2021. The Warrant Incentive Program announced September 16th 2021 has since expired as of October 18th 2021, no individuals participated. The Company announced and closed a private placement of $ 535,210 October 12, 2021.

Qualified Person

Mr. Mike Kilbourne, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company.

The QP and the Company has not completed sufficient work to verify the historic information on the properties comprising the Golden Brook JV, particularly regarding historical exploration, neighbouring companies, and government geological work.

About Falcon Gold Corp.

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20km southeast of Agnico Eagle's Hammond Reef Gold Deposit which has currently estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major northeast-trending splay of the QFZ.

The Company holds 8 additional projects. The Esperanza Gold/Silver/Copper mineral concessions located in La Riojo Province, Argentina. The Springpole West Property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario; and in B.C., the Spitfire-Sunny Boy, Gaspard Gold claims; and most recently the Great Burnt, Hope Brook, and Baie Verte acquisitions adjacent to First Mining, Benton-Sokoman's JV, and Marvel Discovery in Central Newfoundland.

CONTACT INFORMATION:

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/673373/FalconMarvel-Form-Strategic-Partnership-at-Hope-Brook-and-Baie-Verte-Brompton-Line