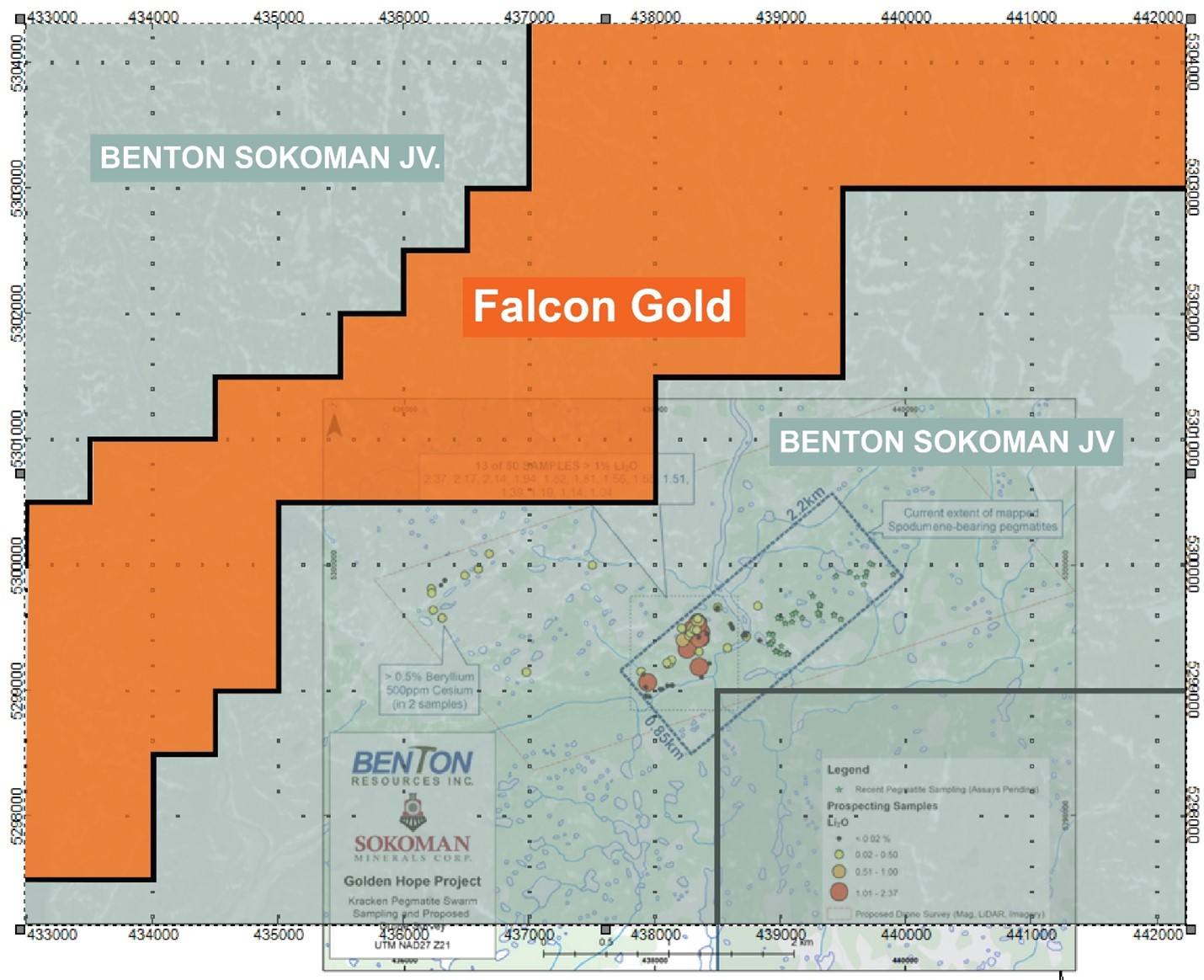

Falcon Gold Corp. (TSXV:FG)(GR:3FA)(OTCQB:FGLDF); ("Falcon" or the "Company") is pleased to announce it has doubled the size of the Hope Brook project making us one of the larger land holders in the Hope Brook Camp. Falcon has now staked a total of 1660 claims totaling 41,500 hectares which are strategically located and contiguous to First Mining Gold, Benton-Sokoman, and Marvel Discovery Corp. Of paramount importance Sokoman made recent headlines on its lithium pegmatite discovery at Hope Brook less than 400 meters from our newly expanded property boundary. The highly prospective ground held by Falcon shows various lithium clusters that may extend onto our ground. Falcon is currently evaluating the data from the government reports which include high resolution radiometric and magnetic surveys previously completed

Falcon's Chief Executive Officer, Karim Rayani commented, "This newly expanded ground could not have happened at a more precise time, Benton- Sokoman just announced today 2.2 km long .85 km- wide meter dyke system called the "Kraken Pegmatite System Swarm". Identifying fine grain spodumene in several key areas. Of key importance they note the area is wide open for expansion, less than 400 meters from our property boundary and looks to be a parallel structure. This speaks to the multi-commodity nature of the large land package we have acquired. Falcon's land is situated in a very active structural corridor giving us a tremendous opportunity for finding the next potential discovery in this camp. We now have 41,500 Hectares under Falcon's control at Hope Brook."

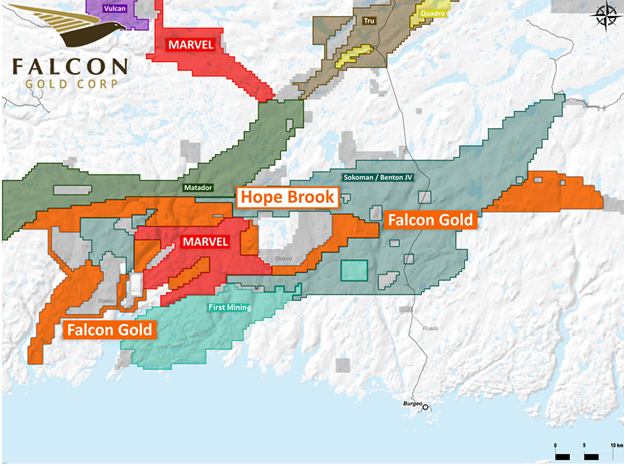

Figure 1. Regional location of Falcon's Hope Brook gold property.

Within this immediate area, the most significant deposit is the Hope Brook gold mine which was in production from 1987 to 1997 producing 752,163 ounces of gold. The Hope Brook now owned by First Mining has since been optioned to Big Ridge Exploration who have outlined an additional 6.33 million tonnes at an average grade of 4.68 g/t Au for 954,000 ounces of gold in the indicated and inferred categories (https://firstmininggold.com/projects/partnerships/hope-brook-project/).

Falcon's land position straddles both the eastern and western extents of recent land acquisitions by the Benton-Sokoman JV partnership with Falcon now controlling areas of considerable structural complexity marked by large scale fold and fault structures which provide important structural controls (traps) for gold mineralization within this area and potentially lithium now.

Figure 2. Location of Falcon's Hope Brook gold property contiguous to First Mining, Matador and the Sokoman-Benton joint venture.

Qualified Person

Mr. Mike Kilbourne, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company.

The QP has not completed sufficient work to verify the historic information on the properties comprising the Hope Brook property, particularly regarding historical exploration, neighboring companies, and government geological work. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.

Falcon's Hope Brook Gold Property

Falcon's new land acquisition is hosted within the Exploits Subzone of the central Newfoundland gold belt. The property covers extensions or is proximal to two major structures linked to significant gold prospects (Cape Ray, Matador Mining) and deposits (Hope Brook, First Mining) in southern Newfoundland (Figure 2). Rock lithologies and structures on the property are also related to those associated with Marathon Golds Valentine Gold Deposits, Sokoman's

About Falcon Gold Corp.

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km southeast of Agnico Eagle's Hammond Reef Gold Deposit which has currently estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major northeast-trending splay of the QFZ.

The Company holds 8 additional projects. The Esperanza Gold/Silver/Copper mineral concessions located in La Riojo Province, Argentina. The Springpole West Property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario; and in B.C., the Spitfire-Sunny Boy, Gaspard Gold claims; and most recently the Great Burnt, Hope Brook, and Baie Verte acquisitions adjacent to First Mining, Benton-Sokoman's JV, and Marvel Discovery in Central Newfoundland.

CONTACT INFORMATION:

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/668210/Falcon-Doubles-the-Size-at-Hope-Brook-to-41500-Hectares-Adjacent-to-Benton-Sokomans-Lithium-Discovery