(TheNewswire)

Toronto, Ontario August 11, 2021 Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) is pleased to announce that it has closed agreements with a number of parties (the "Parties") to option or acquire 321 mining claims (the "Claims " ) in Mann, Hanna, Duff, and Reaume Townships, covering an area totaling approximately 6,539 hectares (the " Transactions "). As reported by the Company on May 31, 2021, the Company has also staked an additional 256 mining claims in Mann, Hanna, Duff and Reaume Townships totaling approximately 5,453 hectares.

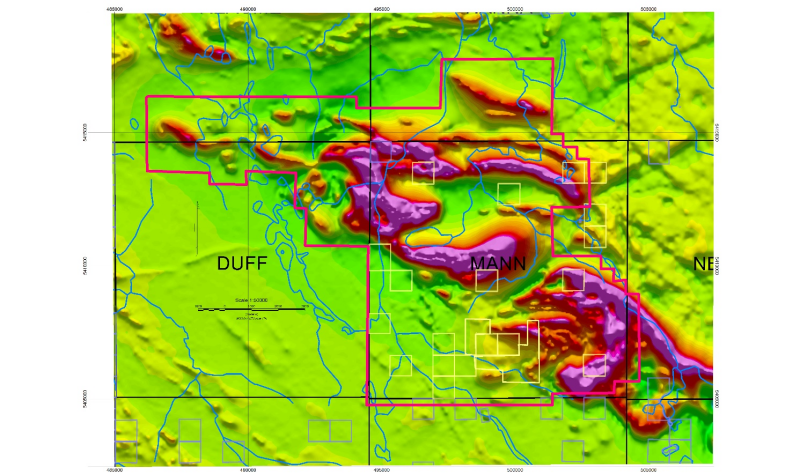

Figure 1. Noble is optioning/acquiring/staking 563 contiguous mining claims (approximately outlined above in red) from various parties in Mann, Duff, Reaume and Hanna Twps (yellow blocks are patents not optioned or controlled).

These acquisitions and earn-ins will provide Noble with control over a contiguous area of ~30km by ~10km.

The Claims cover volcanic rocks of the Kidd Munro assemblage that have been periodically intruded by Ni-Cu bearing mafic to ultramafic intrusions. This assemblage hosts one of the world's largest VMS deposits at Kidd Creek, approximately 20 km to the east, and the Ni-Cu deposit at Enid Creek in Loveland Twp., as well as the Crawford Ni-Co-Pd deposit in Crawford Township. The area is thus felt by Noble's management to be highly prospective for both Ni-Cu and VMS deposits. Like other prospects in the Timmins region, the area is covered by thick glacial till and conductive clays (up to 50 m) that hampered earlier exploration efforts.

There are over 20 km of mapped ultramafic rocks in Mann Township. The ultramafics consist mainly of mafic sheets, sills and dikes that have intruded into and differentiated within volcanogenic sediments. The differentiated intrusions are composed of basal peridotite, usually serpentinized with a transition to pyroxenite, and then gabbro. The peridotite, and the better mineralized dunite, are the host rocks for the nickel-cobalt sulphide.

Exploration for nickel in Mann Township dates to 1948 when International Nickel drilled eight holes into serpentinized peridotite. In 1950 and 1951, Canadian Johns Manville drilled an additional eight holes intersecting serpentinized peridotite. Drilling has been widespread, with numerous holes covering over 2 kilometers of delineated serpentinized peridotite with individual sections up to 450 feet containing 0.25% nickel and averaging 120ppm cobalt. There are numerous higher values up to 0.5% nickel. No data was found showing PGM numbers as the elements were likely not assayed for. There are various elevated copper sections up to 0.2% Cu. At a different part of the complex, numerous previous drill holes show nickel values of 1.1% nickel in net textured pyrrhotite over 4 feet of length in interlayered mafic-ultramafic-interflow rocks, and copper values.

Historic work has disclosed a clinopyroxenite reef with encouraging Palladium ("Pd")values. The latest work completed in 2008 gave repeatable values in drill core that showed up to 0.6 g/t Pd over 15 meters with a higher value section of 1.0 g/t Pd over 4.2 meters. Channel samples showed 0.6 g/t Pd over 22 meters including 0.927 g/t over 6 meters.

All exploration results disclosed in this news release are historical and have not been verified by a qualified person on behalf of Noble. The results are therefore non-compliant with the requirements of National Instrument 43-101.

Noble's payment and exploration expenditure commitments for the claims being acquired or subjected to earn-ins are as follows:

| Cash | Canada Nickel Company Inc. shares to be transferred to vendors/optionors | Shares | Exploration Expenditures Required | |

| On Closing | $115,000 (paid) | 64,000 (transferred) | 900,000 (issued) | $100,000 |

| 1st Anniversary | $65,000 | 14,000 | 450,000 | $400,000 |

| 2nd Anniversary | $105,000 | 14,000 | 700,000 | $600,000 |

| 3rd Anniversary | $50,000 | 14,000 | 250,000 | $300,000 |

| 4th Anniversary | $50,000 | 14,000 | 300,000 | $300,000 |

| $385,000 | 120,000 | 2,600,000 | $1,700,000 |

There are five vendor or optionor groups areas involved. Under three of the five transactions, the vendor or optionor will retain a 2% NSR that will be subject to Noble's right to buyback half of the NSR for $1,000,000 per property. For the fourth transaction, the optionor will retain a 2% NSR that will be subject to Noble's right to buyback 50% of the NSR for $1,000,000 during the first 4 years, and thereafter the buyback payment would be $1,000,000 per project area (with the optioned property being divided into 7 project areas), and the optionor will also retain a 10% gross stone royalty that is subject to Noble's right to buyback half of the stone royalty for $100,000. For the fifth transaction, the vendor will retain a 1% NSR subject to Noble's right to buyback half of the NSR for $500,000.

The Transactions have been approved by the Board of Directors of each party where applicable and are subject to final approval by the TSX Venture Exchange and to compliance with securities and other laws and regulations.

Vance White, President and CEO of Noble, said "we are extremely pleased to be able to secure this very large land package as it represents a 20km strike length where evidence of nickel, cobalt, PGM's, rhodium and rare earth minerals have been found to be present in work carried out by past explorers. A budget and plan of exploration will be developed. I am confident this will turn out to be a very exciting project."

Michael Newbury PEng (ON), a "qualified person" as such term is defined by National Instrument 43-101, has reviewed the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property near Wawa, Ontario, holds approximately 72,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

H. Vance White, President Email: info@noblemineralexploration.com

Phone: 416-214-2250 Investor Relations

Fax: 416-367-1954 Email: ir@noblemineralexploration.com

Copyright (c) 2021 TheNewswire - All rights reserved.