(TheNewswire)

Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) is pleased to announce that it has entered into an agreement to acquire t he Buckingham graphite property, which is located in the Outaouais region of Western Québec, and to engage Wayne Holmstead as the Company's Exploration Manager. Pursuant to the agreement that was signed between the parties, when Noble completes the acquisition of the Buckingham graphite property from Mr. Holmstead, the Company would also sign a consulting agreement for Mr. Holmstead to begin serving as Noble's Exploration Manager

Wayne Holmstead (B.Sc, P.Geo) brings Noble Mineral Exploration 40+ years of exploration experience in Ontario and Quebec. He is a P.Geo who graduated from the University of Toronto. Holding positions of President, Vice President Exploration, Exploration Manager and Director for various Junior Mining companies over the years and he has directed all aspects of mineral exploration in Canada.

Selected Accomplishments include:

Co-discovered and arranged financing for the MacLeod Lake Cu Mo Au Ag deposit in James Bay, Quebec. Later work outlined 18M tonnes of copper, molybdenum, gold, and silver in the Main Zone. Discover ed the South Zone and Rocky Point Zone at Macleod Lake through Boulder Tracing and Beep Mat Prospecting.

Generated and Optioned Exploration Properties to:

- Osisko (Troilus North Gold)

- Royal Nickel (Qiqavik)

- Beaufield Resources (Troilus North and Kukames Gold)

- SNET (Lac Fire Lithium property)

- X-Terra Resources (Veroneau Gold Property)

- UrbanGold Minerals (Numerous properties)

Acquired claims in the Troilus Area, Quebec for UrbanGold Minerals that led to the recent takeover bid by Troilus Gold to the benefit of UrbanGold shareholders.

Wayne uses advanced computer and instrument technology combined with traditional exploration methods to generate projects and new mineral discoveries.

With the assistance of Wayne, Noble Minerals has acquired the following Quebec exploration properties for staking cost.

Buckingham Graphite

The Buckingham graphite property is located in the Outaouais area of the Grenville Subprovince of Quebec.

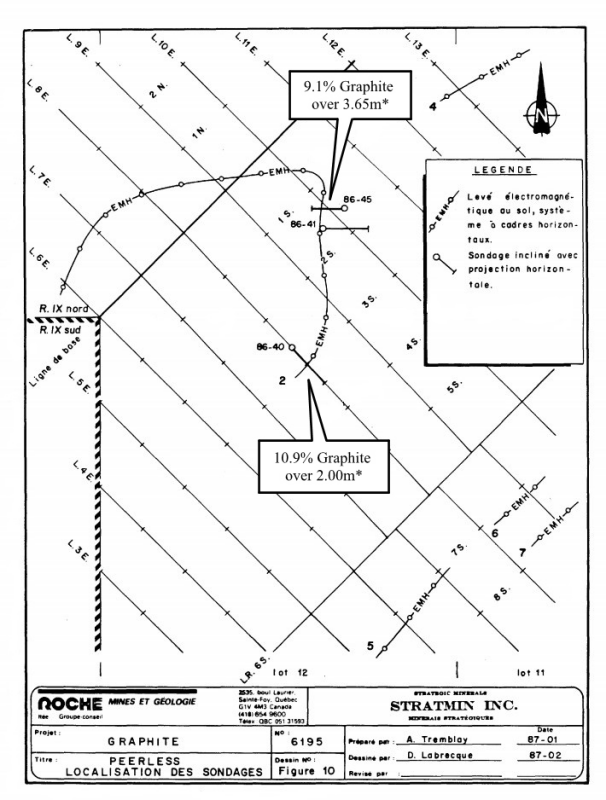

The property consists of 30 claims (1803 hectares) and contains 3 separate graphite occurrences. The main occurrence (McGuire) was worked by Stratmin Inc. in 1985-86 when a ground electromagnetic survey was done following a regional airborne survey. Three diamond drill holes were completed to intersect the electromagnetic anomalies, 2 of which intersected graphite mineralization See Figure 1 . The graphite was found to be hosted by marble and gneissic rocks.

Hole Graphite Length

86-40 10.9% 2.00m*

86-45 9.1% 3.65m*

Hole 86-41 did not intersect the electromagnetic anomaly. Additional visual estimations of graphitic horizons were noted in the log descriptions but were not analyzed for graphite.

Hole Interval(m) Width(m) Visual Graphite(Gp)

86-40 11.3-12.95 1.65* 10-15% Gp

86-40 13.9-14.05 0.15* 8-10% Gp

86-40 18.25-18.75 0.50* 5-10% Gp

86-40 21.2-21.35 0.15* 12-15% Gp

86-40 21.6-21.95 0.35* 10% Gp

86-45 66.35-66.55 0.20* 10-12% Gp

86-45 67.65-68.10 0.45* 3-6% Gp

* (True width not known at this time)

Figure 1: Results of Stratmin Electromagnetic Survey with Location of Diamond Drill Holes

Although the nature of the graphite on the Buckingham Property has not been determined, graphite concurrences in this area are normally coarse grained, flake graphite. This type of graphite is the most desirable of the naturally occurring type s that is used to produce lithium-based batteries. Lithium-based batteries are required for a variety of 'green' technologies, including electric vehicles. The global demand for these types of products is expected to rise as world governments lean towards environmentally friendly products rather than petroleum-based ones.

The second graphite occurrence (Cummings) is described as a "deposit in the form of narrow bands of graphite occurring in gneiss and marble over a length of 300 m and a width of 30 m. The graphite occurs in several irregular bands within the 30 m zone." The Cummings Occurrence is located about 1.5 km southeast of the McGuire Occurrence.

The third graphite showing on the property is called the Robidoux Occurrence and is located about 4 km east of the McGuire Occurrence. It was described by the Quebec Superintendent of Mines in a 1910 report as a "partially uncovered graphitic bed over a length of about forty feet. Some shallow pits have also exposed graphitic outcrops, presumably of the same bed, for an additional distance of 75 to 100 feet. The bed where exposed by the main stripping is about four feet thick and dips into the side of a low hill at an angle of 40 to 50 degrees." It was also noted that "the graphite ore contains over 30% carbon."

(Note: the exploration work, descriptions and analysis are historic and not 43-101 compliant)

Work program on the Buckingham Property will include a property visit with prospecting to identify the existing showings and historic drill holes. A beep mat will be used to identify new conductive zones that may represent graphitic horizons.

The consideration for the acquisition are the costs of staking and reserving to the vendor a 2% NSR that will be subject to Noble's right to buyback 50% of the NSR for $1,000,000.

The Transactions are subject to approval of the Board of Directors of Noble, as well as to compliance with TSX Venture Exchange policies, securities laws and regulations and other laws and regulations.

Vance White, President and CEO of Noble, said "we are extremely pleased to have Wayne join the Noble team and to bring knowledge and understanding of projects in northern Ontario and Quebec. The addition of the Buckingham Graphite project adds in the search for viable projects related to the ever-evolving battery related industries in the search for a "greener" world. Following Exchange approval, a budget and plan of exploration will be developed."

Michael Newbury PEng (ON), a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the Wawa, Ontario area, holds approximately 72,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration/VMS targets at various stages of exploration. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2021 TheNewswire - All rights reserved.