(TheNewswire)

Vancouver, British Columbia, September 26, 2025 TheNewswire - Headwater Gold Inc. (CSE: HWG) (OTCQB: HWAUF) (the "Company" or "Headwater") is pleased to announce that Newmont Corporation ("Newmont") has completed Stage 1 of the Spring Peak earn-in agreement announced on August 16, 2022 (the "Earn-In Agreement") by sole funding of US$15,000,000 in exploration expenditures on the project. Newmont has earned a 51% interest in the Spring Peak project and has elected to proceed to Stage 2 of the Earn-In Agreement to potentially earn a 65% interest in the project by sole funding an additional US$40,000,000 within 36 months. The parties will establish a Joint Venture Company pursuant to a definitive joint venture agreement, to be negotiated, which will govern management, funding commitments and operator transition terms to continue exploration on the project. Headwater is the operator of the project and earns a 10% management fee.

Highlights:

- Newmont has completed Stage 1 of the Spring Peak project Earn-In Agreement and has elected to advance the project to Stage 2.

- Under Stage 2, Newmont may increase its interest in the project from 51% to 65% by funding exploration expenditures of US$40,000,000.

- Upon completion of Stage 2, Newmont may elect to proceed to Stage 3 to earn an additional 10% interest, resulting in a 75% interest in the project by:

- Completing a Pre-Feasibility Study solely funded by Newmont within an additional 2-year period; and

- Granting to Headwater a 2% NSR royalty on claims 100% owned by Headwater and a 1% NSR royalty on inlying claims subject to an underlying option agreement.

- Headwater will be the initial operator of the project under Stage 2 and earn a 10% management fee on exploration expenditures on the project.

Caleb Stroup, President and CEO of Headwater, comments: "The completion of Stage 1 and commencement of Stage 2 at Spring Peak represent a major milestone for the project and the Company. We are extremely pleased that Newmont has elected to continue our partnership on the project following the discovery of the high-grade Disco Zone, encouraging drill results from the Shadow Target, and an expanding set of additional property scale targets. The US$40,000,000 potential funding included in Stage 2 positions the Company to aggressively explore the district scale potential of the project. A significantly expanded drill permit is currently undergoing agency review, which will allow for testing of extensions to the Disco Zone, the Shadow Target, and other potential mineralized structures via 266 proposed new drill sites."

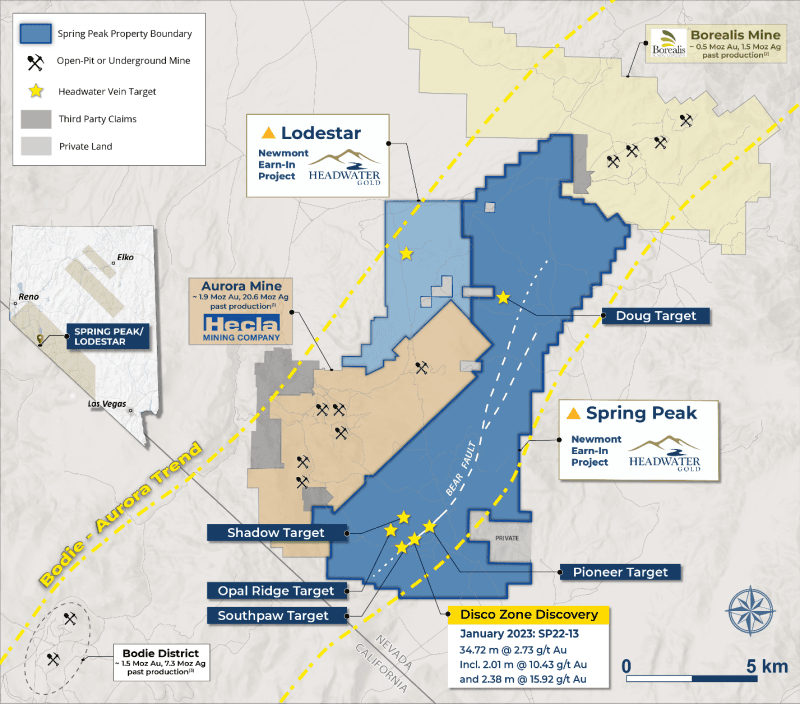

Figure 1: Map of the Headwater Spring Peak and Lodestar land positions within the Aurora trend showing area of the Spring Peak 2024 drill program.

Table 1: Principal Structure of the Spring Peak Earn-In Agreement:

Stage | Expenditures (US$) | Newmont Interest (%) | Time for Each Stage |

Minimum Commitment | $5,000,000 (Complete) | 0% | 3 years from Execution Date |

Stage 1 | $15,000,000 (Complete) | 51% | 3 years from Execution Date |

Stage 2 1 | $40,000,000 (in progress) | 65% | 3 years from beginning of Stage 2 |

Stage 3 2,3 | Completion of PFS | 75% | 2 years from beginning of Stage 3 |

| |||

| |||

About the Spring Peak Project

The Spring Peak project is located in the Aurora Mining District in the Walker Lane belt, west-central Nevada, approximately 50 km southwest of the town of Hawthorne. The project adjoins Hecla Mining Company's past-producing Aurora Mine complex, where existing infrastructure includes a 600 ton per day mill, several production water wells and high-voltage three-phase power. Recent drilling at the Disco Zone has confirmed the presence of high-grade gold mineralization, including significant intersections such as 15.92 g/t Au over 2.38 m and 10.43 g/t Au over 2.01 m within a broader zone of 2.73 g/t Au over 34.72 m. An exploration Plan of Operations has been submitted to the US Forest Service proposing 266 additional drill sites to further explore for extensions of known mineralization and test additional targets within the land package. Headwater holds an option to acquire a 100% undivided interest in the Spring Peak project from Orogen Royalties (TSXV: OGN), subject to retained royalties and subject to Newmont's option to acquire up to 75% of the project following certain expenditures and preparation of a Pre-Feasibility Study within a designated time frame.

About Headwater Gold

Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) is a technically-driven mineral exploration company focused on exploring for and discovering high-grade precious metal deposits in the Western USA. Headwater is actively exploring one of the world's most well-endowed, mining-friendly jurisdictions, with a goal of making world-class precious metal discoveries. The Company has a large portfolio of epithermal vein exploration projects and a technical team with diverse experience in capital markets and major mining companies. Headwater is systematically drill-testing several projects in Nevada and has strategic earn-in agreements with Newmont on its Spring Peak and Lodestar projects. In August 2022 and September 2024, Newmont and Centerra Gold Inc. acquired strategic equity interests in the Company, further strengthening Headwater's exploration capabilities.

For more information about Headwater, please visit the Company's website at www.headwatergold.com .

Headwater is part of the NewQuest Capital Group which is a discovery-driven investment enterprise that builds value through the incubation and financing of mineral projects and companies. Further information about NewQuest can be found on the company website at www.nqcapitalgroup.com .

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

cstroup@headwatergold.com

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

bzerb@headwatergold.com

Figure 1 References:

1 Vikre, P.G., John, D.A., du Bray, E.A., and Fleck, R.J., 2015, Gold-silver mining districts, alteration zones, and paleolandforms in the Miocene Bodie Hills volcanic field, California and Nevada: U.S. Geological Survey Scientific Investigations Report 2015–5012, 160 p.

2 Borealis Mining Company Limited, 2024, NI 43-101 Technical Report, Project Status Report Borealis Mine Nevada USA: Prepared by Douglas Reid. Effective Date: October 10, 2023; Report Date: February 16, 2024.

3 Long, K.R., DeYoung, J.H., and Ludington, S.D., 1998, Database of significant deposits of gold, silver, copper, lead, and zinc in the United States: U.S. Geological Survey Open-File Report 98-206 A, B, 33 p.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Dr. Gregory Dering, P.Geo (AIPG CPG-12298), a "Qualified Person" ("QP") as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Dr. Dering is not independent by reason of being the Company's Vice President of Exploration.

References

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, exploration activities and the specifications, targets, results, analyses, interpretations, benefits, costs and timing of them, Newmont's anticipated funding of the earn-in projects and the timing thereof, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward-looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the anticipated business plans and timing of future activities of the Company, including the Company's exploration plans and the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, the risk that Newmont will not elect to obtain any additional prognostic interest in the earn-in projects in excess of the minimum commitment, the ability of the Company to obtain the required permits, changes in laws, regulations and policies affecting mining operations, the Company's limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading "Risk Factors" in the Company's prospectus dated May 26, 2021 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR+ website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law.

Copyright (c) 2025 TheNewswire - All rights reserved.