May 12, 2025

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a cut-off grade of 0.5g/t Au, confirms a near-surface inferred resource of 72kt @ 2.5g/t Au for 5,800 oz. This adds to the existing 61,300 oz gold resource at the nearby Blue Heaven deposit, bringing the total gold resource inventory at Murchison South to approximately 67,100 oz.

HIGHLIGHTS

- Pansy Pit: Mining Plus confirms Mineral Resource Estimate (MRE) for the Pansy Pit Deposit at Murchison South:

From Surface 72kt @ 2.5g/t Au for 5,800 oz Gold (Table 1) - Blue Heaven: Mining Plus confirms MRE for the Blue Heaven deposit at Murchison South: From Surface 681kt @ 2.8 g/t Au for 61,300 oz Gold (Table 1) (ASX Announcement 9 April 2025)

- Blue Heaven and Pansy Pit MRE, together total ~67,100 oz Gold

- Pansy Pit MRE is based solely on review by Mining Plus of historical drilling

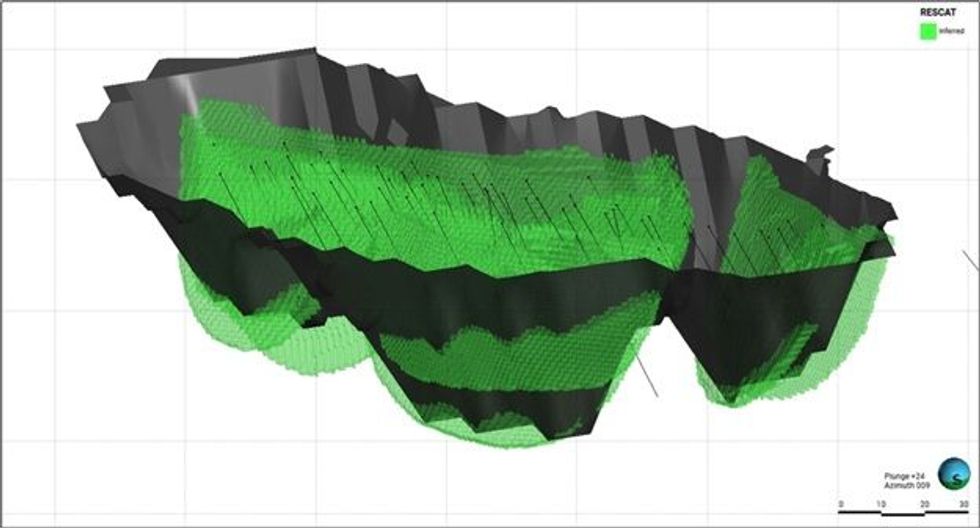

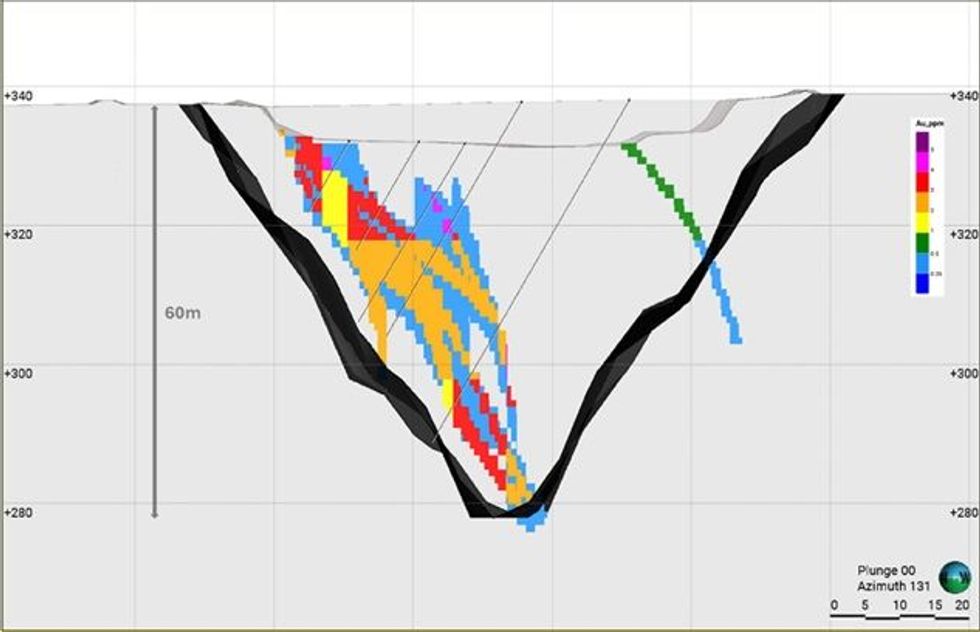

- Historical drilling was only to 60m, mineralisation open at depth and along strike north and south (Figure 2)

- The Pansy Pit has the potential to be a shallow, open pit mining operation, with mineralisation observed from surface

- Strong Gold Market: Spot gold price of ~A$5,000/oz offers significant upside versus the A$3,500/oz price used in the MRE to model pit shells

- The Pansy Pit sits within granted Mining lease M59/662 and is just over 2km from the Company’s Blue Heaven deposit and on the south side of the Great Northern Highway (Figure 3)

- The Pansy Pit provides evidence of the expansion potential along the Primrose Fault, notably to the south at the Shamrock deposit and to the north at the Pansy North and Jacamar deposits (Figure 3)

The Pansy Pit MRE is shown in Table 1 on page 3.

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

14 March 2023

Multiple New Lithium (LCT) Pegmatite Targets Confirmed

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) engaged globally renowned geological consultants RSC Consultants Limited (RSC) to assess the potential of the Company’s Gascoyne projects for:Lithium (Li): hard rock, high grade LCT Pegmatites Rare Earth Elements, Heavy and... Keep Reading...

2h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

13h

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

02 March

Gold, Silver Prices Spike on US-Iran War

Prices for gold and silver spiked higher over the weekend and in early morning trading on Monday (March 2) as a full-blown war broke out in the Middle East.Tensions between Iran on one side and the US and Israel on the other have been intensifying over the past few weeks. On Sunday (February... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00