January 26, 2023

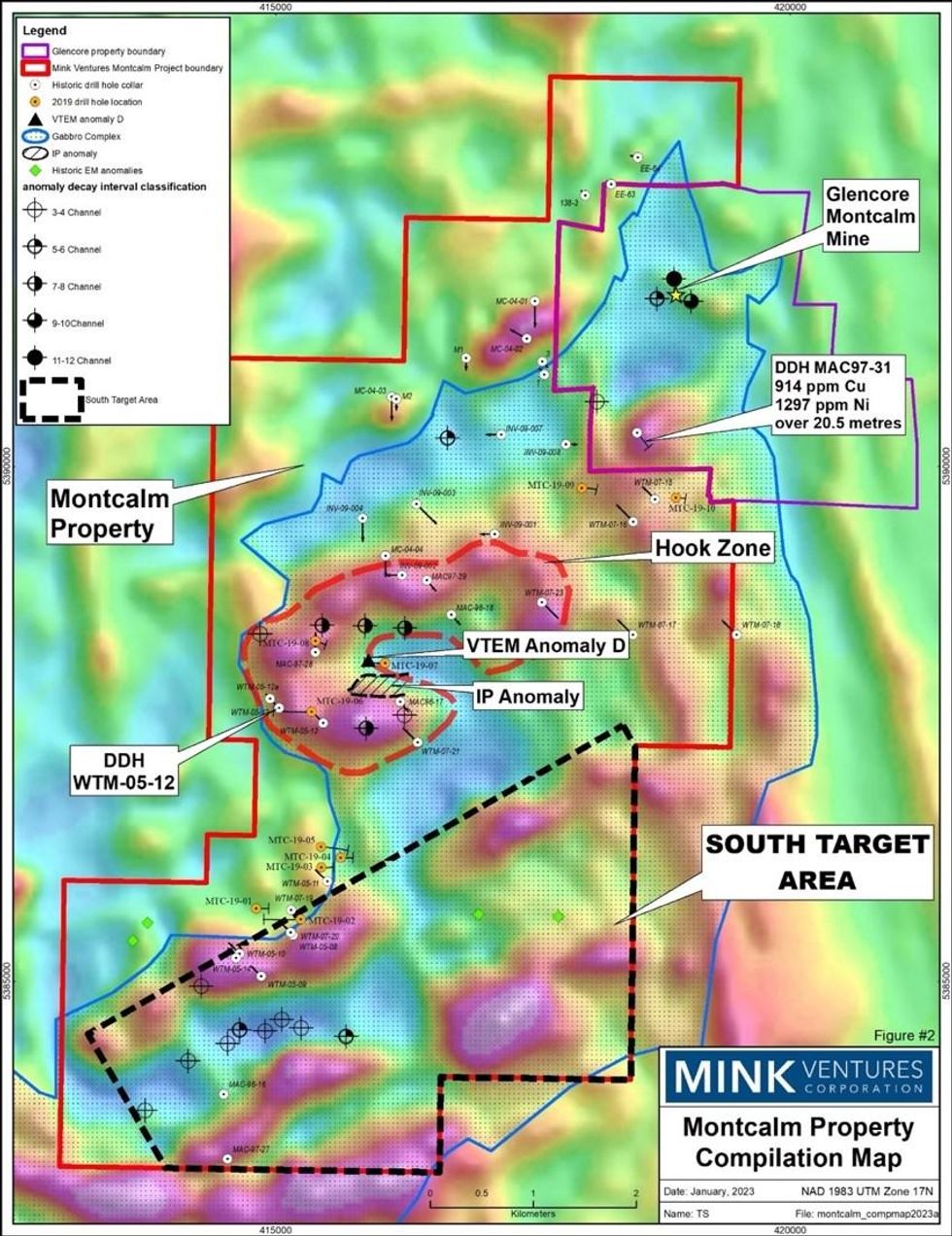

Mink Ventures Corporation (TSXV: MINK) ("Mink" or the "Company") today announced an exploration progress update from its 40 km2 Montcalm nickel copper cobalt project, located adjacent to Glencore's historical Montcalm Mine, 65 km northwest of Timmins, Ontario. The Montcalm Mine had historical production of approximately 3.93 million tonnes of ore grading 1.25% Ni, 0.67% Cu and 0.051% Co. (Ontario Geological Survey, Atkinson, 2010). In just over two weeks since beginning its exploration program, the Company has completed the following at its Montcalm Project (see accompanying Fig.2).

- Completed multiple, borehole induced polarization (IP) surveys, as well as cross hole configurations, within the western portion of the Hook Zone, on five, priority, historical drill holes where unexplained electromagnetic (EM) targets remain relevant. The new, advanced borehole IP technology being utilized here can seek for a 250-meter radius around a borehole and deeper still from the bottom of a hole for both massive and disseminated targets and model these zones in 3D.

- Outlined a number of significant targets of interest from the preliminary field data from the borehole IP survey. The field portion of the borehole surveying will be completed within the week and more detailed processing of the data will continue to prioritize targets for Mink's diamond drill program.

- Applied to the Ontario Government's Critical Minerals Innovation Fund for a non-dilutive, $200,000 grant to build upon the success of Mink's Phase 1, proof-of-concept borehole IP survey, with a Phase 2 and Phase 3 survey program within or proximal to the Hook Zone. These surveys can seek massive and disseminated mineralization cost-effectively and will continue to be an important new exploration tool at Montcalm.

- Mobilized a line-cutting and surface IP crew to evaluate the Southern Target Area of the project. A number of untested historical EM targets and magnetic anomalies identified by previous operators and government surveys will be the focus of this program and will better refine these targets for drill testing. The surface IP survey will begin immediately once the borehole IP work to the north is completed and will help refine and prioritize these targets.

- Secured a diamond drill contractor for a phase 1 drill program which will follow in late February upon the completion of the geophysical surveys.

Significant advances in IP geophysical technology have enabled deeper penetrating systems with incredible clarity. The new IP systems allow for the production of 3D geophysical models of mineralized zones. Mink is benefitting from the work of previous operators who left numerous EM targets unexplained or untested in historical holes; these holes can now be probed with the new borehole IP technology. Borehole IP systems now have the capability to see a 250 meters radius around a bore hole and significantly below the end of the drill hole, which is an extremely cost-effective way of evaluating both disseminated and more massive targets at depth. The deepest known Ni Cu Co lenses at the Montcalm Mine are known to extend from approximately 250 to 400 meters vertical depth, which is well beyond the capability of many older surface EM systems.

Further, historical work at the Glencore mine site demonstrated that in addition to the higher-grade Ni Cu Co lenses, there is potential for disseminated mineralization. In some instances, this type of mineralization is associated with a magnetic high and no coincident electromagnetic (EM) response (ex. Hole MAC9731 see Fig.2). Numerous magnetic targets of this nature are present on Mink's claims both within the Hook Zone and across the southern portion of the property representing valid exploration targets.

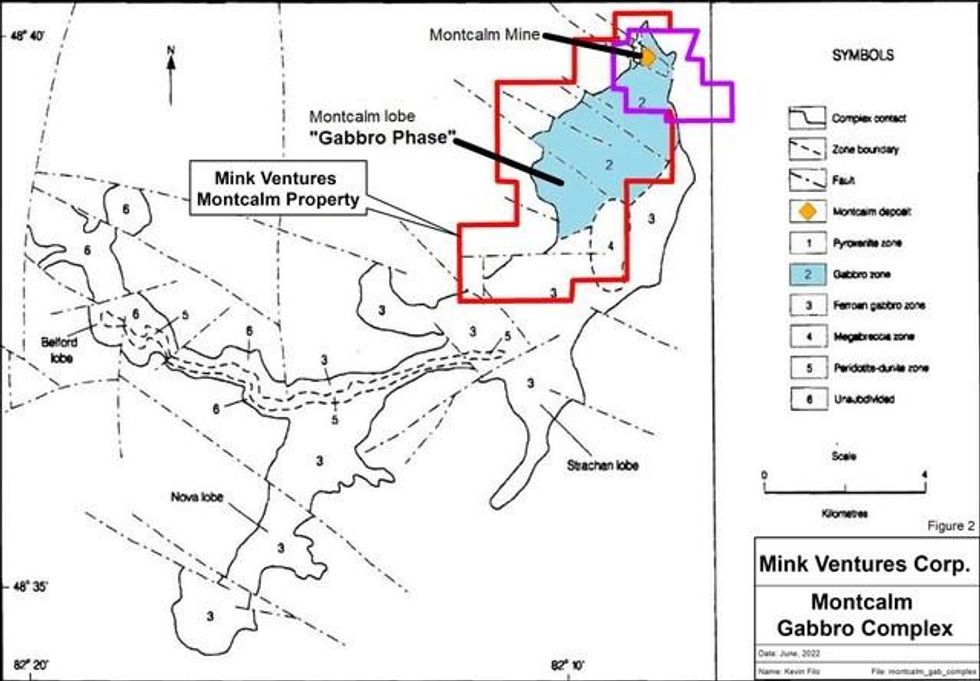

Mink's claims cover very prospective geology including approximately 10 square km of the gabbro phase of the Montcalm gabbro complex. The gabbro phase of the complex hosted the former Montcalm mine (see Fig.1- light blue unit). Mink's project has excellent access and infrastructure including an all-weather road to the property, a series of logging roads throughout, as well as a power line, and proximity to the Timmins Mining Camp, enabling cost-effective mobilization and exploration. The Company has 14,928,257 shares outstanding.

Qualified Person

Mr. Kevin Filo, P.Geo. (Ontario), is a qualified person within the meaning of National Instrument 43-101. Mr. Filo approved the technical data disclosed in this release.

About Mink Ventures Corporation:

Mink Ventures Corporation (TSXV: MINK) is a Canadian mineral exploration company exploring for battery metals (nickel, copper, cobalt) at its Montcalm project, which covers approximately 40 km2 adjacent to Glencore's former Montcalm Mine which had historical production of 3.93 million tonnes of ore grading 1.25% Ni, 0.67% Cu and 0.051% Co. (Ont. Geological Survey, Atkinson, 2010. The project has excellent access and infrastructure with an all-weather access road and power as well as its proximity to the Timmins Mining Camp. The Company has 14,928,257 shares outstanding.

For further information about Mink Ventures Corporation please contact: Natasha Dixon, President & CEO, T: 250-882-5620 E: ndixon@minkventures.com or Kevin Filo, Director, T: 705-266-6818 or visit www.sedar.com.

Forward-Looking Statements

This press release includes certain "forward-looking statements" under applicable Canadian securities legislation, including, but not limited to, statements with respect to the common shares beginning trading on the TSXV. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. These forward-looking statements are made as of the date hereof and Mink disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

MINK:CA

The Conversation (0)

13 February

Editor's Picks: Gold, Silver Prices Dip and Bounce Back, Plus Top Takeover Candidate

Gold and silver were having a fairly quiet week until Thursday (February 12), when both precious metals experienced steep drops early in the day.The gold price, which had been steady above US$5,000 per ounce, and even briefly breached US$5,100, tumbled by over US$100, bottoming out around... Keep Reading...

13 February

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

Keith Weiner: Silver Being Remonetized "With a Vengeance" as Gold Rises

Keith Weiner, founder and CEO of Monetary Metals, shares his outlook for gold and silver in 2026, saying that while he expects higher prices there will be volatility. He also outlines his thoughts on the role of precious metals in the monetary system. Don’t forget to follow us @INN_Resource for... Keep Reading...

12 February

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00