February 19, 2023

West Australian gold exploration and development company, Rox Resources Limited (“Rox” or “the Company”) (ASX: RXL), in conjunction with its joint venture partner Venus Metals Corporation (ASX: VMC), is pleased to report initial drilling results from the substantial reverse circulation (RC) and diamond drilling (DD) programs at the Youanmi Gold Project (OYG JV).

Highlights:

- New drilling at the emerging Midway discovery hits thick high-grade intercepts including:

- 6.76m @ 15.40g/t Au from 169.13m

- 3.73m @ 10.25g/t Au from 405.80m

- 2.86m @ 22.03g/t Au from 356.39m

- The new drilling at Midway confirms the continuity of this developing high-grade discovery, located adjacent to the Youanmi mine

- Exploration and resource drilling at the Youanmi project is proceeding ahead of schedule with 6,434m completed of the planned 23,000m drilling program

Exploration drilling has initially targeted the exciting, high-grade ‘Midway’ discovery made by the OYG JV in 2021 (ASX announcement 8 June 2022). This high-grade, multi-lode system is located just 300m from the hanging-wall of the Youanmi Main Lode and presents an excellent near mine exploration target which is open in all directions. The exceptional drilling results, coupled with the detailed structural information, will provide valuable information to expand the emerging discovery.

4,726 RC meters and 1,708 diamond meters have been completed to date from the planned 16,000 metre RC and 7,000 metre DD drill programs. Drilling is ongoing and is expected to be completed in April.

Management Comments

Rox Resources Managing Director, Mr Robert Ryan, said the Midway discovery has vast potential to grow with follow-up work underway:

“From the initial drilling campaign last year, excitement has been building for the latest drilling results at Midway and they have not disappointed, with thick, high-grade gold intercepts proving the exploration concept. Follow- up drilling is currently being planned and will commence in the coming weeks.

“The results from Midway to date have shown that this discovery has the potential to grow substantially in all directions in a corridor previously untested with drilling. The high-grade tenor of the results to date show Midway has the potential to be higher grade than the Youanmi main lode and has the potential to significantly contribute to the gold resource.

“2023 is evolving into an exciting year for the company as we continue our three pronged approach for building value for shareholders through adding ounces through exploration, increasing resource confidence through in- fill drilling and de-risking the project through feasibility work.”

Midway Exploration Drilling

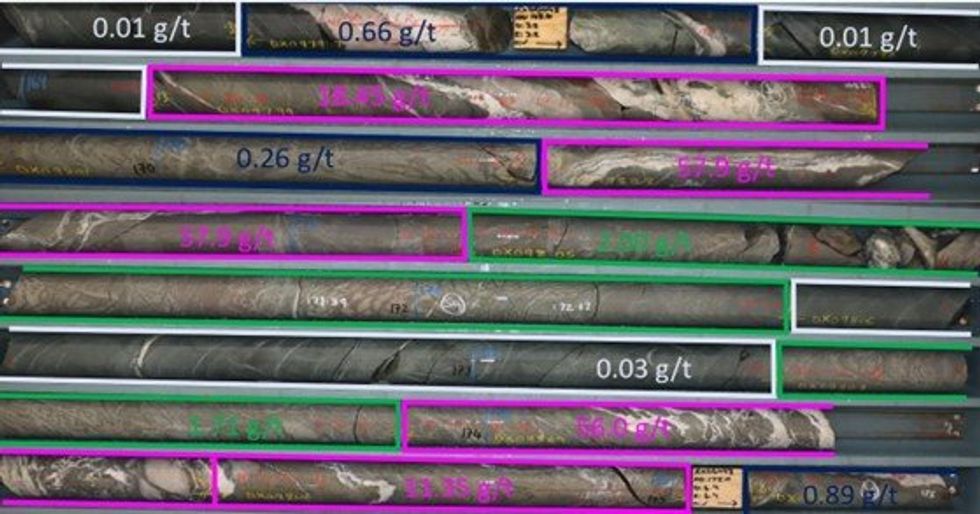

Gold mineralisation at Midway is shear-zone hosted within highly altered tholeiitic and komatiitic basaltic rocks. The alteration assemblage consists of sericite, quartz, carbonate, and biotite. Gold occurs in association with pyrite and lesser arsenopyrite (Figure 1).

The results to date define at least two gold lodes striking WNW and dipping towards the SW. Structural analysis of the mineralised zone (shear fabric and stretching mineral lineation) indicates that the lodes are dipping steeply towards the southwest and show a high-grade component plunging at 50 degrees to the WNW. The orientation of the new lodes is different to previously identified lodes at Youanmi which strike NW to NNW. This new orientation of mineralised structures is apparent in high resolution drone magnetic imagery and has generated several new exploration targets which will be tested by RC and DD drilling. So far the multi-lode structure has been intersected over approximately 100m strike and 300m down plunge.

Click here for the full ASX Release

This article includes content from Rox Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00