March 24, 2024

Test-work to run in parallel with other key development workstreams to unlock the world-class potential of the high-grade flake graphite project

Metals Australia Ltd (ASX:MLS) has a proven track record of battery minerals discovery and has a high-quality portfolio of advanced battery minerals and metals projects in the highly ranked and well-established mining jurisdictions of Quebec, Canada and Western Australia.

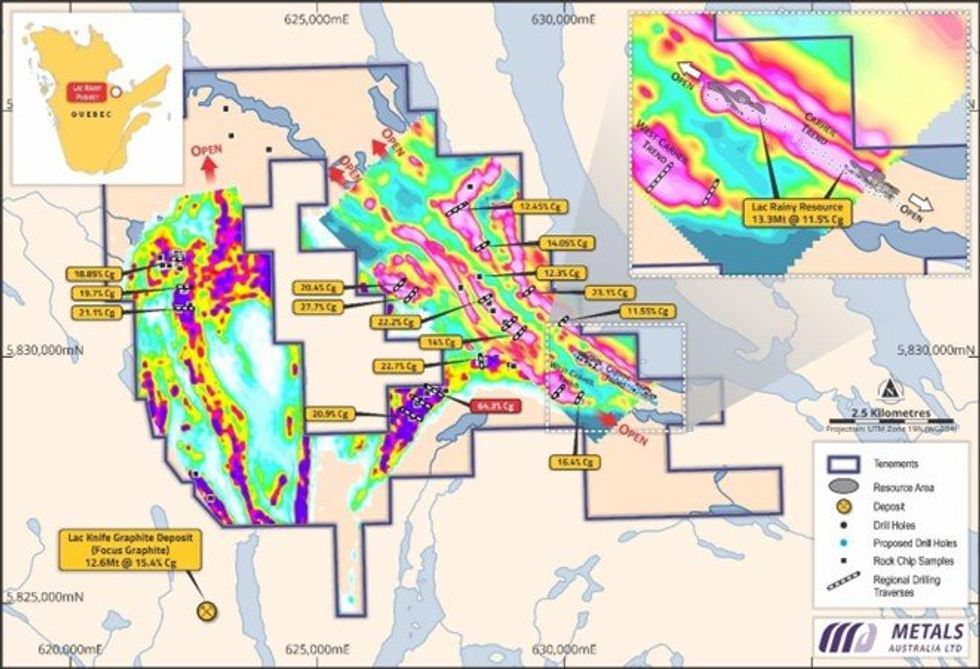

- Major new metallurgical test-work programs are set to commence at the high-grade Lac Rainy flake graphite project in the tier-one Canadian mining jurisdiction of Quebec. The test-work will utilise bulk samples of existing drill-core from the following Mineral Resource1 zones (see Figure 1):

- Southeast Carheil: A 220kg bulk sample grading 13% graphitic carbon (Cg). Sample of predominantly fine to medium flake will be split into several variability samples representing the first 10 years of the mining schedule detailed in the previously completed Scoping Study 2.

- Northwest Carheil: A 200kg bulk sample grading 8%Cg. Examination of drill core from Northwest Carheil indicates a high proportion of large (>180 micron) flake. The metallurgical test-work program for this portion of the Mineral Resource will assess the recovery characteristics of higher value, large flake graphite concentrate.

- Metallurgical test-work will be carried out in two stages:

1. Generation of flake graphite concentrate (>95%Cg) using modified flow-sheet conditions designed to optimise recovery of fine to medium flake for downstream spherical graphite production as well as generation of large flake concentrate that can attract premium pricing.

2. Generation of premium battery grade coated spherical graphite (SpG), trialling chemical and thermal purification options to assess the preferred techno-economic method for production of premium battery grade SpG, followed by lithium-ion battery anode charging and durability testing. This work will expand on the outstanding purification (to 99.96%Cg) and battery test results achieved in 20233 and will result in the optimum SpG production method being adopted for more advanced development studies.

- The Metallurgical test-work results will feed directly into the flake-graphite concentrate Pre-Feasibility Study (PFS) as well as the Options Assessment and Scoping Study into downstream spherical graphite- battery anode material production. Additionally, the results will guide the preferred location for that production facility.

- Latest workstreams will be advanced as the Company finalises discussions with First Nations groups in Quebec to secure the necessary approvals to launch a major new drilling program aimed at significantly expanding and upgrading the existing Lac Rainy Mineral Resource. The program will also test new regional targets where high-grade rock chips of up to 64.3% Cg4 have been generated (see Figure 1). The company is aware of changes to the permitting application process in Quebec that come into effect on May 6th this year. More formal stakeholder engagement is a requirement as part of the revised process.

Metals Australia CEO Paul Ferguson, commented:

“These new metallurgical test-work programs at Lac Rainy represent another important step forward along the very clear pathway we have mapped out to develop what we believe has the potential to be a world-class flake-graphite project in the tier-one Canadian mining jurisdiction of Quebec.”

“The US$50 million equity investment and a future construction commitment of US$275 million5 announced only last month by General Motors and Panasonic Energy to advance the development of Nouveau Monde Graphite Inc’s graphite project in Quebec is another sign of the global rush to secure sources of high-grade flake graphite and downstream products outside China.”

“Building on our Scoping Study which indicates potential for an initial 14-year production mine life, we are committed to accelerating our pre-feasibility studies (PFS) for the production and downstream processing of Lac Rainy’s high-grade flake-graphite product.”

“Other critical work programs being advanced in parallel with our metallurgical test-work include environment and social impact studies, hydrogeological and geotechnical assessments, Mineral Resource estimation work and finalising key inputs to mine planning and engineering design for the concentrate plant PFS and the proposed downstream upgrading facility to produce battery anode material.”

“We have also finalised our drilling plans and contract and look forward to our drilling permit applications being approved by the government authorities in Quebec. The Company has been advised that no adverse comments were provided by stakeholders during the initial public review period for that drilling program and we look forward to our upcoming discussions with representatives of the Innu Council of Uashat Mak Mani- Utenam First Nations group to outline our planned program as part of the approval process.”

“The Company is fully committed to working respectfully and productively with all stakeholders to demonstrate the significance and potential benefits of developing this important critical minerals project, while understanding and accommodating the expectations of stakeholders throughout the development phases.”

“Our drilling program aims to extend and further define the Mineral Resource to allow expansion of the mining plan, as well as testing new regional targets where high-grade rock chips of up to 64.3% Cg4 have been generated. The fact we still have 35km of mineralised zones at Lac Rainy to drill test adds to our confidence that we will be able to significantly grow the existing Mineral Resource.”

“Critically, the recent $3.5 million placement we made through Canadian investors leaves the Company well- funded to accelerate our exploration and development studies with cash reserves of more than $18 million. The fact that Metals Australia’s market capitalisation is less than our cash balance makes us more determined than ever to demonstrate the value of our flagship Lac Rainy project, which we believe will result in a significant re-rating of the Company’s share price.”Click here for the full ASX Release

This article includes content from Metals Australia, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

27 November 2025

Major JORC Resource & Reserve Upgrade at Orom-Cross

Blencowe Resources Plc (LSE: BRES) is pleased to announce the completion of the updated JORC 2012 Mineral Resource and Ore Reserve Statement ("JORC") for its 100%-owned Orom-Cross Graphite Project in Uganda. This upgrade incorporates all the infill drilling undertaken in 2025 across the Camp... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00