July 11, 2023

Heavy Rare Earths Limited (ASX: HRE) is pleased to report results from its ongoing metallurgical investigation of rare earth mineralisation at its 100 per cent-owned Cowalinya project in the Norseman-Esperance region of Western Australia.

- Sizing work indicates simple, low-cost screening capable of delivering two-fold increase in rare earths grade

- Diagnostic leaching test work produces very high extractions of magnet rare earths (as high as 91.3%)

- High extractions achieved with low acid consumption (as low as 3.8 kg/t)

- Program underway to develop downstream flowsheet to a Mixed Rare Earth Carbonate (MREC) product and generate samples for customer assessment

- New Mineral Resources and maiden Exploration Target for Cowalinya project expected in Q3 2023

HRE Executive Director, Richard Brescianini, said, “We are making excellent progress on our metallurgical program to establish an optimal process route for the rare earth resources at Cowalinya.

“Our earlier reported sizing work gave us confidence that simple, low-cost screening is capable of delivering a two-fold increase in rare earth concentration for leaching. More recent diagnostic leaching of this upgraded material has yielded a number of highly promising magnet rare earth extractions with low acid consumption, both of which are central to technical and commercial viability. Whilst we acknowledge some variability in these results and the need to further optimise leach performance, our forward program now has its sights firmly set on producing samples of a Mixed Rare Earth Carbonate, the first possible entry point by HRE into the rare earth supply chain.”

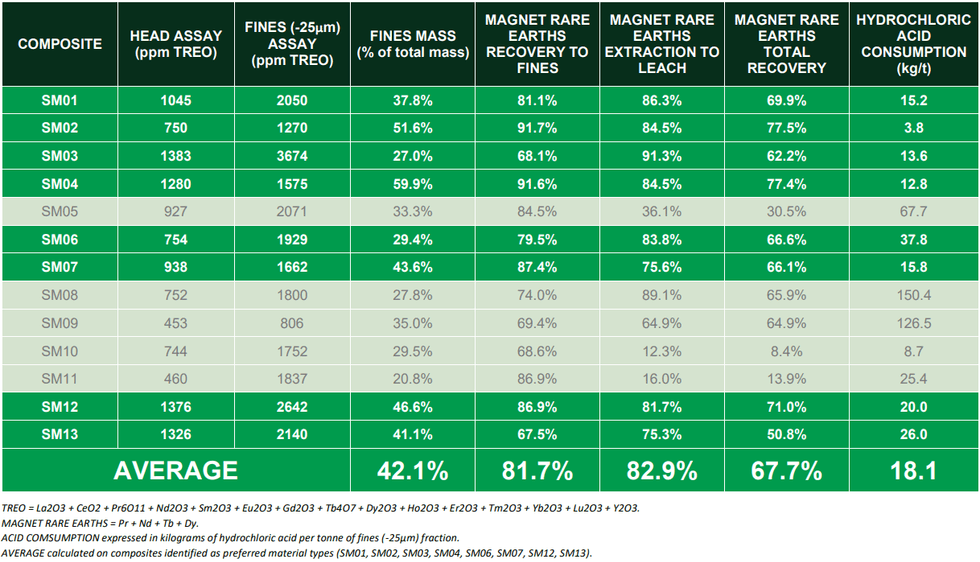

Initial sizing test work by Perth-based Strategic Metallurgy in 2022 on saprolite-hosted mineralisation from 13 (4- and 5-metre) composites from across HRE’s Cowalinya resource1 showed an average of 78.5% of the rare earths are hosted in the fines (-25µm) fraction which comprises 37.2% of the bulk saprolite feed mass. Furthermore, simple recovery of the fines fraction delivers better than a two-fold increase in rare earth grade (refer to ASX announcement 13 December 2022).

These results enable the design of an upstream process flowsheet for the project that removes gangue from saprolite via simple screening and desliming cyclones.

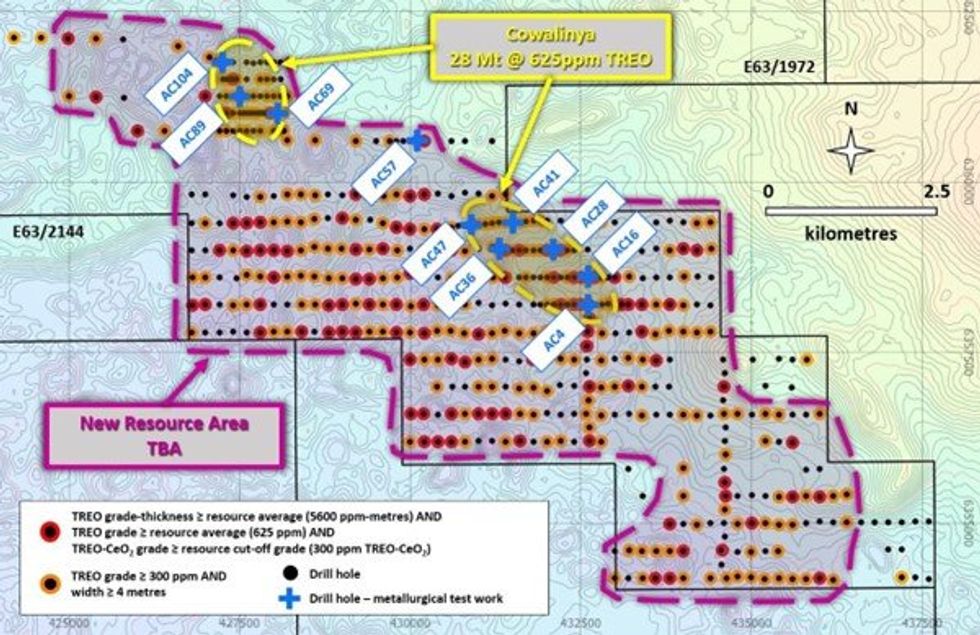

The next phase of test work by Strategic Metallurgy involved subjecting the rare earths-containing fines fraction from the same 13 composites to diagnostic leaching tests to determine the efficiency with which rare earths are brought into solution. The location of the 10 drillholes from which these composites were prepared is shown in Figure 1. Tests were conducted with weak solutions of commercially available hydrochloric acid (“HCl”), sulphuric acid and ammonium sulphate.

In all cases, the tests using HCl delivered superior rare earth solubility and acid consumption results. A summary of the HCl results, along with the corresponding sizing data, is presented in Table 1. The key outcome is that the majority of composites (8 of 13 composites: SM01-04, SM06-07, SM12-13) show both high leachability (>75%) of the magnet rare earths Pr, Nd, Tb and Dy, and low consumption (<40 kilograms per tonne of fines) of acid, with an average of 82.9% and 18.1 kg/t respectively.

Considering the rare earths-containing fines fraction accounts for an average of 42.1% of the saprolite feed mass (see Table 1), HCl consumption is expected to average 7.6 kg per tonne of saprolite feed.

These diagnostic results justify HRE accelerating its metallurgical test program over the coming months:

1. Optimising the leach conditions focusing on maximising magnet rare earth extractions whilst minimising acid consumption.

2. Extending the diagnostic program by treating an additional 50 (6-metre) composites from across the 35 km2 area earmarked for resource expansion (see pink shaded area in Figure 1) under optimised leach conditions. These composites have been identified by HRE using geochemical algorithms aimed at discriminating preferred material (i.e., both high rare earth extraction and low HCl consumption, currently represented by samples SM01-04, SM06-07 and SM12-13) from non-preferred material (i.e., either low rare earth extraction or high HCl consumption, currently represented by samples SM05 and SM08-11). This work will provide further insight into the geo-metallurgical variability of mineralisation at Cowalinya and test the robustness of HRE’s material type discrimination algorithms.

3. In parallel with the above-described work streams, commencing a bench-scale program to develop a flowsheet to a Mixed Rare Earth Carbonate (“MREC”) product (Figure 2) which represents the first entry point by clay-hosted projects into the rare earth supply chain. Subject to the success of this program, the Company plans on making MREC samples available to refiners in Europe, Asia, the United States and Australia to determine marketability.

Strategic Metallurgy expects to complete these programs in Q4 2023, shortly after HRE anticipates reporting new Mineral Resources and a maiden Exploration Target for the Cowalinya project in Q3 2023.

Click here for the full ASX Release

This article includes content from Heavy Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRE:AU

The Conversation (0)

06 September 2022

Heavy Rare Earths

Rare Earth Elements in Western Australia and the Northern Territory

Rare Earth Elements in Western Australia and the Northern Territory Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00