Investing in Graphene Companies

10 Biggest EV Stocks to Watch in 2026

What Was the Highest Price for Silver?

Overview

Nickel has long been used in the production of stainless steel, but as the world races towards widespread adoption of green technologies, such as electric vehicles and renewable energy sources, the metal is becoming increasingly attractive for its role in high-capacity batteries. The green metal recently skyrocketed a historic 250 percent in two days, the largest-ever increase for nickel on the London Metals Exchange (LME). Russia’s invasion of Ukraine is the presumed catalyst, as Russia is the third-largest producer of nickel. LME halted trading for the day on March 8th due to rapidly crossing the US$100,000 per tonne threshold and then receding to US$80,000 per tonne before trading halted.

Even before Russia’s invasion of Ukraine, nickel had a positive outlook for 2022 after it surpassed expectations in 2021 with the metal ending in a deficit. Stainless steel is expected to remain the key driver of nickel demand for 2022, but the usage of nickel cathodes in long-range electric vehicle (EV) batteries is strengthening momentum. Some market analysts anticipate a “supercycle like no other” for the various metals necessary for the world to transition to green energy and the electrification of things.

The supercycle will go down as historically important as it is aims to replace centuries of dedicated fossil fuel use. The demand for nickel in green technologies is still gaining momentum, presenting mining companies with a unique opportunity: act pre-emptively to achieve a sustainable long-term market position. Governments around the world have made promises to transition to clean energy, a strong indication of the anticipated supercycle. Canada alone has promised that all of its electricity and all new cars sold will be zero-emission by 2035 – more clean energy metals are necessary to achieve that goal. Where will they come from?

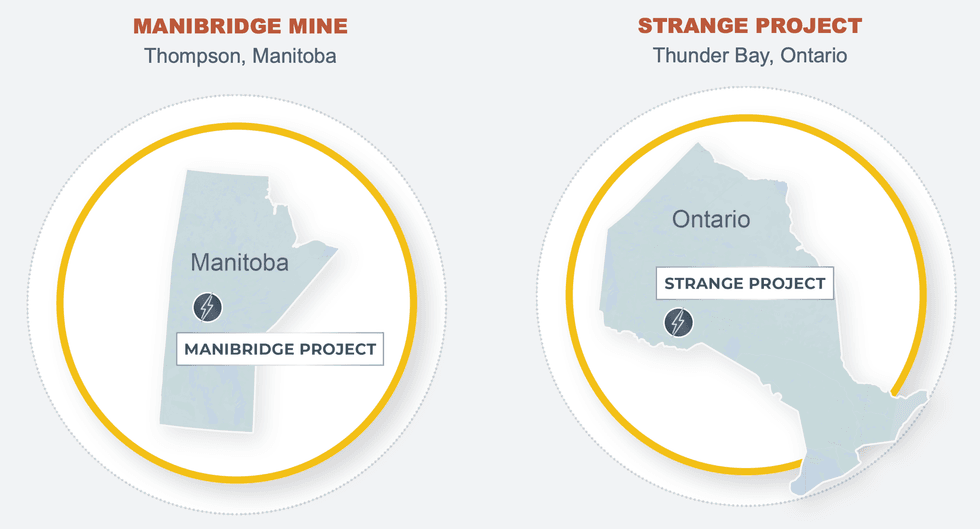

Metal Energy (TSXV:MERG) is a well-funded battery metal exploration company focused primarily on nickel. The company has two projects in politically stable jurisdictions in Canada: Manitoba and Ontario. With a strong management team in place, the company is poised to capitalize on areas known for high-grade nickel deposits. Metal Energy’s flagship project, Manibridge, covers 4,368 hectares within the renowned Thompson Nickel Belt in Manitoba. The company recently acquired 49 percent interest in this project, per option to earn a full 100 percent of Manibridge.

James Sykes, CEO of Metal Energy, recently put the importance of the Manibridge Project’s location into context, stating, “The thing we know about the Thompson Nickel Belt is that over six billion pounds of nickel has been produced from within the belt since 1961, that’s a lot of nickel. It’s the fifth-largest nickel mining jurisdiction in the world; this is not a little area, this is huge. This has global implications moving forward, especially with the advent of EVs and battery requirements, we need nickel! So why not go back to the Thompson Nickel Belt.”

A 3,000-meter drill program recently commenced within the Manibridge Project targeting high-grade nickel within a kilometre of the old mine workings. The drilling program is focused on a historic mining area that produced 1.3 million tonnes of high-grade nickel from 1971 to 1977. Metal Energy isn’t just reproducing historic drill holes, it's identified additional targets to extend the current envelope of high-grade nickel, acting on this interest with its recent 49 percent acquisition of Manibridge.

The Strange Project, the company’s second project, is located within the Animikie Basin geological region in Ontario This area includes major sulphide nickel deposits that resemble the deposits found in the nearby Lundin Mining’s (TSX:LUN) Eagle East and Eagle Mine deposits.

Metal Energy is part of the Ore Group, a collection of mining companies targeting premier jurisdictions that share in-house technical and financial expertise. Additionally, a team of experienced experts lead Metal Energy’s exploration and growth. James Sykes, CEO, brings his past successes in the uranium space to the team, confident he can repeat history with nickel. Stephen Stewart serves as chairman and director, adding his extensive management background to the team. Charles Beaudry adds 30 years of experience in exploration and hands-on project management within the mining space. The team is rounded out by additional experts in their respective fields, including corporate financing and natural resource investment.

Company Highlights

- Metal Energy is focused on high-grade nickel projects in politically stable and mining-friendly jurisdictions in Canada.

- The company’s flagship project, Manibridge, encompasses a high-grade nickel past-producing mine within the historically prolific Thompson Nickel Belt, known for producing billions of pounds of high-grade nickel since 1961.

- A drilling program recently began at Manibridge that aims to confirm historic results and expand the known occurrences of high-grade nickel.

- The Strange Project is located within a geological region in Ontario that is already home to high-grade nickel and copper projects.

- The company is led by a diverse management team with multiple past successes that they believe they can repeat with the company’s nickel projects.

- Metal Energy is part of the Ore Group, providing access to additional financial and technical expertise.

Get access to more exclusive Nickel Investing Stock profiles here