September 10, 2024

McFarlane Lake Mining Limited ("McFarlane" or the "Company") (NEO:MLM)(OTCQB:MLMLF), is excited to announce results of recent field sampling and highlight its upcoming exploration plans at its 100% owned McMillan Gold Mine located 70 kilometers west of Sudbury, Ontario.

Highlights

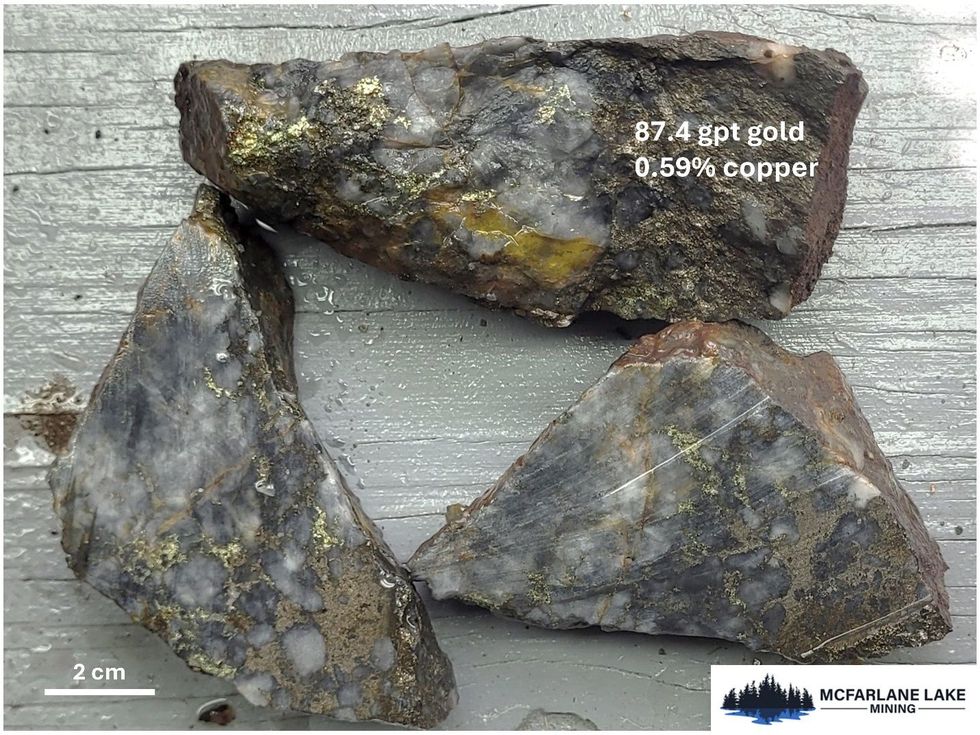

- Recent field sample of 87.4 gpt gold and 0.59% copper demonstrating strong potential for high grade gold and polymetallic mineralization at past producing McMillan Gold Mine

- Fully funded 3,000 metre winter drill program commencing in Q4 2024

- Drilling to confirm and expand on numerous historic high grade gold intercepts including an intercept of 27.9 metres of 6.4 gpt gold containing 8.1 metres of 15.7 gpt gold

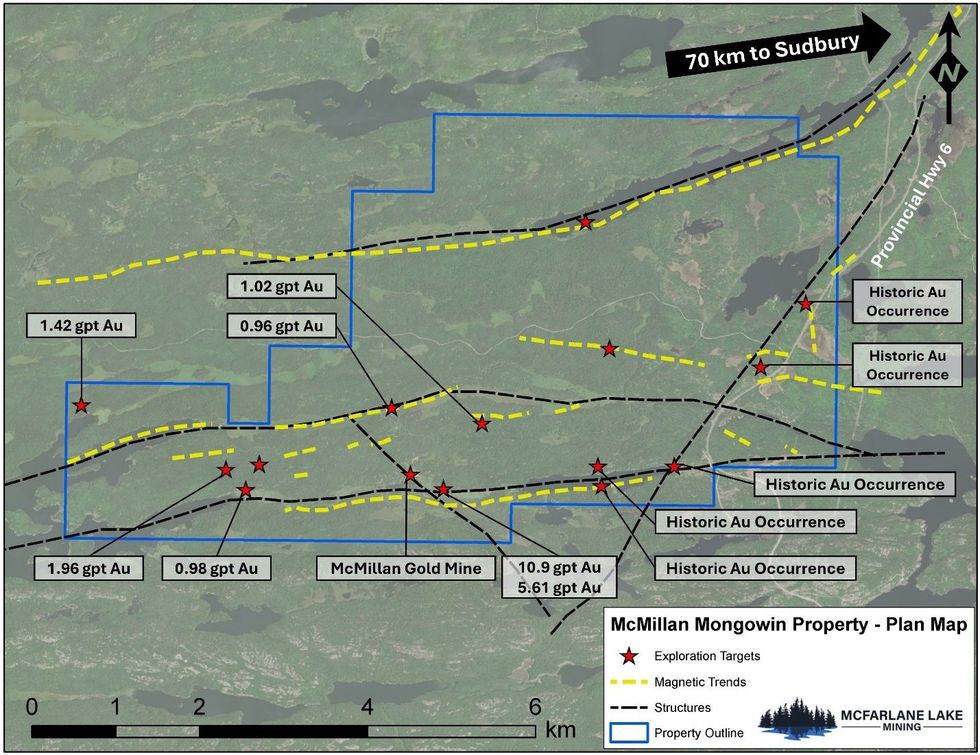

The McMillan Gold Mine was a past producer of gold and is located within 3 km from major highways and power lines. Located geologically in the Huronian Gold Belt 70 km west of Sudbury (Figure 1), this area of the province has been consistently identified as a top gold and polymetallic exploration opportunity as highlighted in the Ontario Geological Survey's "Recommendation for Exploration 2010 to 2011" and "Recommendation for Exploration 2017 to 2018".

Drilling Program

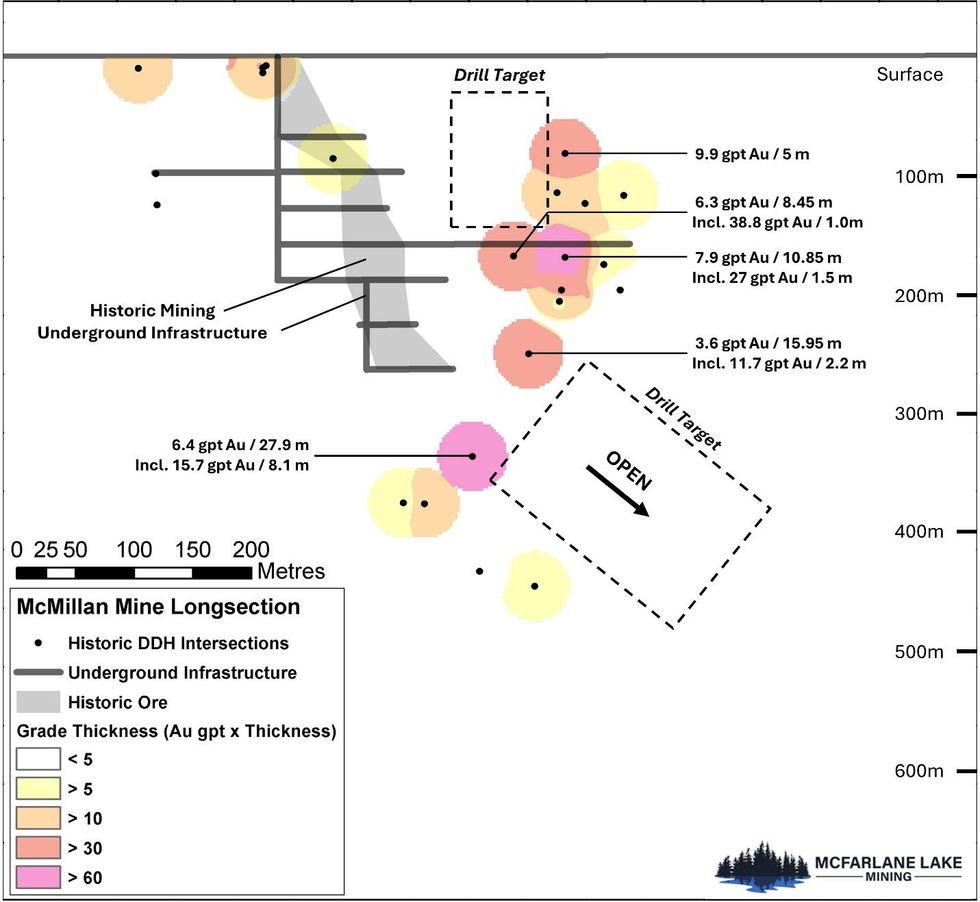

The company has applied for an exploration permit to conduct an initial 3,000 metre drill program, with plans to commence drilling in Q4 2024. The program is fully funded and designed to test and expand on historic high-grade gold intercepts at the McMillan Gold Mine (Figure 2) and to better understand the geology of the deposit.

A recent sample taken at the site, from what is interpreted to have been historic ore from the McMillan Gold Mine, returned 87.4 gpt gold, 0.59% copper and anomalous cobalt and nickel (Figure 3). This has demonstrated the potential for high-grade gold within the setting of a polymetallic mineralized system. Thus far, McFarlane has not seen any historic assays for copper and other base metals in historic data from the mine. This presents an opportunity to add significant value to the property. The company is also testing for platinum and palladium values, these have yet to be received.

The property has not been drilled since the early 2000's where exploration intersected 27.9 metres of 6.4 gpt gold including 8.1 metres of 15.7 gpt below the historic mine. In addition to testing historic intercepts, the company also plans to test the system along strike and at depth to materially expand the mineralization for a future resource estimate. Historic drill core is not available for analysis, hence upcoming diamond drilling will help understand the sub surface geology and allow for polymetallic analysis of drill core samples (ie gold, copper, cobalt and nickel).

Advancing Regional Surface Targets

The company has recently completed its regional geological data compilation on the property which was performed by ORIX Geoscience. This information is being used to assess exploration targets on the property. Multiple high-priority targets have been outlined across the underexplored 32 sq. km property (Figure 4). Evaluation of the targets has been based on positive magnetic anomalies and historic surface sampling. Historic ore at the McMillan Gold Mine contains pyrrhotite and is magnetic. Magnetic anomalies identified from historic geophysical surveys may be expressions of additional areas of mineralization and will be explored. Surface sampling -conducted in 2022 by McFarlane- associated with some of the magnetic anomalies returned assays up to 10.9 gpt gold and 0.12% copper, as well as anomalous cobalt and nickel up to 487 and 468 ppm respectively. The identification of polymetallic mineralization suggests strong potential exists across the property that was not historically tested. Prior to the upcoming drill program, the company plans to evaluate these regional targets for polymetallic gold mineralization in hopes to discover additional prospects for drilling.

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the company, and a Qualified Person as defined under National Instrument 43-101.

Technical Information

The samples collected by McFarlane Lake Mining and described in this news release were transported in secure sealed bags for preparation and assay by Agat Labs. The samples reported were crushed in their entirety to 80% passing -10 mesh, with one 500 g subsample split and pulverized to 95% passing 150 mesh. One 50 g aliquot was taken from the subsample for fire assay (FA) with an AAS finish. Samples over 10 g/t gold were subject to a 50 g aliquot FA with gravimetric finish. Multi-element assays were done by ICP-OES finish.

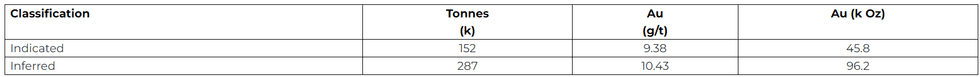

Compliant Resources

McFarlane has compliant gold resources within its property portfolio. In 2023 McFarlane delineated a National Instrument standard 43-101 compliant gold resource for its High Lake Property located 40 kilometres west of Kenora, Ontario near the Ontario/Manitoba border. See Table 1 for the resource statement. https://mcfarlanelakemining.com/news-april-9-mcfarlane-finds-more-gold-extends-gold-mineralization-on-the-purdex-zone/

About McFarlane Lake Mining Limited

McFarlane is a gold exploration company focused on the exploration and development of its portfolio of properties. The past producing McMillan and Mongowin gold properties, located 70 km west of Sudbury, Ontario, the past producing West Hawk Lake property located immediately west of the Ontario-Manitoba border, and the High Lake gold property (see Table 1 for resource statement) located immediately east of the Ontario-Manitoba border and 8 km from the West Hawk lake property. McFarlane also owns the Michaud/Munro mineral property situated 115 km east of Timmins along the so-called "Golden Highway". McFarlane is a "reporting issuer" under applicable securities legislation in the provinces of, British Columbia, Alberta and Ontario.

Additional information on McFarlane can be found by reviewing its profile on SEDAR at www.sedar.com.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release, including without limitation; anticipated results of geophysical surveys or drilling programs, estimated timing, geological interpretations and potential mineral recovery processes. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of McFarlane to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption "Risk Factors" in the Filing Statement dated as of January 14, 2022, which is available for view on SEDAR at www.SEDAR.com Forward-looking statements contained herein are made as of the date of this press release, and McFarlane disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management's estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

For Further Information, Please Contact:

Mark Trevisiol, Chief Executive Officer

McFarlane Lake Mining Limited

info@mcfarlanelakemining.com

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00