Maxar's strategic investment layers its best-in-class satellite imagery with Blackshark.ai's semantic 3D geospatial platform

Maxar Technologies (NYSE:MAXR) (TSX:MAXR), provider of comprehensive space solutions and secure, precise, geospatial intelligence, today announced its strategic investment in Blackshark.ai, a leading provider of AI-powered geospatial analytics services. The partnership represents Maxar's commitment to innovation within its 3D Earth Intelligence product portfolio.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220420005388/en/

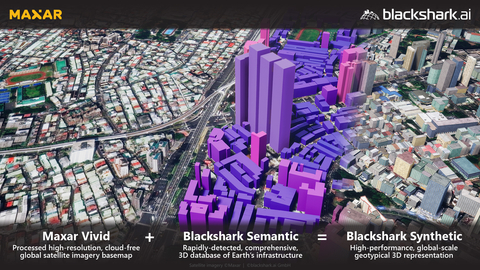

Blackshark.ai will leverage Maxar's global cloudless satellite imagery basemap, Vivid, to create a highly performant and photo-realistic 3D map for enterprise and government customers in industries such as gaming, metaverse, simulation and mixed reality environments. (Graphic: Maxar Technologies)

The Blackshark.ai platform processes petabytes of satellite imagery in hours, and it detects and segments objects, roads, vegetation, and other infrastructure on the surface of the planet without human intervention. This semantic information is used to create a comprehensive 3D digital model of the world.

The strategic investment in Blackshark allows Maxar to bring additional 3D capabilities to broader markets for more customers and opens up a new revenue stream from Blackshark. Blackshark.ai will leverage Maxar's global cloudless satellite imagery basemap, Vivid, to create a highly performant and photo-realistic 3D map for enterprise and government customers in industries such as gaming, metaverse, simulation and mixed reality environments. For example, this type of offering would enable flight simulator customers to access immersive 3D digital experiences with low latency and global scale. Intended for customers who may not need the global accuracy of Maxar's full Precision3D suite.

"We're excited to partner with Blackshark.ai to extend our geospatial analytics offering and bring a AAA video-game quality 3D digital twin of our planet to market," said Dan Nord, Maxar Senior Vice President and General Manager of Enterprise Earth Intelligence. "By integrating our industry leading Vivid basemap with Blackshark algorithms, we expand our customer set by complementing our high accuracy Precision3D portfolio with this lighter weight, visually stunning option."

Michael Putz, Founder and CEO of blackshark.ai said, "The combination of our offerings positions us to create a digital twin of our planet as real as it gets. We cannot wait to see our customers and partners using this to disrupt many industries."

About Blackshark.ai

Blackshark.ai provides a 3D digital twin of Earth by extracting information from satellite imagery and reconstructing detected attributes in photorealistic 3D fully automatically. A scalable artificial intelligence builds the core of the blackshark platform, detecting features globally with incredible precision and speed. A patented approach to 3D reconstruction can store petabytes of data and render it in infinite detail in real-time, allowing for powerful visualization and simulation applications for government, geospatial intelligence, humanitarian relief, planetary management, autonomous driving and flying, insurance, smart cities and more. The blackshark.ai platform, backed by M12 – Microsoft's Venture Fund, Point72 Ventures and provider of global space solutions Maxar Technologies (NYSE:MAXR), serves large clients globally with a team of 100+ people based out of Silicon Valley/US and Graz/Austria, Europe's computer vision hub.

About Maxar

Maxar Technologies (NYSE:MAXR) (TSX:MAXR) is a provider of comprehensive space solutions and secure, precise, geospatial intelligence. We deliver disruptive value to government and commercial customers to help them monitor, understand and navigate our changing planet; deliver global broadband communications; and explore and advance the use of space. Our unique approach combines decades of deep mission understanding and a proven commercial and defense foundation to deploy solutions and deliver insights with unrivaled speed, scale and cost effectiveness. Maxar's 4,400 team members in over 20 global locations are inspired to harness the potential of space to help our customers create a better world. Maxar trades on the New York Stock Exchange and Toronto Stock Exchange as MAXR. For more information, visit www.maxar.com .

Forward-Looking Statements

Certain statements and other information included in this release constitute "forward-looking information" or "forward-looking statements" (collectively, "forward-looking statements") under applicable securities laws. Statements including words such as "may", "will", "could", "should", "would", "plan", "potential", "intend", "anticipate", "believe", "estimate" or "expect" and other words, terms and phrases of similar meaning are often intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties, as well as other statements referring to or including forward-looking information included in this presentation.

Forward-looking statements are subject to various risks and uncertainties which could cause actual results to differ materially from the anticipated results or expectations expressed in this presentation. As a result, although management of the Company believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. The risks that could cause actual results to differ materially from current expectations include, but are not limited to, the risk factors and other disclosures about the Company and its business included in the Company's continuous disclosure materials filed from time to time with U.S. securities and Canadian regulatory authorities, which are available online under the Company's EDGAR profile at www.sec.gov , under the Company's SEDAR profile at www.sedar.com or on the Company's website at www.maxar.com .

The forward-looking statements contained in this release are expressly qualified in their entirety by the foregoing cautionary statements. All such forward-looking statements are based upon data available as of the date of this presentation or other specified date and speak only as of such date. The Company disclaims any intention or obligation to update or revise any forward-looking statements in this presentation as a result of new information or future events, except as may be required under applicable securities legislation.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220420005388/en/

Investor Relations Contact:

Jason Gursky

Maxar VP, Investor Relations and Corporate Treasurer

1-303-684-2207

jason.gursky@maxar.com

Media Contacts:

Fernando Vivanco

Maxar Media Relations

1-720-877-5220

fernando.vivanco@maxar.com

Simona Huebl

Blackshark.ai

shuebl@blackshark.ai