September 26, 2023

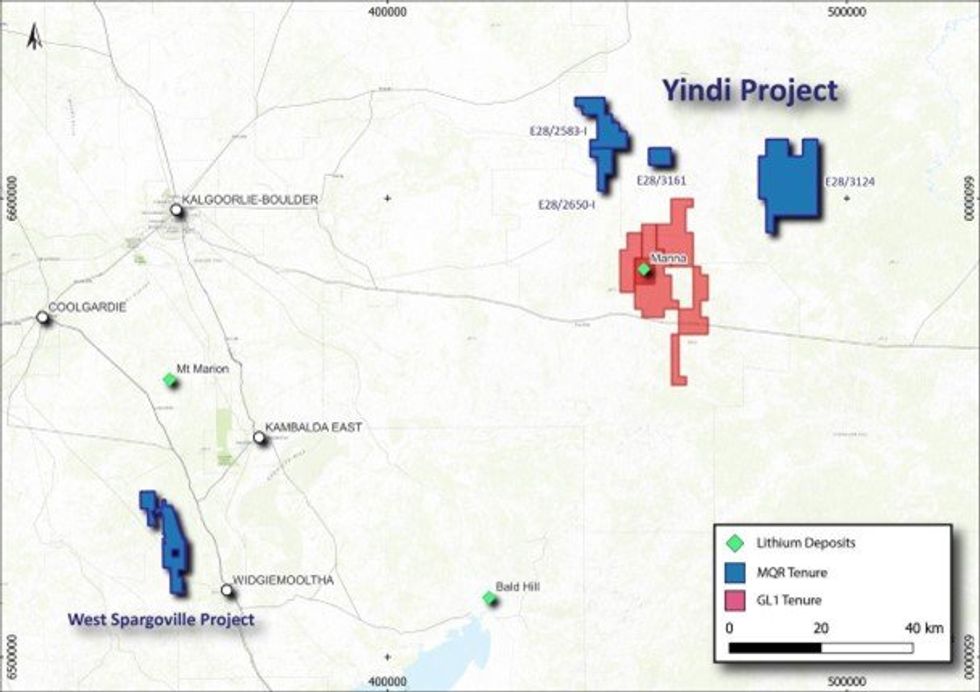

Marquee Resources Limited (“Marquee” or “the Company”) (ASX:MQR) is excited to report that it has executed a Tenement Sale Agreement (“TSPA”) with Solstice Minerals Ltd (“Solstice”)(“ASX:SLS”) to purchase 100% legal and beneficial interest in four exploration tenements E28/2583-I, E28/2650-I, E28/3161 & E28/3124 (together, the “Yindi Project”).

HIGHLIGHTS

- MQR acquires 301 square kilometres (km2) of highly prospective lithium exploration package (to be named the Yindi Project).

- Located 13km from, and geologically analogous to, the Manna Lithium Deposit (36Mt @ 1.13% Li2O) owned by Global Lithium Resources Limited (ASX:GL1), 90km east of Kalgoorlie.

- The presence of mapped intrusive granites and pegmatites in GSWA geology maps.

- The presence of granitic pegmatites units in historical drillhole logs that have not been assayed for lithium.

- Surficial geochemical anomalism from the limited soil sampling data.

- Previous tenement operators have highlighted the potential for the discovery of economic gold mineralisation throughout the Project, however the Company’s focus will be to explore for LCT-pegmatite mineral systems.

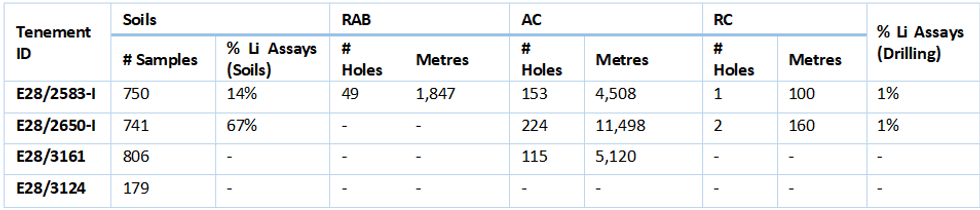

- Approximately 23,233 meters of drilling (RAB, AC and RC) conducted on the tenure within only ~1% assayed for lithium.

- MQR has commenced a review of the historical data and will expedite lithium exploration with field work to commence immediately.

- Further solidifies MQR’s lithium land package within the lithium “Corridor of Power”.

- Firm Commitments received for a share placement to raise $1,985,306 at $0.03 per share (with a 1:2 free attaching option (exercise price $0.08c and 3-year expiry from issue date), subject to shareholder approval at upcoming AGM.

The Yindi Project represent 301km2 of lithium exploration tenure, adjacent to and along strike from Global Lithium Resources Limited (“ASX:GL1”) Manna Lithium Deposit, 90km east of Kalgoorlie.

The Yindi Project Background

The Yindi Project is located 90km east of Kalgoorlie in the Kurnalpi Terrane of the Eastern Goldfields (Figure 1). Historical exploration work has been gold focussed and is of an early-stage nature, consisting of soil geochemistry and shallow drilling (Table 1). Only 24% of soil samples have been assayed for lithium and less than 1% of drill hole samples have been assayed for lithium. Previous tenement operators have highlighted the potential for the discovery of economic gold mineralisation throughout the Project, however the Company’s focus will be to explore for LCT-pegmatite mineral systems.

Following the completion of due diligence and desktop review, the Company believes the Yindi Project provides an excellent, early-stage exploration opportunity for the discovery of spodumene-bearing pegmatites. The primary factors include, but are not limited to:

- Analogous litho-structural setting to known lithium deposits (e.g. Manna Lithium Deposit).

- Geology dominated by mafic rock types surrounding late-stage granitic intrusions.

- The presence of mapped intrusive granites and pegmatites in GSWA geology maps.

- The presence of granitic pegmatites units in historical drillhole logs that have not been assayed for lithium.

- Surficial geochemical anomalism from the limited soil sampling data.

- The presence of transported sediments masking the underlying geology and potential mineralisation (benefit and hindrance).

The initial exploration focus will be on the western tenements E28/2583-I & E28/2650-I and the “Prospective Lithium Corridor” that runs N-S for 20km through the tenure (Figure 2). These tenements have been the primary focus of historical gold exploration efforts, with mafic rock types adjacent to late-stage granite plutons. Transported cover masks approximately 80% of the bedrock, however granitic and pegmatitic dykes have been mapped on surface within the tenure, and it is interpreted that a dyke swarm that has been observed SW of the tenure likely extends north into the Project extents. Additionally, drill hole logs indicate felsic intrusive granitic and pegmatitic rock types were intersected and the Company aims to visit the historical drill sites to resample drill spoils to further assess the prospectivity. While the presence of transported cover has hindered historical exploration for gold deposits, it also provides an opportunity to reassess the tenure with a different mineralisation model using the most modern geophysical and geochemical techniques.

Click here for the full ASX Release

This article includes content from Marquee Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

gold-explorationlithium-stocksgold-stockscopper-explorationasx-stockscopper-stocksresource-stockslithium-explorationasx-mqr

MQR:AU

The Conversation (0)

12 July 2022

Marquee Resources

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00