April 28, 2022

Exceptional new drilling results at Jaguar highlight strong growth potential, with Definitive Feasibility Study, and permitting advancing rapidly; Jaguar selected as a Strategic Minerals Project by the Brazilian Government; $75M capital raising sets strong foundation for Centaurus’ next chapter of growth

Centaurus Metals Limited (‘CTM’) is pleased to provide its Quarterly Report for the period ending 31 March 2022.

JAGUAR NICKEL SULPHIDE PROJECT

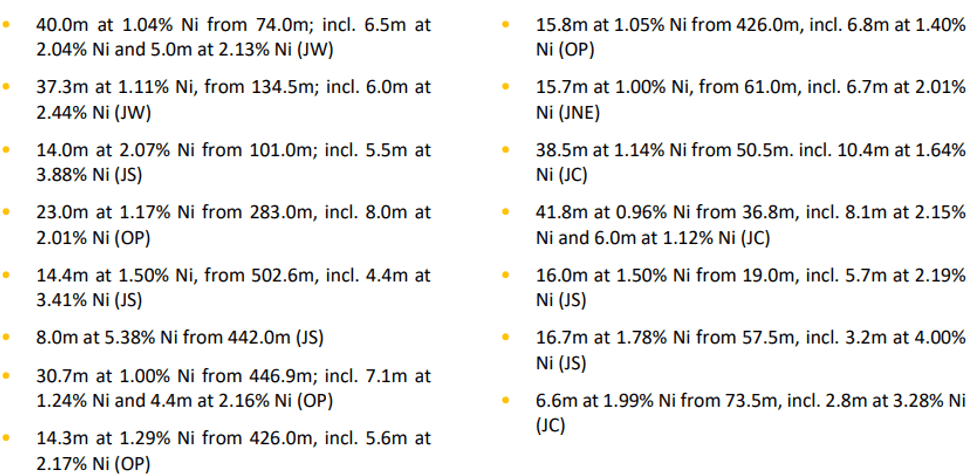

- 4 Step-out, extensional and in-fill drilling at Jaguar South (JS), Jaguar West (JW), Jaguar North-East (JNE) and Onça Preta (OP) continues to deliver strong, consistent results with new assay results including:

- 4 Jaguar selected as a Strategic Minerals Project by the Brazilian Federal Government, recognising Jaguar’s status as a globally significant, long-life green nickel sulphide project.

- 4 Nickel Sulphate Definitive Feasibility Study (DFS) advancing on multiple fronts:

- Industry-leading engineering firm Ausenco appointed as Lead Engineer to deliver both the process and non- process plant infrastructure components of the Jaguar Definitive Feasibility Study.

- Update of the open-pit and underground optimisations and production profile trade-off studies underway.

- 15 rigs currently on site (13 diamond and 2 RC) drilling double shift, with the drilling focused on upgrading the maximum amount of the Mineral Resource Estimate (MRE) into the Measured and Indicated categories.

CORPORATE

- 4 $75M institutional placement completed to drive continued growth and development of the Jaguar Project.

- Cash at 31 March 2022 of $70 million.

JAGUAR NICKEL PROJECT

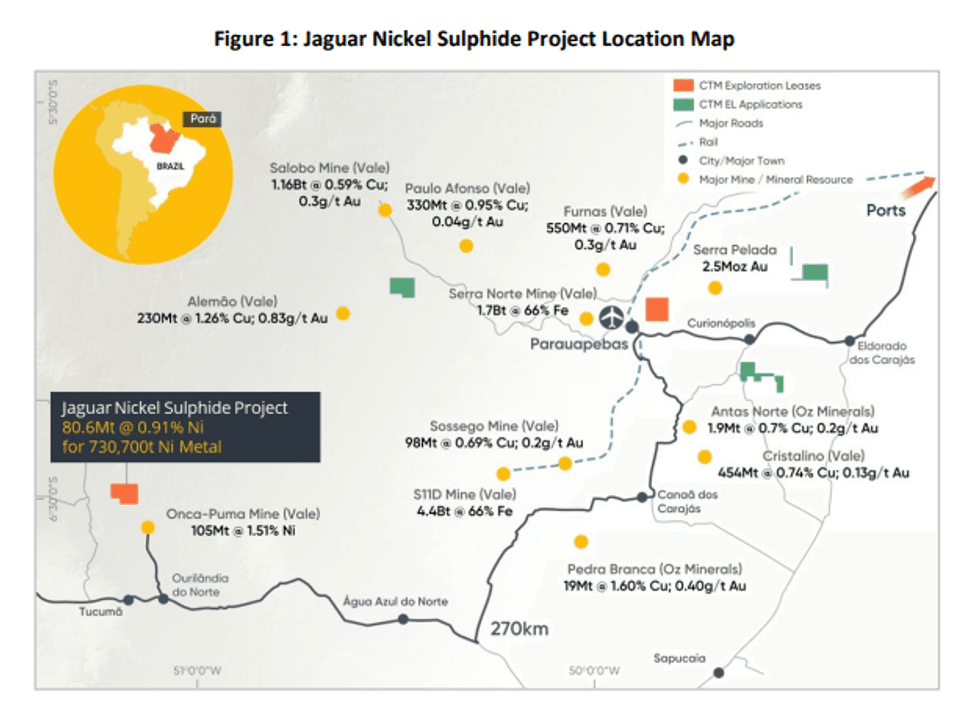

The Jaguar Nickel Sulphide Project, located in the world-class Carajás Mineral Province of northern Brazil (Figure 1), was acquired from global mining giant, Vale S.A. (“Vale”) in April 2020.

The Company delivered a positive Value-Added Scoping Study in May 2021 confirming strong technical parameters and outstanding financial returns from the production of nickel sulphate from a 13-year open pit and underground mining operation. The production of nickel sulphate is proposed to be delivered by a conventional nickel flotation plant, followed by a Pressure Oxidation circuit to further value-add the nickel concentrate produced in the flotation plant to produce +20,000 tonne of nickel per annum1 over the initial 13-year mine life.

Following the robust and compelling economics seen in the Jaguar Value-Add Scoping Study, the Company elected to move straight to a Definitive Feasibility Study (DFS) on the Project focused on the production of a nickel sulphate product.

Centaurus is already well advanced on many of the key components of the proposed project development, positioning the Company to complete the DFS by Q4 2022.

At the end of 2021, Centaurus updated its Mineral Resource Estimate (MRE) for the Jaguar Project to 80.6Mt @ 0.91% Ni for 730,700t of contained nickel, with 54 per cent of the MRE in the higher-confidence Indicated Resource category (43.4Mt grading 0.92% Ni for 397,000 tonnes of contained nickel). A further MRE update is planned for the end of Q3 2022, which will be the Resource used for completion of the DFS and the conversion of Resource to Reserve.

Through the development of the Jaguar Project, Centaurus’ goal is to become a new-generation nickel sulphide mining company in Brazil, capable of delivering more than 20,000 tonnes per annum of Class-1 nickel to global markets over the long term, and to do so in a sustainable and responsible manner that ensures the Company meets the highest possible ESG (Environmental, Social and Governance) standards.

Click here for the full ASX Release

This article includes content from Centurus Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CTM:AU

The Conversation (0)

16 December 2021

Centaurus Metals

The World’s Next Green Nickel Project

The World’s Next Green Nickel Project Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00