April 28, 2022

Sasanof Prospect Update

The Company announced during the quarter that Western Gas Corporation Pty Ltd ("WGC") had secured funding commitments for the remaining 25% of the Sasanof-1 well.

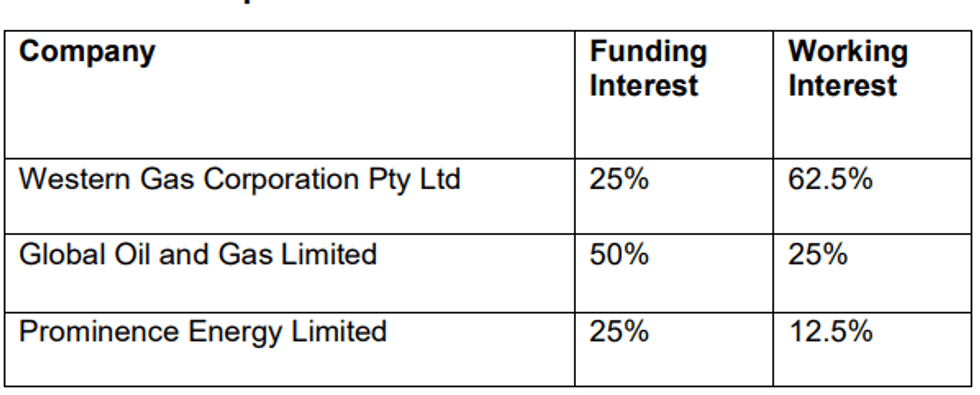

WGC will provide this funding to Western Gas (519 P) Pty Ltd (the holding company for Sasanof) to maintain its working interest at 62.5%. Together with the existing committed funding from Global Oil and Gas Limited (ASX:GLV) (50%) and Prominence Energy Limited (ASX:PRM) (25%), the drilling program is now fully funded.

Sasanof-1 Prospect Interests

Rig Mobilisation and Spudding

Western Gas and Valaris, the owner and operator of the MS-1 semi-submersible drill rig, are progressing plans for the mobilisation of the rig between 9 and 16 May to commence drilling of Sasanof-1.

With all regulatory approvals in place, logistical operations have now commenced with all long lead items being delivered to the Port of Dampier in preparation for loading on to the MS-1

All Major Service and Supply Contracts Awarded

Western Gas also advises all key contracts have now been awarded to support the drilling campaign and execution of contracts is being finalised.

Contract awards include:

- Schlumberger — Master Services Agreement, for services critical to assessing the reservoir and formation fluids and, in a success case, providing quality assured data to support resource definition.

- Baker Hughes — equipment materials and services for deployment of the wellhead and conductor and provision of drill bits.

- Halliburton —cementing services, materials and equipment and contingency liner equipment and services.

- Weatherford —Tubular Running Services and equipment.

- TMT — provision of Remote Operating Vehicle services on the MS-1

- Maersk Marine — provision of the Maersk Mover in support of anchor handling and logistics support.

- Solstad Marine — provision of the Far Senator in support of anchor handling and logistics support

- GO Marine — provision of the GO Spica in support of rig tow and logistics support

- Toll Energy — Toll Dampier Marine Supply Base.

- Wild Well Control — well control support services including Capping Stack membership and access.

Contractors already supporting the campaign are:

- AGR — drilling campaign management· Valaris — provision of the Valaris MS-1 drill rig

- Xodus — environmental consultancy services

All Regulatory Approvals in Place

National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) (Regulator) acceptance of the Environment Plan (and Oil Pollution Emergency Plan), MS-1 Safety Case Revision and the Well Operations Management Plan (WOMP) were secured in recent months.

The Sasanof Prospect

The Sasanof Prospect covers an area of up to 400 km2 and is on trend and updip of Western Gas' liquids rich, low CO2 Mentorc Field.

Sasanof is a large, seismic amplitude supported, structural-stratigraphic trap in the high-quality reservoir sands at the top of the Cretaceous top Lower Barrow Group formation on the Barrow Delta within the Exmouth Plateau.

Sasanof-1 will be Western Gas' first well drilled from its extensive exploration portfolio surrounding the existing Equus Gas Project that contains a discovered resource of 2 Tcf and 42 MMbbl (2C Gaffney Cline). The Equus Gas Project has a historic exploration drilling success rate of 88%, with 15 discoveries from 17 wells.

Click here for the full ASX Release

This article includes content from Global Oil and Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

14h

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00