September 04, 2023

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) welcomes advice that the Ugandan Government has approved and gazetted its updated Mining and Minerals (Licencing) Regulations 2023. This was an important precursor to the grant of the Mining Licence Application (MLA) at its 60 per cent owned Makuutu Heavy Rare Earths Project (“Makuutu” or “the Project”) in Uganda.

“This is an important milestone for the Ugandan mining industry and has been a regulatory requirement for the grant of the Company’s MLA at Makuutu. With this milestone the Company can now finalise the MLA fee payment which is the final item required in Uganda and clears the path to expedite the award of the Mining Licence at Makuutu,” Tim Harrison, Managing Director at IonicRE, said.

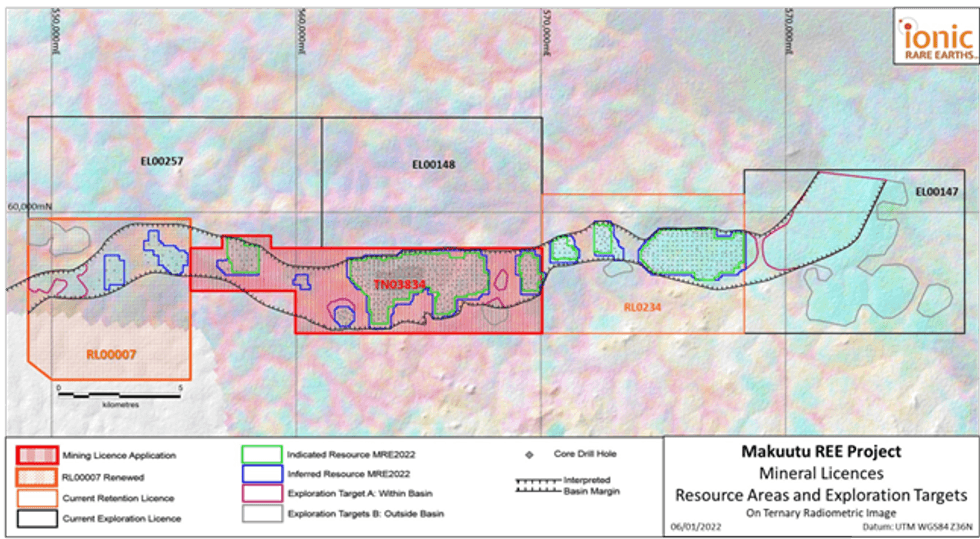

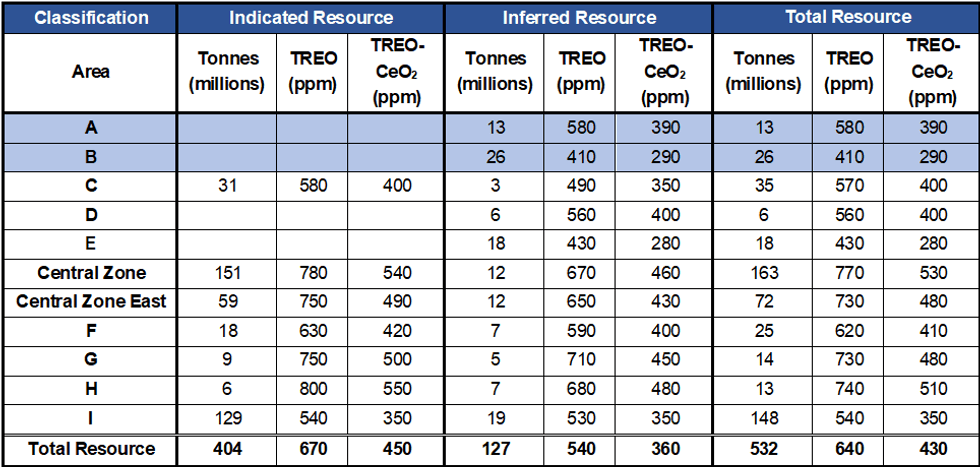

The Company recently announced progress on the demonstration plant at Makuutu and the Phase 5 drill program, (ASX 28 July 2023 and 4 September 2023), which continues on target with 79 holes completed (1,618 metres) currently focusing on upgrading the confidence of the existing Mineral Resource Estimate on RL00007 (see Figure 1 and Table 1).

“Our focus on the delivery of the Makuutu Heavy Rare Earths Project in Uganda positions us to provide a secure, sustainable, and traceable supply of magnet rare earth oxides,” Mr Harrison said.

“Along with our Belfast recycling facility, the Makuutu project is key to us harnessing our technology to accelerate our mining, refining and recycling of magnets and heavy rare earths which are critical for the energy transition, advanced manufacturing, and defence.”

Mr Harrison said the Company, through Rwenzori Rare Metals Limited (“Rwenzori”), had been in regular dialogue with representatives of the Ugandan Ministry of Energy and Mineral Development (MEMD) and other Branches of the Ugandan Government, and were pleased with the progress on approvals. The fee payment required for the MLA is 20 million Ugandan shillings (~ US$5,400).

“The time and diligence to legislate Uganda’s new mining regulations shows the Government is intent on securing the right balance between growing the economy and ensuring sustainable mining practices,” Mr Harrison said.

“The Company is preparing for a review of the Stage 1 DFS at the Makuutu Heavy Rare Earths project through local operating entity Rwenzori prior to initiating an update to support the next phase of development”.

Rounding has been applied to 1Mt and 10ppm which may influence averaging calculations.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00