May 01, 2022

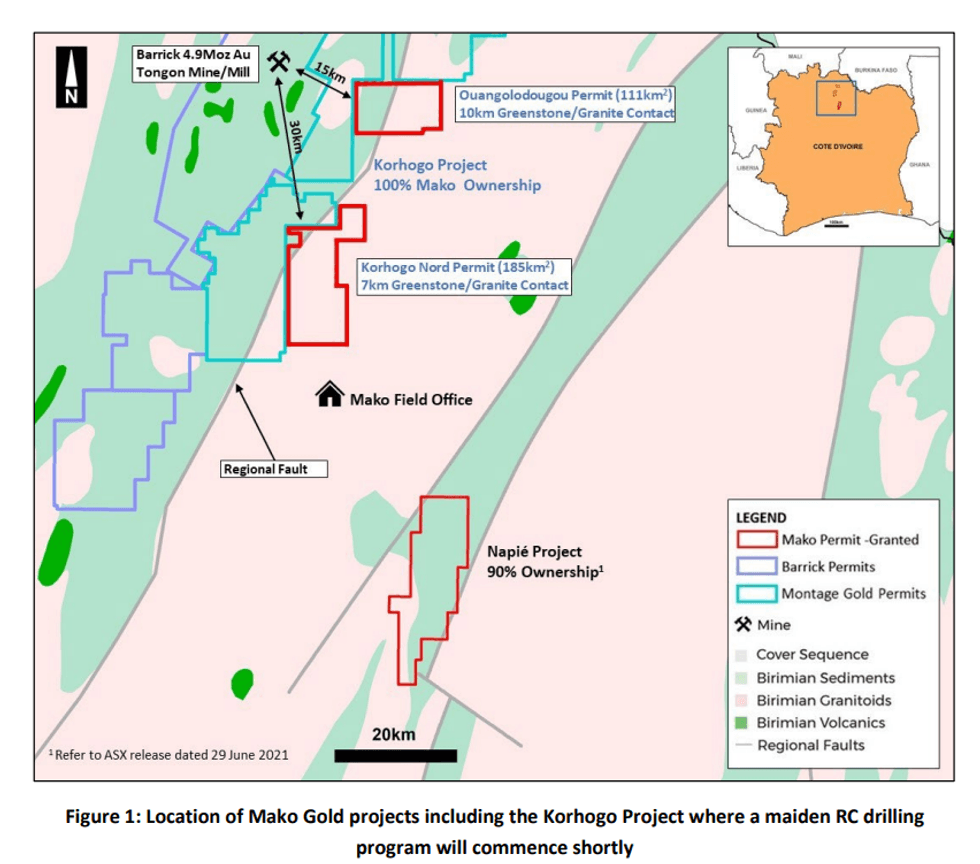

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) is pleased to advise that it has received the results of the 11,000m auger drilling program on the Ouangolodougou and Korhogo Nord permits which constitute the Korhogo Project1 . The permits collectively cover 296km2 hosting 17km of faulted greenstone granite contact as shown in Figure 1. Both permits are 100% owned by Mako and are readily accessible from the Mako Field Office.

HIGHLIGHTS

- Auger drill results confirm 2km-long +20ppb gold anomaly & multiple high-priority targets at Korhogo

- 2,000m maiden reverse circulation (RC) drill program to commence imminently

- Further exploration including RC drilling planned on additional targets

- The 100% Mako owned Korhogo Project has no previously recorded drilling and covers 296km2 of prospective tenure located within 15-30 km of Barrick’s 4.9Moz Tongon Gold Mine

- Mako’s core focus remains its flagship Napié Project where a maiden Mineral Resource Estimate (MRE) is on-track for June 2022

Mako’s Managing Director, Peter Ledwidge commented:

“We are pleased that the recently completed 11,000m auger drilling program has returned large gold anomalies which pave the way for the imminent start of a maiden RC drilling program at Korhogo. The first target to be drilled is a 2km-long +20ppb gold auger anomaly with high grade cores over 60ppb Au, coincident with the faulted greenstone/ granite contact. We are highly encouraged by these coincident anomalies as this validates our motivation for acquiring these permits and increases the chance of the Company making another significant gold discovery”.

Korhogo is located in a fertile greenstone belt that hosts Barrick Gold’s 4.9Moz Tongon gold mine and Montage Gold’s 4.5Moz Kone gold deposit, both in Côte d’Ivoire, as well as Endeavour’s 2.7Moz Wahgnion gold mine just across the border in Burkina Faso (Figure 5).

A maiden 2,000m RC drill program is planned on one of the first of several anomalies outlined by the 11,000m auger program (Figure 2). The auger gold anomalies are coincident with the soil anomalies and geophysical structural anomalies identified through Mako’s previous field work.

Four fences of heel to toe RC holes will be drilled (where the bottom of one hole when projected to surface is the collar of the next hole), covering approximately 900m of the highest auger anomalies (Figure 3).

Ongoing exploration at the Korhogo Project will consist of further RC drilling on other high priority targets, as well as additional auger drilling along the structural trends in order to extend current anomalies or discover new anomalies which would then be tested with RC drilling.

Click here for the full ASX Release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00