February 13, 2023

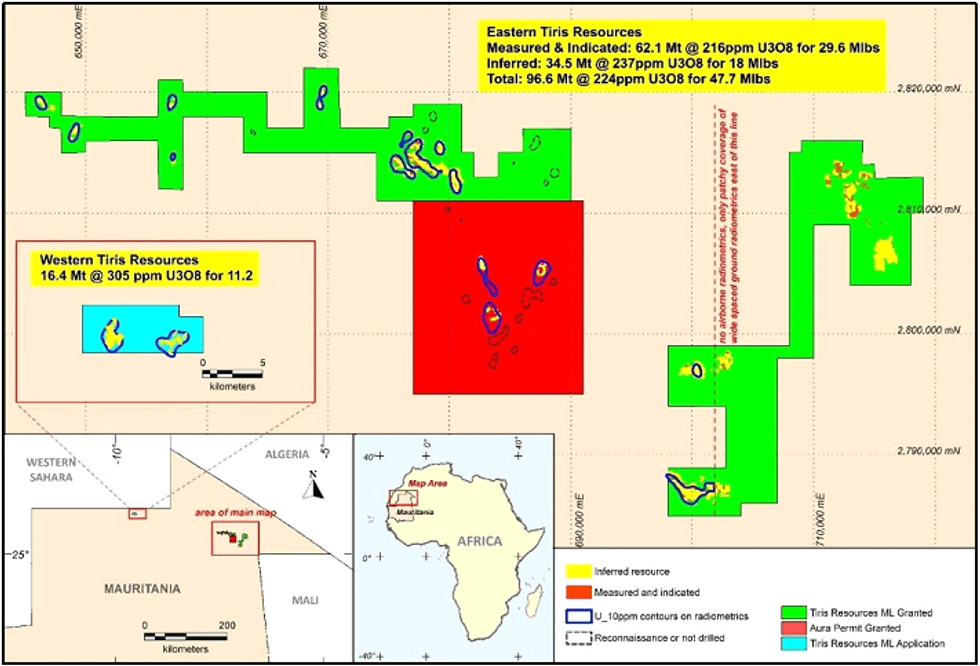

Aura Energy Limited (ASX:AEE, AIM:AURA) is pleased to announce that the Resource Upgrade program undertaken in 2022 has increased the Measured and Indicated (M&I) Resources at the Tiris Project (“Tiris or the “Project”) from 19.5 Mlbs to 29.6 Mlbs, 62.2Mt at 216ppm U3O8 at a 100ppm cut-off.

KEY POINTS:

- 52% increase in Measured and Indicated Resources to 29.6 Mlbs U3O8, 62.1Mt at 216 ppm U3O8 at a 100ppm grade cut-off.

- Global Mineral Resource Estimate (MRE) of 58.9 Mlbs U3O8, 113Mt at 236 ppm U3O8 at a 100ppm grade cut-off.

- Near-term exploration targets identified to further grow the Tiris resource.

- Tiris Reserves estimate with the updated expanded Feasibility imminent

The significance of the Resource upgrade is that it enables Aura to update the 2019 Tiris Definitive Feasibility Study (DFS)1 project work, assessing the potential to increase the production rate based on the increased M&I resource. This work is expected to be released before the end of Q1 2023.

Aura’s Tiris Project differs from other near-term projects in that the carnotite is mostly ultrafine, micron scale in grain size enabling the separation of the uranium without crushing and grinding as demonstrated in the 2019 DFS1. In the DFS1 production averaged 800,000 lbs U3O8 per year with a capital cost of USD 74.8 million and C1 costs of USD 25.43/lb U3O8. Aura is confident that our existing fast-to-market development strategy will be accentuated in the updated DFS as a result of the economies of scale on the capital and operating costs using a modular expansion of the Tiris Project.

Commenting on the increased MRE, Aura Energy Managing Director Dave Woodall said:

“The significant increase of our M&I resources confirms our confidence that the Tiris province which we believe has great expansion potential. Our immediate focus is now to work with our Mauritanian stakeholders, offtake providers, investors and financing partners to progress towards a decision to Mine in Q3 CY2023, a target construction timeline of Q4 CY2023, and first production expected in late 2024 or early 2025.

“Our exploration success is creating a strong platform for growth for Aura’s shareholders and our Mauritanian partners, and an exciting new zero-carbon energy source for an increasingly energy-hungry world.”

Upgraded Measured and Indicated Resource

The program successfully delivered an additional Measured and Indicated resource of 23.0Mt at 200ppm U3O8 containing 10.1Mlb U3O8 at 100ppm U3O8 cut-off grade. The detail of the upgraded resource across the project areas and the previous resources are shown in Tables 1 and 2. The drilling program completed in 2022 comprised 1,746 holes (1,680 air-core and 66 diamond-core holes) at an average depth of 7m, from 11,600m of drilling.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00