September 17, 2023

Wildcat Resources Limited (ASX: WC8) (“Wildcat” or the “Company”) is pleased to announce it has received the first assay results from maiden drilling at the Tabba Tabba Lithium Tantalum Project in the Pilbara, near Port Hedland, WA 1 (Appendix 1, Table 1), with initial results from 21 RC holes confirming pegmatite bodies contain significant widths and grades of lithium mineralisation (see Figures 1 to 4). Tabba Tabba is near some of the world’s largest hard-rock lithium mines, 47km from Pilbara Minerals’ (ASX: PLS) 414Mt Pilgangoora Project and 87km from Mineral Resources’ (ASX: MIN) 259Mt Wodgina Project.

Highlights

- First assays from Wildcat’s maiden drilling at Tabba Tabba, WA, confirm high-grade lithium mineralisation from surface in northern and central pegmatite clusters, demonstrating potential for a large-scale lithium camp

- Best results from the central cluster:

- 85m at 1.1% Li2O from surface (TARC086) (down-hole length)

- including 59m @ 1.5% Li2O from surface

- 218m at 0.8% Li2O from 16m (TARC089) (down-hole length)

- including 22m at 1.0% Li2O from 31m

- including 23m at 1.0% Li2O from 152m

- including 51m at 1.5% Li2O from 183m to end of hole

- Estimated true width is approximately 53m

- 85m at 1.1% Li2O from surface (TARC086) (down-hole length)

- Best results from the northern cluster:

- 21m at 1.1% Li2O from 42m (TARC055) (est. true width)

- 26m at 0.9% Li2O from 76m (TARC015) (est. true width)

- 20m at 1.3% Li2O from 20m (TARC005) (est. true width)

- 16m at 1.1% Li2O from 17m (TARC001) (est. true width)

- Central pegmatite zone is now more than 1.2km long at true widths of 50m and up to 132m

- Over 66 drill holes are pending assay and over 15,000 metres drilled year to date with drilling continuing

- Wildcat to deploy a diamond drill rig in early October to accelerate the evaluation of the new discovery

- Continuous batches of assays expected over the coming months

1 ASX announcement 17 May 2023: https://www.investi.com.au/api/announcements/wc8/4788276b-630.pdf

Wildcat’s initial batch of assays comprises seventeen holes from the northern pegmatite cluster and four holes from the central pegmatite cluster. Initial scout drilling commenced in the north of the Mining Leases, and this confirmed shallow- north easterly dipping, stacked pegmatites. The exploration program proceeded south to the central area where multiple, wide, sub-vertical (70°) dipping pegmatites were intercepted, and a second rig was added. The first intercepts from the central area were fast-tracked through the laboratory so they could be included in the first batch of results to aid exploration planning.

Managing Director Samuel Ekins said: “I’m confident we are in the early stages of a major discovery at Tabba Tabba and it’s been a welcome surprise to see the size of the system. Over 95% of all holes to date have intersected pegmatites and we eagerly await further rounds of assays. Our central pegmatite is now over 1.2km long (open to the north), subvertical and outcropping at widths of over 50m which is very significant.”

“Given our proximity to major global lithium projects including Pilgangoora and Wodgina, we see plenty of potential to uncover a large-scale lithium deposit across the extensive 3.2km trending pegmatite system. We anticipate receiving Foreign Investment Review Board (FIRB) approval for our acquisition of Tabba Tabba and Ministerial Approval by the end of September and bringing our first diamond rig onto site in early October, with more results from our initial drilling expected also.”

Discussion of Exploration Activities

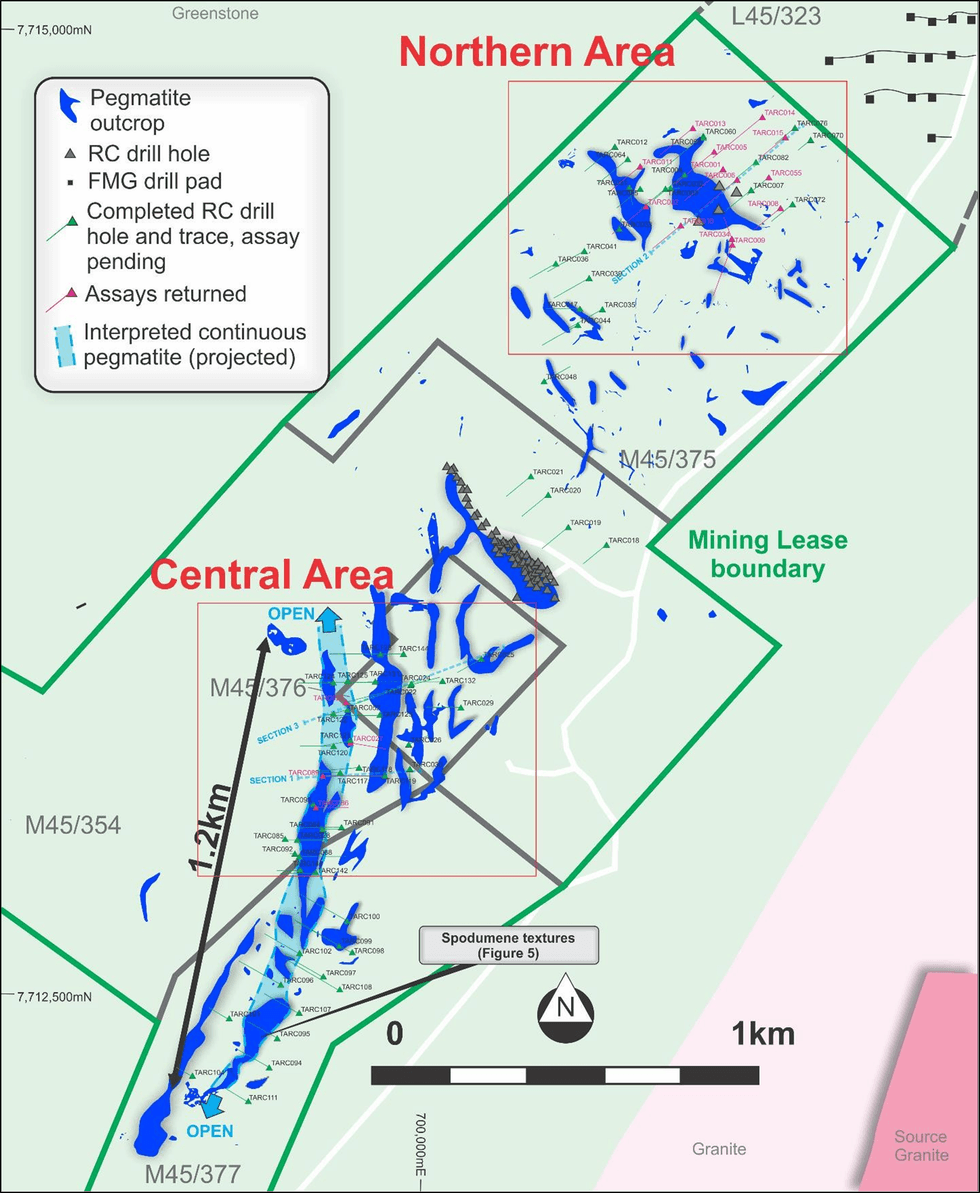

The Company has focussed on drilling the defined “simple pegmatite” outcrops which were mapped by Pancontinental in the 1980’s as albite rich, the pegmatites at Pilagangoora are described as albite-spodumene type. The Tabba Tabba LCT pegmatite field has never been explored for lithium historically and previous groups only focussed on the high-grade tantalum resource. Two RC rigs are drilling at Tabba Tabba and to date 87 holes for 15,142m have been competed (See Figure 1 and Appendix 1, Table 2). A third rig is planned to be deployed in early October to commence diamond drilling to accelerate the evaluation of the lithium discoveries.

Assays have been returned for 21 RC holes from two areas of the pegmatite field, the northern cluster and the central area, as highlighted in red on Figure 1. Significant intercepts are listed in Appendix 1, Table 1 and are reported using 0.1% Li2O cut-off grade with 10m internal dilution for aggregated intercepts and 0.3% Li2O cut-off and 3m of dilution for internal high-grade zones. The results represent drilling from only a small area of the 3.2km trend of over 50 outcropping pegmatite drill targets and are for only 21 of the 87 holes drilled to date.

The broadest intersections have been returned from the previously undrilled central area of the Mining Leases to the south of the Tabba Tabba Tantalum deposit (Figures 1 and 2). In this area the pegmatites seem to occur as large, north-south trending, steeply east dipping, stacked sets with some sections more than 130m wide (true width). The central cluster is currently defined by mapping and drilling over a 1.2km strike length (which is open in all directions) and is the priority of current exploration efforts due to the wide, high-grade intersections returned from initial drilling.

RC drill hole TARC086 returned 85m at 1.1% Li2O from surface and includes a high-grade zone of 59m at 1.5% Li2O from surface. Note that fresh rock is intercepted at 2m below surface, and this has been common in the holes drilled to date. RC hole TARC089, collared approximately 80m to the north of TARC086), returned 218m at 0.8% Li2O from 16m to end of the hole (true width estimated at ~53m). The pegmatite intercept in TARC089 contains several internal high-grade zones including 22m at 1.0% Li2O from 31m, 23m at 1.0% Li2O from 152m and 51m at 1.5% Li2O from 183m (including 4m at 1.9% Li2O at the end of the hole).

The pegmatite was initially interpreted to dip west based on observations of magmatic layering in the outcropping pegmatite. However, after TARC086 and TARC089 intercepted very wide intervals of pegmatite it was suspected that the holes were drilled obliquely down-dip and scissors holes (drilled to the west) were completed (see Figure 3). The follow-up scissor holes confirm the pegmatites in this area have an easterly dip, and therefore the down hole intersections in TARC086 and 089 are not true width. However, the follow up drilling has confirmed the pegmatites in this area appear to be of considerable thickness over 50m and up to 132m (true width) and extend over 1.2km of strike (currently open in all directions) as illustrated on Figures 1 and 2.

Figure 2 shows a section through TARC089 and follow-up scissor holes TARC117, TARC118 and TARC119 – assays pending. The section shows four, thick, stacked steeply dipping pegmatite bodies, noting that the west quarter of the section progresses under shallow alluvial cover.

Click here for the full ASX Release

This article includes content from Wildcat Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00