November 19, 2023

Flynn Gold Limited (ASX: FG1, “Flynn” or “the Company”) is pleased to announce results from its in-fill soil sampling program at its 100% owned Mt Dove lithium-gold project in Western Australia. The program was designed to evaluate multiple lithium and gold anomalies outlined from the Company’s 2022 Ultra-fine fraction (UFF) soil sampling program.1

Highlights

- Seven high priority lithium anomalies confirmed and enhanced by in-fill soil sampling at the Mt Dove Project in the Pilbara region of Western Australia

- Coherent lithium anomalies extend up to 3,100m length within predominantly shallow sand covered eastern part of licence area

- Outcropping pegmatite samples, with high rubidium (max 0.14% Rb) identified within the highest priority lithium anomaly

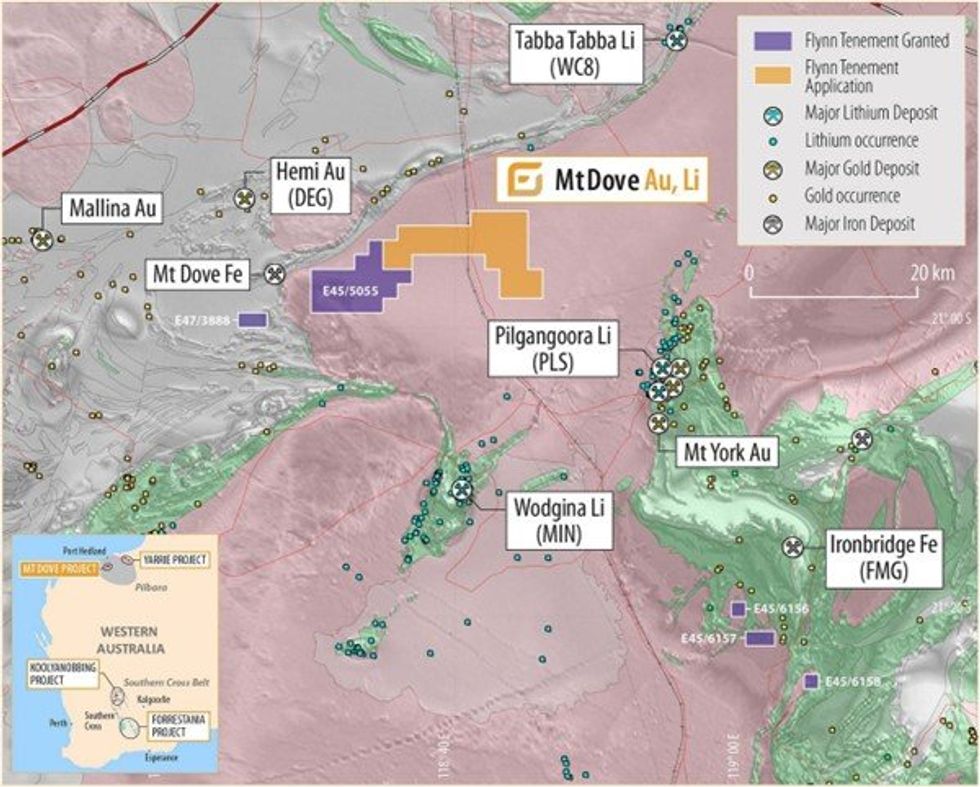

- Project located near world class Pilgangoora (ASX:PLS) and Wodgina (ASX:MIN) lithium mines and Hemi gold deposit (ASX:DEG)

- Mt Dove Project also near recent lithium pegmatite discoveries at Tabba Tabba (ASX:WC8) and Pippingarra (ASX:IND)

- Planning underway for design and permitting of a first pass aircore drilling program to cover high-priority targets

The Mt Dove project is located approximately 25km NNW of Mineral Resources’ (ASX: MIN) Wodgina Lithium Mine, 34km WNW of Pilbara Minerals’ (ASX: PLS) Pilgangoora Lithium Mine, 12km SE of De Grey Mining’s (ASX: DEG) Hemi gold deposit, 45km SW of Wildcat Resources’ (ASX: WC8) Tabba Tabba lithium deposit and 41km SSW of Industrial Metals’ (ASX: IND) Pippingarra lithium prospect in the Pilbara region (see Figure 1).

Managing Director and CEO, Neil Marston commented,

“The Mt Dove in-fill soil sampling program has confirmed seven broad areas of lithium and associated pathfinder element anomalism, highlighting the exciting lithium potential of the project.

“Flynn has recently commenced an accelerated work program on its Mt Dove, Lake Johnston and Forrestania lithium projects in Western Australia.”

“The projects are located close to world class lithium deposits and some exciting new discoveries including the Tabba Tabba and Pippingarra projects in the Pilbara and the Burmeister, Jaegermeister and Mt Gordon prospects in the Lake Johnston region.

“The aim of our fieldwork has been to identify pegmatite bodies across our tenements from mapping, sampling and target generation for drill testing. We look forward to providing updates to shareholders on our exploration progress including the plans for our first drill program.”

Soil Sampling Program

The results from an in-fill soil sampling program at the Mt Dove project (E45/5055) have been received and have outlined seven high priority coherent lithium anomalies with associated pathfinder geochemistry and eleven lower priority, less coherent lithium anomalies (Figure 2). The program has been successful in confirming and enhancing the seven high priority lithium geochemical anomalies and in providing further detail of the pathfinder zonation trends (refer to Table 1 and Appendix 1 for further details).

The seven high priority anomalies reveal broad areas of lithium soil anomalism extending between 600m and 3,100m in length and between 200m and 1,000m in width. The soil anomalies have been defined by clusters of samples which are greater than 75ppm Li (+160ppm Li2O) for the original UFF samples and greater than 21ppm Li (+45ppm Li2O) for the recent -2mm soil samples. These are considered significant anomalies particularly when taking into account the supporting associated pathfinder anomalism and trends (Figures 5 - 9).

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00