May 29, 2025

Lithium Africa is a next-generation exploration company purpose-built to seize the opportunities of the coming lithium supercycle. With a focus on early-stage land acquisition, rapid drilling, and a landmark joint venture with Ganfeng Lithium, the company delivers maximum exploration efficiency, capital leverage, and de-risked discovery potential at scale.

Lithium Africa’s mission is to discover, de-risk, and monetize Tier 1 hard rock lithium assets through data-driven targeting, aggressive fieldwork, and disciplined exit strategies. Its partnership with Ganfeng—one of the world’s leading lithium producers—anchors its strategy with industrial expertise and financial strength from the earliest phases of project development.

Lithium Africa is the first company to implement a systematic, multi-jurisdictional discovery strategy across the continent, combining world-class geology with capital discipline and strategic focus to unlock the next generation of globally significant lithium deposits.

Company Highlights

- Exploration-focused Model: Lithium Africa focuses purely on discovery and value creation, with no intention to develop or operate a mine

- Strategic 50/50 JV with Ganfeng Lithium: Doubles exploration spending and provides access to processing expertise and long-term downstream offtake partners.

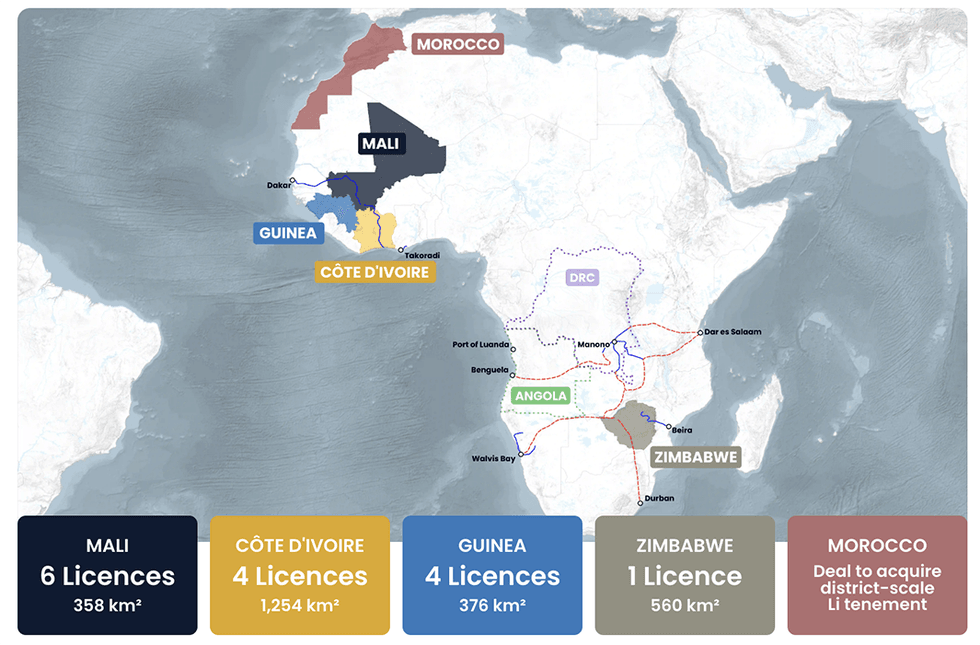

- Pan-African Footprint: Over 8,000 sq km of tenure across Zimbabwe, Morocco, Mali, Côte d’Ivoire, Guinea, and others – enabling diversification in discovery strategy.

- Contrarian, Countercyclical M&A: Well-capitalized and positioned to roll up distressed lithium juniors during a downcycle

- Rapid Permitting & Scalability: Target jurisdictions offer 3- to 4-year discovery-to-mine timelines versus 10 to 15 years in North America.

- RTO & Listing Expected by August 2025: Tight structure, early institutional support and significant near-term drilling catalysts

This Lithium Africa profile is part of a paid investor education campaign.*

Click here to connect with Lithium Africa to receive an Investor Presentation

The Conversation (0)

24 October

PMET Releases Lithium-Only Feasibility Study for Shaakichiuwaanaan in Québec

PMET Resources (ASX:PMT, TSX:PMET,OTCQX:PMETF) has completed a lithium-only feasibility study on the CV5 deposit of its Shaakichiuwaanaan lithium project in Northern Québec. The company said the feasibility study confirms the project is a large-scale and long-life operation, with CV5’s probable... Keep Reading...

22 October

Lithium Market Update: Q3 2025 in Review

Volatility punctuated the global lithium market during the third quarter of 2025, with prices, supply/demand dynamics and geopolitics converging to reshape the landscape. After slipping to a four year low at the end of June, benchmark lithium carbonate prices rallied through July to reach an 11... Keep Reading...

22 October

Argentina Lithium & Energy Corp. Announces Initial Mineral Resource Estimate at the Rincon West Lithium Project

TSX Venture Exchange (TSX-V): LITFrankfurt Stock Exchange (FSE): OAY3OTCQX Venture Market: LILIF Argentina Lithium & Energy Corp. (TSX-V: LIT, FSE: OAY3, OTCQX: LILIF), ("Argentina Lithium" or the "Company") is pleased to announce the results of the first Mineral Resource estimate ("MRE") for... Keep Reading...

21 October

Vertical Integration: The New Lithium Supply Chain Dynamic and What it Means for Investors

When the US government announced it would take a 5 percent equity stake in Vancouver-based Lithium Americas (TSX:LAC,NYSE:LAC), the move underscored a seismic shift underway in the lithium industry. This significant federal backing, tied to the company’s massive Thacker Pass project in Nevada... Keep Reading...

17 October

Successful A$4.5M Placement to Accelerate Battery, REE and Solar Panel Recycling Growth

Livium Ltd (ASX: LIT) (“Livium” or the “Company”) is pleased to announce it has received firm commitments from new and existing, institutional and sophisticated investors to raise $4.5m (“Placement”) before costs. HighlightsFirm commitments of A$4.5m received from institutional and sophisticated... Keep Reading...

15 October

7 Biggest Lithium-mining Companies in 2025

For a long time, most of the world's lithium was produced by an oligopoly of US-listed producers. However, the sector has transformed significantly in recent years.Interested investors should cast a wider net to look at global companies — in particular those listed in Australia and China, as... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00