March 20, 2024

Lincoln Minerals (ASX: LML) is pleased to announce it will commence a partnering process for its large-scale Green Iron Project on the Eyre Peninsula in South Australia, which is underpinned by the recently announced 1.2 billion tonne (Bt) magnetite resource1. A review by Lincoln’s new Board and management team has highlighted the development potential of this large-scale multi deposit magnetite project, known as the “Green Iron Project”., which Lincoln has held since 20182.

- Portfolio review by new management team validates significant scale of Lincoln’s Green Iron Project on South Australia’s Eyre Peninsula, underpinned by 1.2 billion tonne magnetite resource1.

- Previously completed studies contemplated production scenarios of 3 – 10 million tonnes per annum of magnetite concentrate analysing all aspects of project development, including mining, processing, logistics, port, power and water.

- Previous incomplete feasibility studies demonstrated the project’s favourable metallurgical properties, including high recoveries, high resultant iron ore grades and favourable grind size characteristics.

- The commencement of a partnering process for Lincoln’s Green Iron Project is the first step towards unlocking shareholder and regional value from its magnetite resource. The Company understands the local Eyre Peninsula community has an interest in our projects and Lincoln looks forward to working constructively with the community to develop this important Green Iron Project.

- Recent initiatives aimed at decarbonising Australia’s steel industry are expected to support third party project interest, noting plans by the SA Government to update its magnetite strategy, in which Lincoln has been requested to participate.

- Project partnering process aimed at advancing the project to Definitive Feasibility Study (DFS) status and complete approval documents to commence imminently, overseen by Lincoln Director Julian Babarczy.

- Value realised from Lincoln’s Green Iron Project will fund and fast-track development of the Kookaburra Graphite Project, the Company’s core asset and primary focus.

The Green Iron Project partnership process, which Lincoln is launching today, seeks to identify a funding and project partner for advancing the Green Iron Project to operational status. The initial phase involves progressing the project to Definitive Feasibility Study (DFS) status and completing necessary approval documents. It is important to note that previous DFS-level studies and regulatory approvals were not finalized, although were well advanced. The goal of the partnering process is to realise value for shareholders and potentially secure funding for the Kookaburra Graphite Project (KGP) while minimizing equity dilution for Lincoln shareholders.

Lincoln Director Julian Babarczy said, “We believe there is substantial potential value in Lincoln’s 100%-owned Green Iron Project, which in our view is currently not reflected in Lincoln’s share price, due to a lack of awareness by the market of the scale and attractiveness of previous study outcomes. During the strong iron ore pricing environment of 2010-2012, the project attracted significant funding as well as strong engagement from major steel companies, however project advancement halted due to the retracement of iron ore prices in subsequent years.

Following our review of the project, it is clear it has a compelling and significant scale, with detailed yet incomplete, advanced stage feasibility studies undertaken on all aspects of the project showing the potential to produce a very high-quality magnetite end-product with favourable metallurgical characteristics, ideal for the production of green steel in the region. I look forward to overseeing this important partnering process for the Company in the months ahead.”

Lincoln CEO Jonathon Trewartha said, “Magnetite, with its environmental advantages, has emerged as an appealing option for sustainable, low carbon steel production. Lincoln’s Green Iron Project, focused on producing a coarse-grind, high-grade iron ore concentrate, is expected to attract interest from potential steel producers, as has been the case with other peers in the region. The project’s unique properties, positive environmental impact, and proximity to established infrastructure and workforce contribute significantly to the project’s attractiveness.”

“Lincoln Minerals has recently unearthed a wealth of assets during an extensive review of the company’s overall portfolio. Among these are the iron ore assets, which represent just one facet of Lincoln’s underlying value and potential. Additionally, we are in the final stages of evaluating Lincoln’s Uranium assets, which we look forward to updating shareholders on shortly.”

“While we remain focused on development of our Kookaburra Graphite Project, our aim is to deliver maximum value to our shareholders and realise value from assets within our broad portfolio in the best interests of shareholders.”

Overview of Lincoln’s Green Iron Project

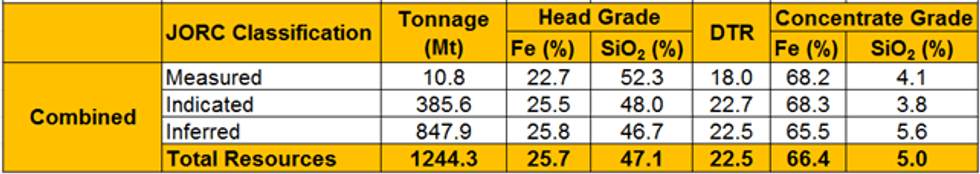

Lincoln’s Green Iron Project encompasses iron ore rights for a large-scale magnetite project on the Eyre Peninsula in South Australia, with a JORC Mineral Resource estimate of >1.2 Bt of magnetite iron ore, which has demonstrated strong metallurgical recoveries and a high-quality end product (as displayed in Table 1).

Mineral Resources & Metallurgy1

Underpinning Lincoln’s Green Iron Project is a magnetite Total Mineral Resource of 1.2 Bt at a head grade of 25.7% Fe, which is considered significant due to the optimal location of the resource, the strongly supportive metallurgical characteristics, the overall potential scale of the project as well as the recently emerged preference for high quality magnetite feedstock for green steel production.

Click here for the full ASX Release

This article includes content from Lincoln Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

9h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00