(TheNewswire)

Kelowna, British Columbia TheNewswire - January 12, 2026 Lexaria Bioscience Corp. (Nasdaq: LEXX) (Nasdaq: LEXXW), (the "Company" or "Lexaria"), a global innovator in drug delivery platforms is pleased to provide this Annual Letter from its Chief Executive Officer ("CEO") Richard Christopher as a strategic update to all stakeholders.

CEO Letter to Stakeholders

Dear Fellow Stakeholders,

I'm truly honored to deliver Lexaria's Annual Letter from the CEO following my first full year in the position.

I'm pleased to report that, in 2025, Lexaria made significant progress in further evidencing the potential to advance oral based drug delivery within the GLP-1 sector with the use of its proprietary DehydraTECHTM ("DHT") technology. A number of human and animal studies were conducted and concluded in 2025 which produced extremely encouraging safety and tolerability, pharmacokinetic, weight loss, blood glucose, insulin, biodistribution, and blood pressure results.

The key highlights, results, and achievements from 2025; as well as a glimpse into our 2026 plans, are summarized as follows:

(Please note: all dates within this letter refer to calendar periods versus fiscal periods)

2025 Highlights

-

Our DHT technology once again this year demonstrated positive results in each and every research and development ("R") study reported on in 2025. These studies included: Human Pilot Study #3 (GLP-1-H24-3), Human Study #4 (GLP-1-H24-4), Human Pilot Study #5 (GLP-1-H25-5), and our rodent biodistribution study

-

The Company completed its first Phase 1b registrational study (Human Study #4) in Australia;

-

10 additional patents were issued in 2025, including important new patents in the GLP-1 sector, increasing the Lexaria portfolio to 56 patents worldwide;

-

We extended our Material Transfer Agreement ("MTA") with a pharmaceutical company ("PharmaCo") to evaluate our DHT technology; and

-

The Company successfully raised a gross total of $9.5M during 2025 over the course of three distinct equity raises which fuels our exciting 2026 plans.

2025 R&D Results

In 2025, Lexaria dedicated nearly all of its resources to studying the use of its proprietary oral DHT technology with each of the three top GLP-1 drugs in the world today: semaglutide, tirzepatide, and liraglutide. These drugs are the active ingredients contained in the following seven branded products offered by industry leaders Novo Nordisk® and Eli Lilly.

1 liraglutide went off patent in 2024 and is currently offered by Teva Pharmaceuticals and others in a generic form.

We conducted initial evaluations of each of these drugs because we want to provide as many opportunities for commercial success as possible, even if doing so was audaciously aggressive given our diminutive size.

The market for these branded products continued to explode in 2025 with 9-month worldwide revenues increasing from $34.4B in 2024 to $51.9B in 2025 – an increase of $17.5B or 51% year-over-year. This may be the largest revenue growth of any drug class in history.

In addition, the marketplace is becoming increasingly more competitive with new companies, new products, and new opportunities seemingly coming forth each and every week. On top of that, companies are seeking label expansion beyond diabetes and weight loss into such areas as: cardiovascular disease, sleep apnea, metabolic dysfunction associated steatohepatitis (MASH/NASH), chronic kidney disease, and neurodegenerative diseases to name a few. Just one example of this was that semaglutide received both FDA and Health Canada approval in 2025 to treat kidney disease.

Despite the massive opportunities noted above, revenue growth has been largely absent in the orally-delivered segment of the GLP-1 marketplace. Prior to the recent approval of the oral version of the Wegovy® product, there had only been one orally-delivered product approved by the FDA - Rybelsus®. Revenues from Rybelsus® remained relatively flat increasing from $2.5B in 2024 to $2.6B in 2025 – an increase of just $0.1B or 2% year-over-year on a 9-month basis. In fact, only 5% of the overall revenue generated by the seven branded products listed above during the first 9 months of 2025 was oral based. But we believe this is about to change, and we are positioning Lexaria to ride the wave of expected new oral products.

Lexaria's opportunity has never been greater! We are dedicated to advancing and expanding the oral offerings both inside and outside of the GLP-1 marketplace. We aim to do so by leveraging our DHT technology's proven ability to reduce the adverse events ("AEs") of some of the world's biggest-selling drugs while maintaining or even improving their effectiveness.

Why is this so important?

Unwanted AEs are a significant problem plaguing the GLP-1 industry – which, as noted, is currently primarily an injectable industry. They are led by gastrointestinal ("GI") issues, namely: nausea, vomiting, diarrhea and constipation. One study showed that between 47% and 64% of GLP-1 users with type 2 diabetes discontinued use of their GLP-1 drug within 1 or 2 years, respectively, with GI AEs having been cited as the main cause linked to the discontinuation rates.

If roughly half of the patients using GLP-1 drugs discontinue use, the industry is faced with the potential loss of tens of billions of revenue dollars per year based just on the current approved therapeutic conditions. This loss grows dramatically as GLP-1 drugs are approved to treat additional conditions and diseases. Lexaria's market opportunity is truly measured in the tens of billions of dollars.

Oral GLP-1 drug delivery without unwanted AE's is even more challenging than injectable, in part because much more of the drug must be used in oral formats to overcome the inherent obstacles in oral vs. injectable drug delivery; and using higher quantities of drug can lead to even worse AE's. These are the industry challenges that Lexaria's DehydraTECH is specifically designed to mitigate.

Throughout 2025, we added to our dataset evidencing continued success when utilizing DHT with all three of the top GLP-1 drugs in the world today (semaglutide, tirzepatide, and liraglutide), as well as our own cannabidiol ("CBD") formulations. We generated many thousands of pages of study outputs, a small fraction of which was publicly released. We are currently leveraging this wealth of data in designing upcoming R&D work that will build upon what was learned through 2025.

The results from our 2025 studies are summarized as follows (ordered chronologically by results reporting dates):

Human Pilot Study #3:

In Human Pilot Study #3, Lexaria for the first time worked with the drug tirzepatide, which is currently only sold in an injectable format by Eli Lilly under the brand names Zepbound® and Mounjaro®. The study was designed to investigate the safety, tolerability, and pharmacokinetics of the conventional injected Zepbound® product as compared to an oral version of DHT-processed Zepbound®.

The results of this study were released during the first quarter of 2025, and were notable in terms of AE improvement, blood glucose reduction, insulin secretion, and drug accumulation in the bloodstream. As for AEs, the DHT-tirzepatide capsule arm demonstrated a 47% AE reduction as compared to the injectable Zepbound® control arm. In terms of blood glucose levels, the DHT-tirzepatide capsule arm evidenced a comparable reduction in blood glucose levels over the 8-day duration period to the injectable Zepbound® control arm. Further, both arms in this study produced similarly increased levels of insulin from baseline to the end of the 8-day duration period. Lastly, DHT-tirzepatide oral capsules delivered more consistent accumulation and ultimately reached parity with injectable Zepbound® in terms of the delivery of drug into the bloodstream by the end of this study.

Human Pilot Study #5:

In Human Pilot Study #5, Lexaria continued its work with the drug liraglutide, which is sold by Novo Nordisk® under the brand names Saxenda® and Victoza®, and is also currently only available in an injectable format. This drug went off-patent in 2024 and is now also marketed as a generic by Teva Pharmaceuticals and others.

Human Pilot Study #5 was designed to investigate the safety, tolerability, and pharmacokinetics of Novo Nordisk's conventional injected Saxenda® product as compared to an oral version of DHT-liraglutide.

The initial results of the study were published in June, and were highlighted once again by pronounced AE improvement as oral DHT-liraglutide offered a 23% reduction in AEs as compared to the injected Saxenda®. The differences in measurements of blood glucose, insulin, and body weight across most time points in this study were not statistically significantly different, with remarkable similarity in many areas and slight differences in others. Weight loss was experienced by 9 out of 10 people in each study arm and was slightly higher in the Saxenda® study arm, though weight loss was not a primary goal of this study with the relatively short treatment period.

We achieved the primary goal of this study by demonstrating that oral DHT-liraglutide had comparable functional results to that of the injected version of liraglutide – Saxenda®. This could allow for an expedited FDA regulatory pathway known as a 505(b)(2) new drug application that is available when an alternate version of a drug (e.g., the dosage form change from injection to oral administration as tested within this study) retains certain similar performance characteristics as an earlier-approved version of that same drug.

We are still completing final reporting from this study and remain excited about the possibility of establishing DHT-liraglutide as a brand new oral liraglutide-dosing alternative to Saxenda® and the other generic versions of injected liraglutide. We feel this is an unmet market need which DHT may have the ability to address. We plan to take additional steps in 2026, including exploring prospective strategic corporate partnering interest and opportunities, to investigate whether relatively rapid access to the marketplace of DHT-processed liraglutide might be possible via the expedited 505(b)(2) development pathway.

Rodent Biodistribution Study:

In 2025, we conducted the world's first-ever fluorescently tagged semaglutide ("FTS") rodent biodistribution study. The main goal of this study was to determine whether the DHT processing of semaglutide improved its biodistribution in any significant way as compared to the conventional orally administered semaglutide formulation practice used by Novo Nordisk's Rybelsus® product.

The results of the study were announced in September. The most intriguing finding from the study was that Lexaria's DHT-FTS composition, across all doses tested, demonstrated a predominantly higher apparent trend in brain biodistribution (evidenced as fluorescent signal intensity upon whole brain imaging) than the Rybelsus® composition and all study controls.

The findings were very meaningful to us and, as a recent CNBC report indicates, GLP-1 drug performance is increasingly understood to include or even depend upon involvement of brain neurochemistry, thus making brain biodistribution vital.

We consider the early-stage results from our rodent biodistribution study to be highly encouraging and supportive of both additional research and of industry partnerships designed to produce safer and more effective GLP-1 drugs.

Human Study #4:

In 2025, we completed our first registered Phase 1b study (Human Study #4) in Australia, which was focused on diabetes and weight loss.

The results of the study were released on December 23rd and December 30th. We were extremely pleased to report that the primary endpoints of safety and tolerability were met. In fact, all four of the DHT articles tested proved to be safe and well tolerated. Of the DHT formulations evaluated, DHT-semaglutide was the top performer in terms of total AE reductions. There was a 48% reduction in the total quantity of AEs derived from the DHT-semaglutide arm versus the Rybelsus® control arm. Of note, there was also a statistically significant (nominal p-value <0.05) 55% reduction in GI AEs from DHT-semaglutide vs. Rybelsus® with pronounced reductions evidenced in the instances of nausea, vomiting and diarrhea. It is also worthy of note that the DHT-semaglutide AE percent reductions were higher at the end of this study than they were at the 8-week interim analysis mark, meaning that the safety gap improved over time.

In addition, this study demonstrated positive findings across other parameters such as the intriguing evidence that DHT-semaglutide appeared to achieve proportionally lower lean mass to fat mass bodyweight reduction compared to the Rybelsus® control.

Another finding of particular note from this study, was the impact that the DHT-CBD capsule arm had on reducing blood pressure in patients who were generally not hypertensive at the beginning of the study (i.e. hypertension was not a recruitment requirement). At week 4, a mean change of −4.6 mmHg in systolic blood pressure and −4.0 mmHg in diastolic blood pressure was evidenced in the DHT-CBD arm. Blood pressure reductions were also evident in this arm following completion of treatment at the week 16 follow up point (4 weeks after cessation of treatment) with a mean change of −2.6 mmHg in systolic blood pressure and −3.0 mmHg in diastolic blood pressure reported. These findings were very encouraging relative to our separate program interests in pursuing development of DHT-CBD for the treatment of hypertensive patients. Lexaria has previously received FDA clearance to conduct a Phase 1b study to investigate DHT-CBD for hypertension.

This study also provided Lexaria with important clues toward prospective DHT-GLP-1 composition enhancements perhaps leading to superior DHT formulations to be tested in 2026. For instance, while the findings from this study obviously pointed to the DHT-semaglutide test article being most worthy of continued investigation, it would seem most prudent for any such testing work to include the salcaprozate sodium ("SNAC") ingredient chemistry present in Lexaria's DHT-semaglutide formulations originally tested in its previous clinical studies Human Pilot Studies #1 and #2, but not included in Human Study #4. These previous human clinical studies evidenced the strongest DHT-semaglutide efficacy performance to-date, superior even to the Rybelsus® control used therein, while also maintaining improvements in safety and tolerability relatively speaking with the DHT-semaglutide formulation studied. Of note, the decision to not include the SNAC ingredient chemistry together with the DHT-semaglutide composition in Human Study #4 was an intentional design to clearly distinguish performance differences versus Rybelsus® in a controlled clinical setting. Potentially revisiting inclusion of SNAC, or SNAC-like ingredients, in the DHT-semaglutide composition in future clinical testing work would allow Lexaria to explore the goal of evidencing performance gains for new compositions.

Now that the final results from Human Study #4 have been publicly released, Lexaria is in the process of relaying the dataset to PharmaCo. Of note, the study report is quite voluminous at over 7,000 pages long, contains a tremendous amount of data, and is expected to take some time to review and analyze. All of this was taken into account when the MTA agreement with PharmaCo was extended through April 30, 2026.

2026 Research & Development:

Even before our 2025 R&D program came to an end, we had already begun scoping out work plans for 2026 to build upon key lessons learned to-date. Although we are not ready today to provide detailed plans of that work, we certainly can provide some basic guidance.

Our #1 priority remains GLP-1, and specifically, our relationship with our MTA partner (discussed in more detail below). Our 2025 Human Study #4 produced extremely important information that greatly advanced our DHT-GLP-1 program. Indeed, Human Study #4 provided us with vital clues that we intend to utilize to formulate potentially new and improved oral GLP-1 products, as measured both by reduced AE's and impressive performance.

Therefore, we have already started designing our next DHT-GLP-1 human study to leverage advanced, next-generation DHT oral formulations that no other company in the world possesses. Once we have finalized this study design, it will be announced and vigorously pursued. As currently envisioned, we would expect to complete this study during calendar 2026, and we can fully fund it using existing Company resources.

We are also considering a new animal study under design to explore additional new and improved DHT-GLP-1 formulations, including leading developmental GLP-1 peptide agonists not previously tested together with DHT. Lexaria's DHT technology is a dynamic platform that allows us to build layers of specialized and varied ingredients on top of standard patented processes; this compatibility grants us numerous choices when optimizing for different drugs, and that optimization process for DHT-GLP-1 is by no means complete! While design work is still ongoing, we expect to complete this study during calendar 2026 as well utilizing existing Company resources.

Also, as noted above, we plan to also take additional steps in 2026 to investigate whether DHT-processed liraglutide might offer relatively rapid access to the marketplace via the expedited 505(b)(2) development pathway. This may involve select R&D activities, fully funded using existing Company resources, and the exploration of prospective strategic corporate partnering interest and opportunities to support this program.

Newer shareholders might not fully realize the adaptability that DHT offers, and I believe it is important to convey that our DHT-GLP-1 formulation explorations are not complete and may yet yield even more powerful results than have been obtained to date. As such, part of our ongoing work is to continually explore additional formulations in search of higher performance. The animal and human studies under consideration will be designed to do exactly this.

We are also exploring additional R&D in areas outside of GLP-1. We've conducted work in many sectors since our original discovery of DHT, and we have intriguing commercial opportunities that remain untapped. Once design work has been more fully completed, we will announce those studies that we decide to pursue.

Collaboration Agreement:

In September of 2024, the Company entered into an MTA with PharmaCo. The purpose of the agreement was to evaluate the use of Lexaria's DHT technology in a pre-clinical setting with use of the partner's undisclosed drug.

The pre-clinical studies covered by the MTA, which examined pharmacokinetics in animals, were completed in early 2025. In May, Lexaria was informed by PharmaCo that they wished to review the pending safety (AE), pharmacokinetic, and efficacy data from Lexaria's independent Human Study #4.

In November of 2025, we announced that the MTA had been extended through April 30, 2026, to accommodate the time needed for PharmaCo's receipt and review of the full dataset from Lexaria's Human Study #4. This allows the parties to continue their relationship under the MTA, keep the temporary exclusive license active and in force, and contemplate additional strategic planning discussions.

As of the date of this Letter, as noted above, Lexaria is in the process of relaying the Human Study #4 dataset to our MTA partner and, once they have completed their review, we expect to discuss with them possible next steps. Our goal with our MTA pharmaceutical partner is to provide them with data sufficient to enable them to make decisions about potential next steps utilizing DHT. The achievement of the primary endpoint in Human Study #4, with DHT evidencing superior safety and tolerability and a significant reduction in GI side effects especially relative to Rybelsus®, may be considered attractive and compelling to PharmaCo in its deliberations about potential next steps in its relationship with Lexaria. This would be consistent with the pharmaceutical industry's strong appetite in the related therapeutic sectors for improvements in unwanted side effects as Lexaria previously reported.

Business Development:

Our MTA partner is of great importance to us but is not our only business initiative. Lexaria has held a variety of discussions during 2025 – and expects this to intensify in 2026 – with a number of other pharmaceutical companies located in various jurisdictions around the world. DHT technology is not only being discussed within the GLP-1 drug sector, but also for other applications where Lexaria has completed previous investigatory work (e.g., for DHT-CBD for hypertension where we are ideally seeking to achieve strategic partner funding support for prospective future development activities of this Company asset), and even for brand-new drug sectors where DHT has never before been utilized. These discussions are being held with companies ranging in size from smaller regional companies up to and including some of the largest pharmaceutical companies in the world.

Adhering to our internal policies, Lexaria does not generally issue news about business development ("BD") discussions. Since BD work is by its nature speculative, uncertain, and an ongoing process, it would be irresponsible or even reckless for us to comment on every phone call and every meeting we have with third parties. That said, we devote both internal human resources, as well as the engagement of third-party service providers in order to identify and reach out to companies we believe could be interested in our technology on a regular and ongoing basis.

Lexaria's management is grateful and pleased to have attracted the attention of several potential partners. Even so, our stakeholders should always remember that we cannot force the timelines nor the decisions of third parties, and that the evaluation processes of other companies can be quite arduous and lengthy. Lexaria is aggressive and nimble but the pharmaceutical industry is itself very thorough and tries to leave little, if anything, to chance; meaning it typically takes months or even years to form strong industry relationships after a wide array of scientific questions have been satisfactorily answered.

Funding:

The Company successfully raised a gross total of $9.5M over the course of three distinct transactions taking place in April, September, and December of 2025. Importantly, the last two of these transactions followed our fiscal year-end, August 31, 2025, at which time we had just $1.8M of cash remaining on-hand. Furthermore, as such, the Company had less than 12 months of cash on hand. This amount was insufficient to fully fund R&D activities through 2026. I and the rest of the management team hope you value the fact that we will not gamble the future of your Company away: our role is to always provide the best and most ample opportunities for value creation while avoiding catastrophic corporate failure such as is likely when a small company runs out of cash.

We acted in the best interest of shareholders by raising cash at stock high points in both September and December. In fact, the weighted average price of the gross total of the $7.5M raised over the last two transactions was $1.41/share. In comparison, our daily average closing price for the period May 1st through December 12th was ~$1.00/share. Said another way, the Company, in effect, raised funds at a $0.41/share or 41% premium to market as compared to the daily average closing price for the stated period. That is not a small achievement during a time when many companies in the biotech industry have gone out of business due to their inability to raise capital. The investment banking community continues to support Lexaria because they also see the great potential that our technology offers.

While dilution is never welcomed by shareholders – nor by us as managers - our options were limited and we opportunistically struck when the markets were favorable. We are a development stage company that needs to continuously test and iterate our formulations, and generate clinical data in an attempt to move the technology forward towards commercial viability. Our 2025 financings allow us to fund the prospective new development opportunities described above for the entirety of calendar 2026, some details of which we have disclosed within this letter, and final details that will be disclosed in due course.

Stock Price:

The weakness in Lexaria's stock price is extremely frustrating for your management team and, we know, for you as well. Indeed, it is perplexing to us given the overall positivity that we have achieved from our DHT investigatory work, and progress we are making with new and prospective commercial partners. We understand that our shareholders are unhappy with the stock performance this year and that some of you even may have sold some of your stock as result of that frustration.

That said, we have no choice but to drive our R&D programs forward and aggressively support potential partnership pursuits which can all be very time consuming and expensive; hence the need to always endeavor to find opportunistic ways to fund our operations while maximizing the attractiveness of deal terms. To whatever degree that our stock price weakness is connected to the dilution of issuing new equity to raise capital, we can only reiterate that we conducted that practice at the absolute best times possible (see above) in an effort to minimize the dilution associated with this necessary evil.

On the other hand, we feel we are in superb corporate shape to begin 2026. There is no urgency for us to finance in the short-term as our treasury is currently healthy. We are awaiting outcomes of potential commercial pursuits with our MTA partner, as well as with other, undisclosed potential commercial partners in the fields of GLP-1 and others. In addition, we have exciting new R&D under consideration and designed to continue advancing our commercial pursuits.

Directly as a result of our replenishing our corporate bank accounts in the last year, we also now have sufficient funding to enable us to carry out a national marketing campaign for a number of months during 2026. While we are not disclosing details of our marketing plans, we can provide that they will persist over a period of many months during the year with a budget in the mid 6-figure range. As a smaller company with impressive technology and intellectual property, it is important that we communicate extensively to our national and even international audiences.

I truly believe that our current stock price represents good value and offers an exciting opportunity to own a company with unbridled potential. In any case, we the management team remain steadfast in our efforts to reestablish and build value in 2026 by executing on our corporate strategy and continuing our goal of entering into a commercial agreement with one or more pharmaceutical companies in our quest to deliver exciting and transformative returns to all Lexaria stakeholders!

Summary/Closing:

I'm extremely proud of what the Lexaria team has been able to accomplish not only in my short 16-month tenure, but also long prior to my arrival. We've conducted a number of studies, generated a tremendous amount of data, and learned a lot about our technology since the Company expanded into GLP-1 back in 2023.

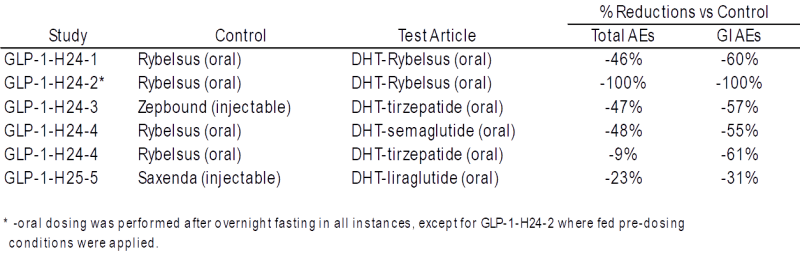

Over the course of now five human studies in GLP-1, we have evidenced that our DHT technology improves the ways in which active pharmaceutical ingredients enter the bloodstream, allowing for greater effectiveness, and reduced side effects consistent with our corporate mission. To that end, I'm compelled to summarize and share with you the dramatic impact that DHT has had on reducing the occurrence of AEs across these five human studies:

As I've stated many times, Lexaria is likely the only biotechnology company in existence that has demonstrated broad success utilizing three of the top GLP-1 drugs (semaglutide, tirzepatide, and liraglutide) in the world today.

We are executing on a multi-pronged commercialization strategy which includes:

-

Producing compelling clinical data in an effort to attract and partner with pharmaceutical companies seeking the benefits of our DHT technology;

-

Potential to develop and commercialize the world's first oral version of a leading GLP-1 drug, liraglutide, utilizing DHT;

-

Potential to develop and commercialize a patented DHT-CBD product.

Our development plans for 2026, partially introduced above, are aimed at putting the capital raised during 2025 to work as we further execute on this strategy. We feel that DehydraTECH is more advanced today than at any point in the past, and that we are closer to a commercial breakthrough than ever before.

Thank you to the long-term shareholders who stood by the Company through a number of strategic pivots and capital raises which have brought us to this point, as well as welcome to the newer shareholders who have placed their faith and confidence in the hands of Lexaria. We do not take your loyalty lightly. Please be assured that we are committed to acting in your best interests as we drive towards expanded value creation in 2026.

I look forward to updating you on the Company's progress and to an extremely successful 2026!

Sincerely,

Richard Christopher

Chief Executive Officer

Lexaria Bioscience Corp.

About Lexaria Bioscience Corp. & DehydraTECH

DehydraTECH™ is Lexaria's patented drug delivery formulation and processing platform technology which improves the way a wide variety of drugs enter the bloodstream, always through oral delivery. DehydraTECH has repeatedly evidenced the ability to increase bio-absorption, reduce side-effects, and deliver some drugs more effectively across the blood brain barrier. Lexaria operates a licensed in-house research laboratory and holds a robust intellectual property portfolio with 56 patents granted and additional patents pending worldwide. For more information, please visit www.lexariabioscience.com.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements. Statements as such term is defined under applicable securities laws. These statements may be identified by words such as "anticipate," "if," "believe," "plan," "estimate," "expect," "intend," "may," "could," "should," "will," and other similar expressions. Such forward-looking statements in this press release include, but are not limited to, statements by the Company relating to the intended use of proceeds from the offering and relating to the Company's ability to carry out research initiatives, receive regulatory approvals or grants or experience positive effects or results from any research or study. Such forward-looking statements are estimates reflecting the Company's best judgment based upon current information and involve a number of risks and uncertainties, and there can be no assurance that the Company will actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements. As such, you should not place undue reliance on these forward-looking statements. Factors which could cause actual results to differ materially from those estimated by the Company include, but are not limited to, market and other conditions, government regulation and regulatory approvals, managing and maintaining growth, the effect of adverse publicity, litigation, competition, scientific discovery, the patent application and approval process, potential adverse effects arising from the testing or use of products utilizing the DehydraTECH technology, the Company's ability to maintain existing collaborations and realize the benefits thereof, delays or cancellations of planned R&D that could occur related to pandemics or for other reasons, and other factors which may be identified from time to time in the Company's public announcements and periodic filings with the US Securities and Exchange Commission on EDGAR. The Company provides links to third-party websites only as a courtesy to readers and disclaims any responsibility for the thoroughness, accuracy or timeliness of information at third-party websites. There is no assurance that any of Lexaria's postulated uses, benefits, or advantages for the patented and patent-pending technology will in fact be realized in any manner or in any part. No statement herein has been evaluated by the Food and Drug Administration (FDA). Lexaria-associated products are not intended to diagnose, treat, cure or prevent any disease. Any forward-looking statements contained in this release speak only as of the date hereof, and the Company expressly disclaims any obligation to update any forward-looking statements or links to third-party websites contained herein, whether as a result of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

INVESTOR CONTACT:

George Jurcic – Head of Investor Relations

ir@lexariabioscience.com

Phone: 250-765-6424, ext 202

Copyright (c) 2026 TheNewswire - All rights reserved.