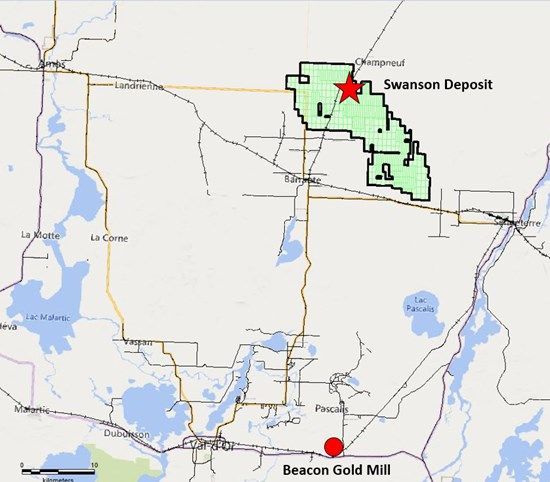

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to provide the results of its recent exploration programs, including an update on its diamond drilling and bulk sampling plans at its district-scale Swanson Gold Project ("Swanson"), positioned in the prolific Abitibi Gold Belt (Figure 1). The Company is also fast-tracking the restart of its 100%-owned, 750 tonne per day ("tpd") Beacon Gold Mill ("Beacon") in Val-d'Or, Québec, and has received significant interest from several groups for the purpose of financing the mill restart as well as to offtake material and support the ramp-up to full production with the goal to be generating cash flow by early 2026.

The interest received to date is a strong vote of confidence in the quality and potential of the Beacon Mill, as a foundational and keystone asset of the Company, its strategic positioning in one of the world's richest and most well-endowed mineralized mining regions with numerous surrounding gold deposits suitable for bulk sampling, which would be ideal sources of mineralized material to complement this transformational next phase of development for LaFleur Minerals.

HIGHLIGHTS

- Immediate plans to complete at least 5,000 metres of diamond drilling at Swanson starting in June using existing flow-through (FT) funds, with over 50 promising drilling targets identified, among the other highly prospective Bartec, Jolin, and Marimac gold targets. A drilling contractor has been selected with drilling permits expected by early June.

- Recent exploration work by LaFleur Minerals at Swanson which included geological mapping and prospecting, soil sampling surveys, and Induced Polarization (IP) geophysics surveys, have resulted in several high-grade gold assay results (including 11.7 g/t Au in a grab sample at Jolin), and the identification of several new potential gold targets to be drill-tested during the upcoming drilling program. Further details are summarized below.

- Geological and engineering planning continues for a large bulk sampling program at the Swanson mining lease with an updated Scoping Study and mine plan to be submitted to Québec government for approval. The plan includes the extraction of an up to 100,000 tonne surface bulk sample at Swanson for processing at the Beacon Mill once it is in full production (anticipated by early 2026).

- The Beacon restart plan and budget has been finalized with a total estimated cost of C$5-6M to restart the mill and complete all the necessary repairs and maintenance at the site over a 6-to-8-month period. LaFleur Minerals anticipates achieving full production at the Beacon Mill by early 2026 once the restart tasks and ramp-up period are complete, with plans to commence initial production launch by the end of 2025. LaFleur Minerals is planning to process mineralized material from its Swanson Gold Project at Beacon and envisions processing bulk samples and completing custom or toll milling of nearby advanced gold deposits with the goal of generating positive cash flow from the mill within the next 12 months.

- The Company is in advanced discussions with several institutional and private equity groups, as well as exploring non-dilutive funding options with several commodity trading and debt financing firms to fund Beacon Mill's restart. The Company's goal is to be fully-funded, complete upgrades, and become fully operational by early 2026.

Paul Ténière, CEO of LaFleur Minerals, commented, "We are very excited to commence our summer diamond drilling program to test the regional exploration targets identified from our recent exploration programs at Swanson. These drilling targets are based on careful and well executed geological, geochemical, and geophysical programs by our technical team. Swanson is a large regional exploration project with numerous gold showings and the upcoming diamond drilling program will focus on showings that have the potential to host significant large gold deposits.

"In addition, we are forging ahead with the permitting process for the Swanson bulk sample and funding the restart of the Beacon Gold Mill to generate cash flow as quickly as possible, with the longer-term vision of funding additional project acquisitions and expanding LaFleur Minerals from a small to intermediate gold producer in the Val-d'Or region. With a restart cost that is so low, LaFleur Minerals has the ability to move towards commercial production and profitability near term, achieving an outstanding milestone in an exceptionally short period of time thanks to the methodical work of the Company's technical and management team, largely supported by the increasingly attractive precious metals market."

PETER ESPIG JOINS LaFleur Minerals AS STRATEGIC ADVISOR

The Company is also pleased to announce that Peter Espig has joined the Company as a Strategic Advisor and Consultant focused on the capital markets and assisting with the funding of the Swanson and Beacon Gold Mill projects. Mr. Espig also brings substantial experience in managing the funding, construction, ramp up, and operation of gold and silver milling and processing facilities in Canada.

Mr. Espig served as Vice-President at Goldman Sachs Japan in both the Principal Finance and Securitization Group and the Asia Special Situations Group, where his team participated in more than $10 billion in structured deals, capital raises, and cross-border transactions. Prior to Goldman Sachs, he was Vice-President at Olympus Capital, a New York-based private equity firm, where he focused on corporate restructurings, investment analysis, and international financing negotiations. He also played a pioneering role in some of the earliest SPAC transactions, totaling over US$1.2 billion, and brings deep experience in disciplined capital deployment and turnaround execution.

Since 2013, Mr. Espig has served as President and CEO of Nicola Mining Inc. and is a board member of ESGold Corp and First Lithium Minerals. Mr. Espig holds a Bachelor of Arts from the University of British Columbia and an MBA from Columbia Business School, where he was a Chazen International Scholar. He has served on various public boards and was recognized among Industry Era's "Top 10 Admired Leaders" in 2023.

GRANT OF STOCK OPTIONS

The Company also announces that it has granted incentive stock options ("Options") to management and consultants of the Company to acquire an aggregate of 1,250,000 common shares at $0.20 per share, for a period of three years. These Options have been granted in accordance with the Company's stock option plan.

SITE VISIT AND MANAGEMENT UPDATE CALL

The Company plans to coordinate a site visit of its Beacon Mill in June 2025 for any prospective investors, shareholders, and analysts. The Company will host a management update call for investors on Thursday June 5, 2025, at 10:00 a.m. Pacific Time / 1:00 p.m. Eastern Time. The call will be accessible via the Zoom platform, by video conference and by telephone, and participants should use the following information to join the call:

Please click the link below to join the LaFleur video call:

https://us06web.zoom.us/j/89960363165?pwd=0a0hXT9yEvAogURcX4EO0VRwuU3LaZ.1

Webinar ID: 899 6036 3165

Passcode: 888888

Or join via telephone:

United States: +1 646 931 3860

Canada: +1 647 374 4685

United Kingdom: +44 330 088 5830

Webinar ID: 864 5330 0862

More international numbers are available on the following link: https://us06web.zoom.us/u/keDxuREffH

SUMMARY OF RECENT SWANSON EXPLORATION RESULTS

LaFleur Minerals recently received the final reports for its 2024 prospecting and reconnaissance mapping, soil sampling program, and IP survey. This exploration data has been incorporated into the Company's geological and GIS database, along with the regional high-resolution magnetic and VLF-EM survey completed earlier in 2024, which has been used to develop priority drill targets to be tested this summer.

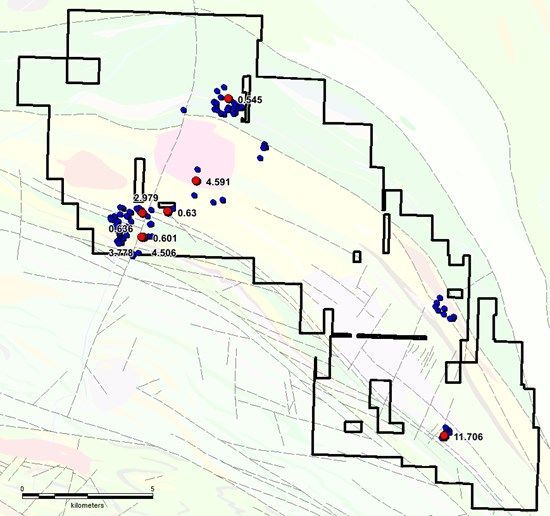

Geological Reconnaissance Mapping and Prospecting

Geological reconnaissance mapping and prospecting was carried out in September 2024 by IOS Géosciences Inc. ("IOS"). The work, including the collection of 144 samples that were sent to the laboratory, focused on key deposits, showings, and mineralized outcrops, compiled from the literature (Figure 2). Out of the 25 mineral occurrences reported since 1926 at Swanson, 10 were selected to represent the focus of interest. The Swanson, Jolin, Barautte VII, and Jackson showings display characteristics that are indicative of orogenic-gold-type mineralization and magmatic-hydrothermal-type mineralization. The reported results included the discovery of new highly prospective lithologies, hydrothermal alterations, sulphide mineralization, and corresponding gold grades. Best gold grades from grab samples included:

- 11.71 g/t Au located 425 m SW of the Jolin deposit

- 4.59 g/t Au located 140 m south of the Barautte VII showing

- 4.51 g/t Au and 3.78 g/t Au in the area of the Jackson showing

- 2.98 g/t Au in the area of the Bartec showing

Please note: Grab samples are selective by nature and may not be representative of the overall mineralization on the Swanson Project. While they are useful for identifying areas of interest and guiding further exploration, they should not be relied upon as an indicator of the average grade or extent of mineralization.

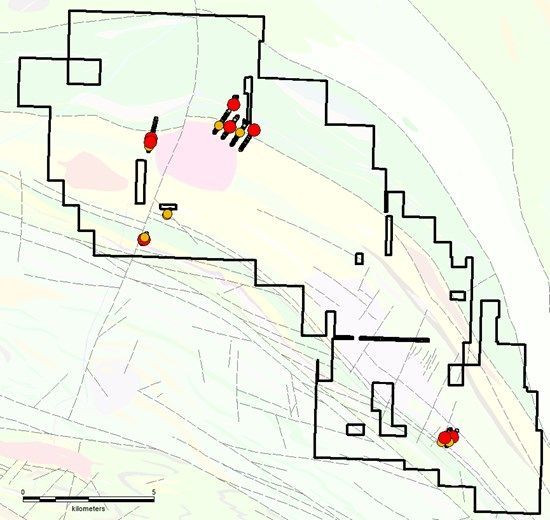

Soil Survey

A soil survey was also carried out in September 2024 by IOS. The objective of the 2024 soil sampling program was to assess Swanson's potential to contain unknown blind gold occurrences by using the dispersion of geochemical signals in surficial materials. The survey included 315 sampling sites distributed along 8 grids according to the local quaternary geology, aerial photos and LiDAR images (Figure 3). The survey was designed to test the efficiency of the method and targeted areas with known occurrences. Lines were oriented perpendicular to the geophysical anomaly and/or geological features.

The gold-enriched soil samples located to the SW of the Damascus showing were found to be associated with an untested IP anomaly. The soil samples near the Jackson showing and Bartec deposit, and samples approximately 750 m SSW of the Swanson deposit and on two lines located 300 to 550 m south of the Jolin deposit, all show gold-enrichment.

Please note: Soil sampling surveys are not definitive, and the results are still at an early stage of interpretation, with no guarantee of a mineral discovery.

Induced Polarization Geophysics Survey

An Induced Polarization (IP) survey was carried out at Swanson between January and April 2024 by TMC Geophysics. The survey consisted of 120.4 line-km of IP using the pole-dipole electrode array with a configuration of a=25 m, n=1 to 16 over two distinct grids, namely Jolin and Bartec (Figure 4).

A total of 64 IP axes indicative of the most obvious anomalies have been identified on both prospects. These include:

- A first group of IP axes characterize some of the strongest and more continuous polarizable anomalies. The associated polarizable sources are typically correlated with slight to strong decreases in resistivity or included within the confines of thin conductive beds/horizons. According to the regional geology, this type of signature is, at least partially, of the lithological type and indicative of the known pyrite and graphite rich units/lithologies of both prospects. On the other hand, one cannot exclude to see these units themselves locally enriched in poly-metallic mineralization (+/- Au). Some other axes of this group may also directly emphasize polymetallic mineralization developed along broad shear zones, or altered geological contacts favored by the upwelling of hydrothermal fluids.

- The second group of IP axes feature weaker and less continuous polarizable anomalies that are partially correlated with an increase in resistivity. They all have the potential to indicate the presence of gold-rich mineralization associated with disseminated sulphide remobilized along a fault or altered and silicified band of rocks (+/- quartz/carbonate veining).

As for the follow-up work, 7 IP axes have been selected to be drill tested on the Jolin grid, and 4 others on the Bartec grid.

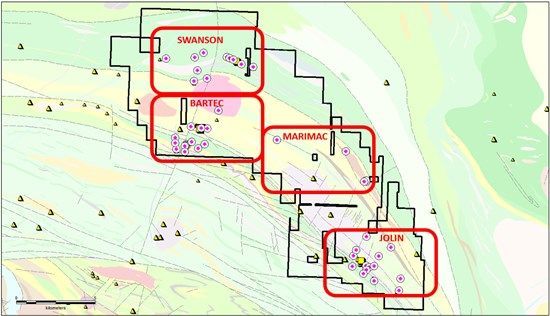

2025 SWANSON DIAMOND DRILLING PROGRAM PLANS

Following the regional compilation and high-resolution magnetics and VLF-EM over the entire Swanson Gold Project, along with the recent encouraging results of the reconnaissance mapping and prospecting, soil sampling and IP survey discussed above, LaFleur Minerals will move forward with its regional drilling program.

Approximately 50 drill targets have currently been identified based on the compilation and recent field work. The targets are located regionally in the Swanson, Jolin, Bartec and Marimac regions (Figure 5). Phase I of the diamond drill program will include 20 exploration drill holes totalling at least 5,000 m of diamond drilling.

LaFleur Minerals is pleased to announce that it has signed a drilling contract with Forage Rouillier Drilling of Amos, Québec and is expecting to start drilling at Swanson in early- to mid-June 2025 once drilling permits have been received from the Québec government.

Figure 1: Swanson Gold Project (including the Swanson Deposit) located 50 km from the Beacon Gold Mill

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/254409_d95e6950644fe9dd_001full.jpg

Figure 2: Geological Reconnaissance - Sample locations and anomalous results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/254409_d95e6950644fe9dd_002full.jpg

Figure 3: Soil Samples - Anomalous Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/254409_d95e6950644fe9dd_003full.jpg

Figure 4: Lines Completed by IP Survey

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/254409_d95e6950644fe9dd_004full.jpg

Figure 5: Swanson drilling target regions and proposed 2025 drill holes (in purple)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/254409_d95e6950644fe9dd_005full.jpg

SAMPLE PREPARATION, LABORATORY ANALYSIS, AND QA/QC SUMMARY

Rock (Grab) Samples

All rock (grab) samples collected by IOS during the program were securely transported to Activation Laboratories (Actlabs) in Ancaster, Ontario, an ISO/IEC 17025-accredited laboratory. Grab sample sizes vary by rock collected but varies from 1 kg to 3 kg. Actlabs is independent of LaFleur Minerals. Sample preparation included crushing, splitting, and pulverizing to 95% passing 105 microns. Gold analysis was performed using fire assay with an inductively coupled plasma mass spectrometry (1A2-ICPMS) finish. A multi-element analysis (63 elements) was also done on the samples using an Aqua regia digestion / ICP-MS (Ultratrace-1). Borate fusion with XRF finishing was carried out for samples exceeding the limit for tungsten. The Company follows industry-standard QA/QC protocols, including the insertion of certified reference materials, blanks, and duplicates to ensure the accuracy and precision of the results.

Soil Samples

Soil samples were collected by IOS at a depth of 10 cm to 25 cm below the base of the Ah horizon with an average sample size approximately 1 kg. As such, the sample can be composed of either the Ae, B or C horizon, or be a composite of these horizons depending on the soil profile. Sampling was done using a shovel or an auger depending on the environment and depth necessary to sample the correct horizon.

Samples were securely transported back to IOS facilities in Saguenay, Québec by the field crew. The samples were prepared in the IOS laboratory for environmental parameter measurements (e.g. pH, Eh, etc.) and handheld XRF analysis. Upon reception of the samples by the IOS lab and prior to any preparation, a 20 gram aliquot was taken to perform measurements that need to be conducted on the raw material. The remaining material was dedicated to preparation for loss on ignition (LOI) and chemical analyses. Environmental parameters such as pH, δpH, Eh and TDS (Total Dissolved Solids, i.e., conductivity) were measured on saturated paste according to standard procedures.

Samples were then securely courier shipped to ALS Minerals in Val-d'Or for final preparation before the final shipping to ALS Minerals in Vancouver for Ionic LeachTM. ALS Minerals is independent of LaFleur Minerals. Sample material dedicated for chemical analysis were air dried and sieved at

The anomaly thresholds were determined by IOS using a probabilistic approach. In that the assays results are first transformed into logarithmic data. The Z-score is then calculated for each element of each sample. This significantly limits the range of values and enables the use of a normal distribution for the probability modelling. The anomaly threshold for an element is determined by the difference between the sample's Z-score and the expected Z-score for a log-normal population with an average of 0 and a standard deviation of 1, which represents the regional background as confirmed by the analysis of IOS's large database. Any sample deviated from that regional trend is likely related to an anomalous population.

SWANSON GOLD PROJECT SUMMARY

The Swanson Gold Project is approximately 16,600 hectares in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. The Swanson Gold Project covers major structural breaks that hosts the Swanson Gold Deposit, and Bartec, and Jolin gold targets and numerous other showings which make up the Swanson Gold Project. The Swanson Gold Project has had in excess of 36,000 metres of historical diamond drilling, is easily accessible by road with a rail line running through the property, allowing direct access to the Beacon Gold Mill, which further enhances its development potential.

The Swanson Gold Deposit hosts:

- Indicated Mineral Resource Estimate:

- 2,113,000 t with an average grade of 1.8 g/t gold, containing 123,400 oz of gold.

- Inferred Mineral Resource Estimate:

- 872,000 t with an average grade of 2.3 g/t gold, containing 64,500 oz of gold.

(MRE source: NI 43-101 technical report, effective September 17, 2024, filed on the Company's SEDAR+ profile)

- The Swanson Gold Project is located within 50 km of the Company's fully-permitted Beacon Gold Mill (Figure 1), and includes:

- Jolin target (Au): Historical Mineral Resource Estimate

(Source: GESTIM -1996, GM62629 - historical estimate not compliant with NI 43-101)

- Bartec target (Au): Historical Mineral Resource Estimate.

(Source: GESTIM - DV 87-01 - historical estimate not compliant NI 43-101)

QUALIFIED PERSON STATEMENT AND DATA VERIFICATION

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo. (OGQ), Exploration Manager and Technical Advisor of the Company and considered a Qualified Person for the purposes of NI 43-101. Mr. Martin has reviewed and verified the rock and soil sampling results and certified analytical data underlying the technical information disclosed. Mr. Martin noted no errors or omissions during the data verification process and the Company's management have also verified the technical information disclosed. The Company and Mr. Martin do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the assay data and exploration results disclosed in this news release.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the development of district-scale gold projects in the Abitibi Gold Belt near Val-d'Or, Québec. Our mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project and the Beacon Gold Mill, which have significant potential to deliver long-term value. The Swanson Gold Project is approximately 16,600 hectares (166 km2) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Project. The Swanson Gold Project is easily accessible by road with a rail line running through the property allowing direct access to several nearby gold mills, further enhancing its development potential. LaFleur Minerals' fully-refurbished and permitted Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material at Swanson and for custom milling operations for other nearby gold projects.

ON BEHALF OF LaFleur Minerals INC.

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254409