August 23, 2022

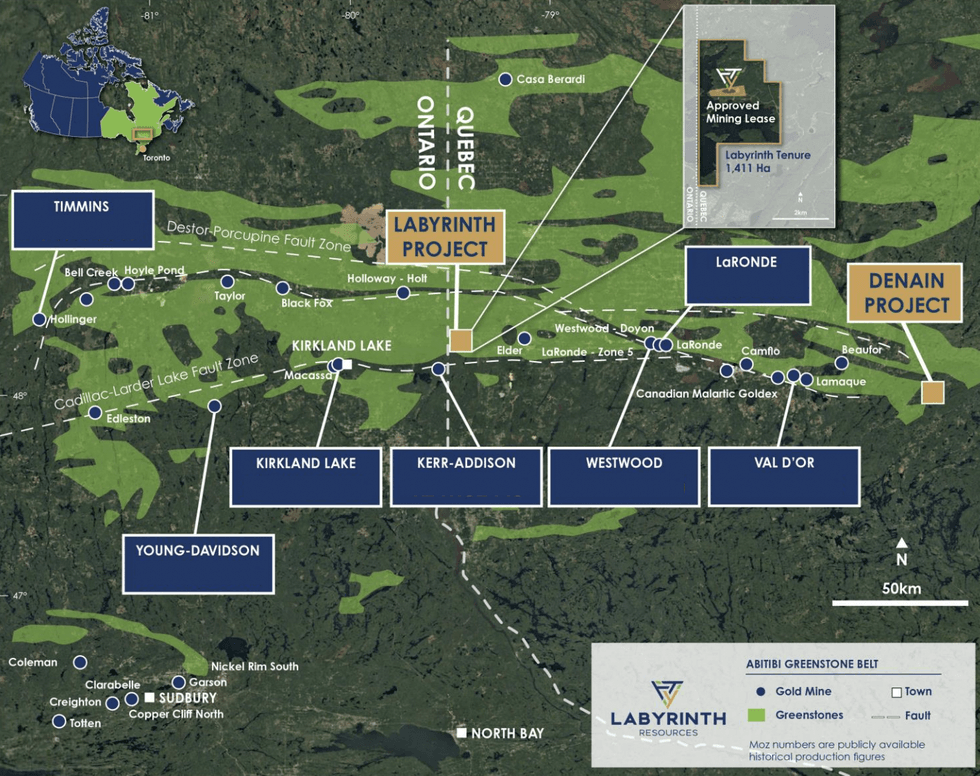

Labyrinth Resources Limited (ASX: LRL) advances an underexplored gold asset located in the heart of the Abitibi Gold Belt. The Labyrinth Gold Project is located on the Abitibi Gold Belt in Quebec, a recognised tier-1 jurisdiction. However, the asset has not received significant exploration attention for over 15 years, creating tremendous blue sky potential. Labyrinth Resources has a solid management team with a record of consistent delivery of operational success throughout world-class mining assets.

The Labyrinth Gold Project has a 2010 foreign resource estimate of 479,000 ounces of gold at 7.1 g/t, which is only modelled to 250-400 meters in depth. Yet, the project has neighbours with deposits reaching over 2 kilometres in depth. Many of those neighbours are also sitting on multi-million-ounce deposits. Despite the proven presence of high-grade gold, only one single 400-meter hole has been drilled within the past 15 years by the asset’s previous owner. The project has a multi-million-ounce potential for Labyrinth Resources to fully realise. In 2022, Labyrinth received assays for the first three holes of the maiden surface exploration program at its flagship Labyrinth Gold Project. Assays revealed high-grade results which include 44g/t in LABS-22-01A and 20.53g/t in LABS-22-02 extending the Boucher lode by a significant 375m downdip. The company is working towards a new JORC-compliant resource estimate.

Company Highlights

- Labyrinth Resources is a junior minor exploration and development mining company with an underexplored gold asset on the Abitibi Gold Belt in Quebec.

- Quebec is a globally-recognized tier-1 mining jurisdiction with strong government and community support.

- The Labyrinth Gold Project has significant blue sky potential as it has not received meaningful exploration attention over the past 15 years.

- The project has a 2010 foreign resource estimate of 479,000 ounces of gold at 7.1 g/t, and the company is working towards a current JORC-compliant estimate.

- The company’s project is surrounded by prolific mining companies with multi-million-ounce gold deposits, with testing of the Labyrinth deposit barely scratching the surface in comparison to the deep nature of many Abitibi gold operations.

- A management team with a proven track record of success in the natural resources industry adds value to the company. It creates confidence in its ability to capitalise on its project fully.

This Labyrinth Resources profile is part of a paid investor education campaign.*

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

7h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

19h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

20h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

20h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

21h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

21h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00