Kenorland Minerals Ltd. (TSXV: KLD,OTC:KLDCF) (OTCQX: KLDCF) (FSE: 3WQ0) ("Kenorland" or the "Company") is pleased to announce the remaining results from the 2025 winter drill program at the Frotet Project (the "Project"), located in northern Quebec. Assays from the last 13 of 34 drill holes completed, including 8,865 metres of the 22,913-metre program, are reported herein. The Company also announces the transfer of operatorship to Sumitomo Metal Mining as well as the initiation of the maiden Mineral Resource Estimate (the "MRE"), prepared in accordance with National Instrument 43-101 and expected to be completed by late 2025 or early 2026. Kenorland currently holds a 4% NSR Royalty on the Project.

Drill highlights include the following:

- 25RDD261: 12.15m at 26.33 g/t Au incl. 1.80m at 99.64 g/t Au at R6

- 25RDD257: 7.80m at 13.98 g/t Au incl. 1.15m at 81.01 g/t Au at R1

- 25RDD259: 4.50m at 18.06 g/t Au incl. 1.60m at 47.14 g/t Au at R1

- 25RDD262: 0.60m at 91.60 g/t Au at R9

- 25RDD258: 1.70m at 31.59 g/t Au incl. 0.35m at 145.90 g/t Au at R5

- 25RDD257: 14.40m at 3.45 g/t Au incl. 4.60m at 7.51 g/t Au at R6

- 25RDD264: 4.80m at 9.85 g/t Au incl. 1.15m at 32.16 g/t Au at R6

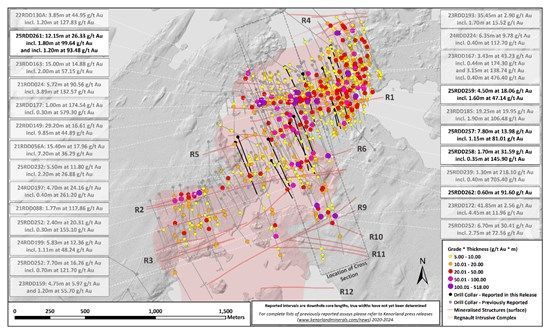

Figure 1. Plan map of Regnault drilling including highlights from this press release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/263601_311c1ebf14415a6d_001full.jpg

Discussion of Results

The 2025 winter drill program focused on stepping out along known mineralised structures as well as increasing confidence in vein system geometry and grade continuity through targeted infill drilling. Drill holes were optimised to maintain 50-100m spacing within the known mineralised footprint.

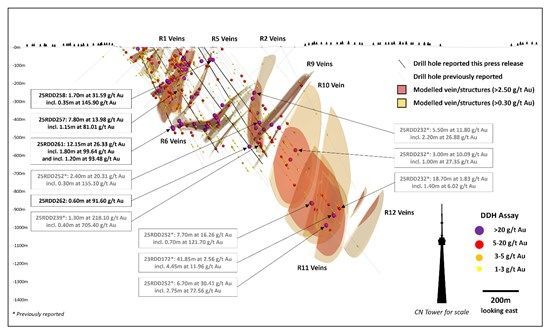

Along the R6 trend, step-out drilling continued to return significant high-grade mineralisation with 25RDD261 intersecting 12.15m at 26.33 g/t Au including 1.80m at 99.64 g/t Au and including 1.20m at 93.48 g/t Au, a 92m step-out at depth towards the north of 23RDD161 which returned 14.35m at 1.97 g/t Au including 1.72m at 8.83 g/t Au*. Infill drilling within R6 returned 14.40m at 3.45 g/t Au including 4.60m at 7.51 g/t Au in 25RDD257, located 65m to the east of 24RDD217 (9.75m at 6.91 g/t Au including 0.95m at 44.99 g/t Au**), and 25RDD264 which returned 4.80m at 9.85 g/t Au including 1.15m at 32.16 g/t Au, 48m west of 24RDD200A (7.55m at 6.19 g/t Au including 1.85m at 17.29 g/t Au**).

Figure 2. Cross section through the Regnault gold system including highlights from this press release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/263601_311c1ebf14415a6d_002full.jpg

Drilling completed during the 2025 program along the R1 trend has reduced drill spacing to approximately 50 metres along significant portions of the R1 vein system, increasing confidence in the current vein models. Highlights from infill drill holes along the R1 mineralised structure include 7.80m at 13.98 g/t Au including 1.15m at 81.01 g/t Au in 25RDD257, 43m west of 24RDD209 (6.50m at 4.93 g/t Au including 1.80m at 14.77 g/t Au**), and 4.50m at 18.06 g/t Au incl. 1.60m at 47.14 g/t Au in 25RDD259, 67m below 23RDD160 (4.04m at 4.65 g/t Au including 0.5m at 29.10 g/t*).

Other significant results from the 2025 winter drill program include 1.70m at 31.59 g/t Au including 0.35m at 145.90 g/t Au from 25RDD258 along R5, a 45m step-out to the east of 24RDD197 (0.85m at 20.15 g/t Au**); drill hole 25RDD255 with 22.40m at 1.99 g/t Au including 0.90m at 24.00 g/t Au, an infill intercept along R9 located 85m down-dip to the west of 24RDD195 (7.85m at 2.32 g/t Au including 0.50m at 16.80 g/t Au**); and 9.00m at 2.58 g/t Au including 0.70m at 17.90 g/t Au from infill dill hole 25RDD260 along R2E, located 80m west of 23RDD159 (9.62m at 4.22 g/t Au including 0.40m at 57.60 g/t Au*).

Step-out and infill drilling during the 2025 winter program has continued to confirm the scale, continuity, and high-grade nature of the Regnault system. Step-out holes returned some of the most significant mineralisation intersected to date, remaining open and highlighting strong potential for growth at depth. Geological and vein models are being updated to guide targeting for the 2025 summer drill campaign and support advancement toward a maiden mineral resource estimate, expected in late 2025 or early 2026.

Figure 3. Core photo of R6 vein in hole 25RDD261: 12.15m at 26.33 g/t Au including 1.80m at 99.64 g/t Au and including 1.20m at 93.48 g/t Au

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/263601_311c1ebf14415a6d_003full.jpg

(*See press release May 31, 2023)

(**See press release June 18, 2024)

(***See press release June 17, 2025)

Operatorship Transfer and Mineral Resource Estimate

Kenorland announces the transfer of operatorship of the Frotet Project to Sumitomo Metal Mining Canada Ltd. ("Sumitomo"). The Company will remain involved on a consulting basis and retains records access rights, enabling continued reporting on exploration progress, including drill results and technical studies. Kenorland and Sumitomo have engaged an independent consulting firm to author a maiden Mineral Resource Estimate for the Regnault gold system at the Frotet Project, which will provide an independent statement, prepared in accordance with National Instrument 43-101, of the size, grade, and confidence level of the mineralisation. The supporting technical report will be filed by Kenorland on its SEDAR+ profile, marking a key milestone to inform future economic studies and potential development of the Regnault gold system.

Table 1. Table of assay results from 2025 winter drill program

| HOLE ID | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Residual Au (g/t) | |

| 25RDD253 | 415.45 | 416.10 | 0.65 | 54.15 | 80.57 | ||

| 25RDD254 | 22.25 | 22.65 | 0.40 | 20.60 | 10.50 | ||

| 476.00 | 482.50 | 6.50 | 1.91 | 1.88 | |||

| 25RDD255 | 214.40 | 214.80 | 0.40 | 16.50 | 18.90 | ||

| 352.50 | 364.00 | 11.50 | 0.80 | 0.74 | |||

| 606.00 | 628.40 | 22.40 | 1.99 | 2.77 | 1.07 | ||

| Incl. | 618.65 | 619.55 | 0.90 | 24.00 | 31.60 | ||

| 638.30 | 644.90 | 6.60 | 1.26 | 1.70 | |||

| 25RDD256 | 335.70 | 339.90 | 4.20 | 1.42 | 1.34 | ||

| 584.60 | 587.60 | 3.00 | 2.64 | 1.99 | 1.87 | ||

| Incl. | 585.65 | 586.20 | 0.55 | 6.09 | 4.00 | ||

| 25RDD257 | 241.90 | 248.30 | 6.40 | 1.08 | 1.07 | ||

| 283.00 | 290.80 | 7.80 | 13.98 | 9.25 | 2.39 | ||

| Incl. | 283.90 | 285.05 | 1.15 | 81.01 | 51.97 | ||

| 296.80 | 305.50 | 8.70 | 0.95 | 0.76 | |||

| 396.00 | 399.80 | 3.80 | 1.52 | 0.92 | |||

| 526.70 | 541.10 | 14.40 | 3.45 | 3.38 | 1.54 | ||

| Incl. | 532.50 | 537.10 | 4.60 | 7.51 | 7.58 | ||

| 554.00 | 567.00 | 13.00 | 1.19 | 1.20 | |||

| 605.00 | 611.30 | 6.30 | 1.09 | 1.16 | |||

| 682.40 | 685.60 | 3.20 | 2.49 | 1.23 | 1.02 | ||

| Incl. | 682.40 | 682.70 | 0.30 | 16.70 | 9.10 | ||

| 25RDD258 | 85.00 | 86.70 | 1.70 | 31.59 | 9.15 | 1.96 | |

| Incl. | 86.35 | 86.70 | 0.35 | 145.90 | 39.10 | ||

| 447.60 | 451.15 | 3.55 | 1.52 | 1.32 | |||

| 608.00 | 618.65 | 10.65 | 0.53 | 0.40 | |||

| 637.75 | 642.50 | 4.75 | 1.18 | 0.94 | |||

| 25RDD259 | 208.00 | 208.75 | 0.75 | 7.24 | 6.60 | ||

| 405.80 | 410.30 | 4.50 | 18.06 | 25.92 | 2.02 | ||

| Incl. | 408.70 | 410.30 | 1.60 | 47.14 | 70.07 | ||

| 427.50 | 432.55 | 5.05 | 1.28 | 0.70 | |||

| 462.50 | 467.00 | 4.50 | 1.49 | 1.49 | |||

| 496.00 | 513.50 | 17.50 | 1.15 | 0.86 | |||

| 662.00 | 666.15 | 4.15 | 3.95 | 4.91 | 1.36 | ||

| Incl. | 665.25 | 665.55 | 0.30 | 37.20 | 47.10 | ||

| 718.55 | 728.60 | 10.05 | 1.36 | 1.17 | 1.09 | ||

| Incl. | 725.55 | 726.00 | 0.45 | 7.13 | 3.50 | ||

| 900.80 | 901.50 | 0.70 | 42.70 | 24.50 | |||

| 936.00 | 939.00 | 3.00 | 3.61 | 2.46 | |||

| 25RDD260 | 374.00 | 383.00 | 9.00 | 2.58 | 2.71 | 1.29 | |

| Incl. | 382.30 | 383.00 | 0.70 | 17.90 | 17.90 | ||

| 25RDD261 | 9.00 | 9.40 | 0.40 | 23.10 | 15.50 | ||

| 219.90 | 220.60 | 0.70 | 12.50 | 15.70 | |||

| 450.00 | 454.00 | 4.00 | 2.18 | 2.83 | |||

| 500.15 | 512.30 | 12.15 | 26.33 | 39.69 | 3.10 | ||

| Incl. | 505.80 | 507.60 | 1.80 | 99.64 | 149.11 | ||

| And Incl. | 510.20 | 511.40 | 1.20 | 93.48 | 136.42 | ||

| 25RDD262 | 456.50 | 461.30 | 4.80 | 1.90 | 1.84 | ||

| 704.10 | 704.70 | 0.60 | 91.60 | 19.90 | |||

| 25RDD263 | 342.30 | 348.35 | 6.05 | 1.66 | 1.79 | ||

| 457.10 | 460.50 | 3.40 | 2.98 | 2.43 | 2.06 | ||

| Incl. | 458.80 | 459.25 | 0.45 | 9.07 | 6.10 | ||

| 25RDD264 | 177.50 | 180.00 | 2.50 | 4.98 | 3.09 | 1.60 | |

| Incl. | 179.50 | 180.00 | 0.50 | 18.50 | 11.00 | ||

| 196.00 | 204.00 | 8.00 | 1.28 | 0.65 | |||

| 270.15 | 271.65 | 1.50 | 9.78 | 5.19 | 1.78 | ||

| Incl. | 270.15 | 271.00 | 0.85 | 15.90 | 8.40 | ||

| 286.85 | 293.00 | 6.15 | 1.21 | 0.80 | |||

| 340.50 | 347.10 | 6.60 | 1.33 | 1.18 | |||

| 366.90 | 371.20 | 4.30 | 1.98 | 1.94 | 1.07 | ||

| Incl. | 369.35 | 369.70 | 0.35 | 12.30 | 13.90 | ||

| 489.00 | 493.80 | 4.80 | 9.85 | 9.32 | 2.82 | ||

| Incl. | 492.65 | 493.80 | 1.15 | 32.16 | 32.13 | ||

| 627.10 | 632.35 | 5.25 | 1.10 | 0.98 | |||

| 726.35 | 728.85 | 2.50 | 3.04 | 2.60 | |||

| 25RDD265 | 14.70 | 16.20 | 1.50 | 4.23 | 1.21 | ||

| 86.50 | 95.10 | 8.60 | 0.60 | 0.49 | |||

| 227.00 | 230.00 | 3.00 | 5.03 | 2.80 | |||

| 262.70 | 265.35 | 2.65 | 10.26 | 7.53 | 1.97 | ||

| Incl. | 264.40 | 265.00 | 0.60 | 38.60 | 25.50 | ||

| 456.80 | 469.50 | 12.70 | 0.87 | 0.82 | |||

| 521.10 | 523.60 | 2.50 | 7.16 | 6.40 | 1.16 | ||

| Incl. | 521.55 | 522.70 | 1.15 | 14.21 | 12.86 | ||

† Assay intervals reported are core lengths, true widths have not been determined

‡ Residual Au (g/t) represents the average grade of the drill hole interval excluding the highlighted internal interval

Table 2. Drill collar table of reported drill holes from the 2025 winter drill program

| Hole ID | Easting (NAD83) | Northing (NAD83) | Elevation (m) | Depth (m) | Dip | Azimuth |

| 25RDD253 | 519311 | 5620320 | 374.0 | 549.00 | -56 | 151 |

| 25RDD254 | 519716 | 5620827 | 373.2 | 534.00 | -57 | 161 |

| 25RDD255 | 519471 | 5620634 | 374.7 | 743.50 | -58 | 161 |

| 25RDD256 | 519290 | 5620473 | 374.2 | 660.00 | -56 | 155 |

| 25RDD257 | 519535 | 5620938 | 373.7 | 708.00 | -59 | 165 |

| 25RDD258 | 519441 | 5620587 | 374.4 | 678.00 | -54 | 153 |

| 25RDD259 | 519724 | 5621053 | 374.2 | 999.00 | -61 | 160 |

| 25RDD260 | 519055 | 5620450 | 374.5 | 579.00 | -46 | 156 |

| 25RDD261 | 519408 | 5620986 | 375.5 | 543.00 | -66 | 151 |

| 25RDD263 | 519073 | 5620488 | 374.3 | 489.00 | -54 | 155 |

| 25RDD262 | 519447 | 5620760 | 374.3 | 831.00 | -52 | 158 |

| 25RDD264 | 519676 | 5620979 | 373.0 | 927.00 | -62 | 162 |

| 25RDD265 | 519734 | 5621135 | 374.0 | 624.00 | -66 | 160 |

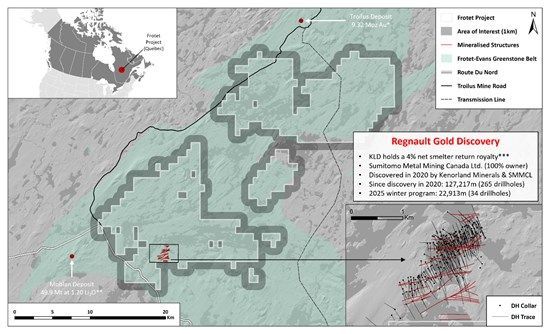

About the Frotet Project

The Project covers 39,365 hectares of the Frotet-Evans greenstone belt within the Opatica geological sub-province of Quebec. The property is adjacent to the past-producing Troilus Gold Corporation's Au-Cu mine (9.32Moz Au indicated resource) and covers several major deformation zones associated with known orogenic gold prospects, as well as stratigraphy hosting VMS deposits elsewhere in the belt. Kenorland initially staked the Project in 2017 and then entered into a joint venture and earn-in agreement with Sumitomo in 2018.

The Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo in 2020 following two years of systematic exploration. Since the initial discovery, Regnault has seen extensive exploration, totaling 127,217 metres of drilling (265 drill holes).

On February 19, 2024, Kenorland closed a transaction to exchange its 20% participating interest in the Frotet Joint Venture with Sumitomo to a 4% NSR Royalty.

The Project is located 100 kilometres to the north of Chibougamau, Quebec. Favorable infrastructure exists in the project area with an extensive forestry road network as well as the Route-du-Nord crossing the southwestern portion of the property. A power transmission line also crosses through the property which supplied power to the past producing Troilus mine.

Figure 4. Frotet Project, Quebec: 4% NSR Royalty

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/263601_311c1ebf14415a6d_004full.jpg

*Technical Report and Mineral Resource Estimate on the Troilus Gold-Copper Project, Mineral Resources Effective Date: 02 October 2023

** Mineral Resource Estimate on Moblan Lithium Project, Mineral Resources Effective Date: 21 March, 2023

***The Frotet Royalty is subject to the following buy down rights in favour of Sumitomo:

A 0.25% royalty interest may be purchased for a C$3,000,000 cash payment to Kenorland within five (5) years of the grant of the Frotet Royalty

A 0.50% royalty interest may be purchased for a C$10,000,000 cash payment to Kenorland within ten (10) years of the grant of the Frotet Royalty

In the event Sumitomo exercises the foregoing buy down rights, the Frotet Royalty would be reduced to an uncapped 3.25% net smelter return royalty on all minerals extracted from the Project

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to Bureau Veritas Commodities ("BV") laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program were carried out by BV. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm (10 mesh) and a 250g split was pulverized to 75μm (200 mesh) for analysis and then assayed for gold. Gold in samples were analyzed using BV method FA430 where a 30g split is analyzed with fire assay by Pb collection and AAS finish. Over-limits gold samples were re-analyzed using BV method FA530 where a 30g split is analyzed with fire assay by Pb collection and gravimetric finish. Multi-element geochemical analysis (45 elements) was performed on all samples within the mineralised zones and alteration halos using BV method MA200 where a 0.25g split is by multi-acid digest with ICP-MS/ES finish. All results passed the QA/QC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Person

Cédric Mayer, M.Sc., P.Geo. (OGQ #02385), Senior Project Geologist at Kenorland, "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSXV: KLD,OTC:KLDCF) is a well-financed mineral exploration company focused on project generation and early-stage exploration in North America. Kenorland's exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including option to joint venture agreements. Kenorland holds a 4% net smelter return royalty on the Frotet Project in Quebec which is owned by Sumitomo Metal Mining Canada Ltd. The Frotet Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo Metal Mining Canada Ltd. in 2020. Kenorland is based in Vancouver, British Columbia, Canada.

Further information can be found on the Company's website www.kenorlandminerals.com.

On behalf of the Board of Directors,

Zach Flood

President, CEO & Director

For further information, please contact:

Alex Muir, CFA

Corporate Development and Investor Relations Manager

Tel +1 604 568 6005

info@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects", "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263601