June 11, 2025

Juggernaut Exploration (TSXV: UGR,OTCQB:JUGRF,FSE:4JE) is a precious metals exploration company focused on British Columbia’s Golden Triangle — a world-renowned region for high-grade gold, VMS, and porphyry systems.

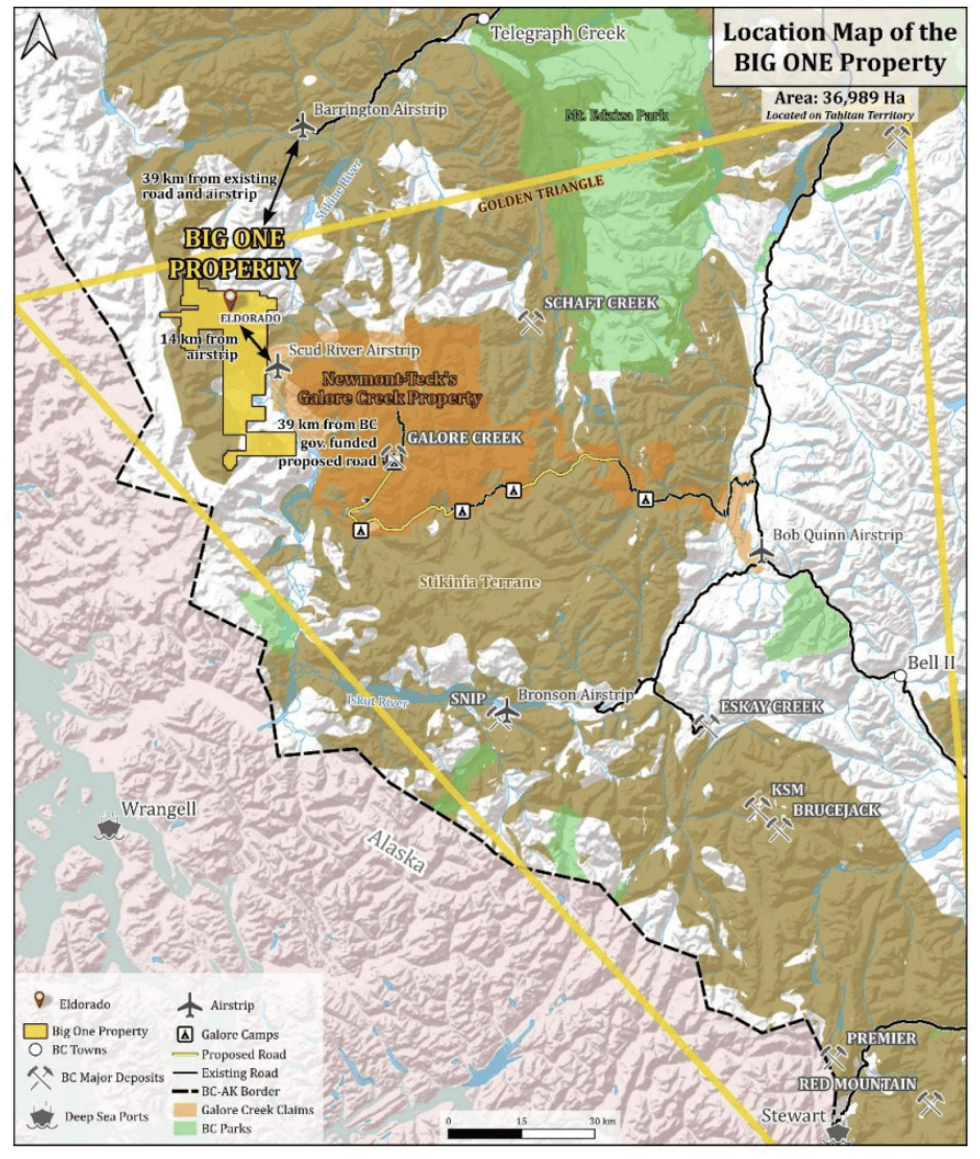

The company operates in a stable, well-developed area, near Newmont’s Galore Creek project and close to key roads and air access.The company holds 100 percent ownership of three key projects — Big One, Midas, and Bingo — spanning nearly 60,000 hectares in the heart of British Columbia’s most mineral-rich belt.

Juggernaut Exploration is on aggressive exploration at the flagship Big One project, where the rapid retreat of glacial cover recently revealed over 200 mineralized veins in just a few days. Early results, combined with compelling geophysical and geochemical indicators, suggest the presence of a large, buried porphyry system with significant discovery potential.

The Big One project is Juggernaut’s flagship asset and the centerpiece of its 2025 exploration campaign. Situated in the heart of British Columbia’s renowned Golden Triangle, the project covers 36,989 hectares of highly prospective ground, with 95 percent of the property still unexplored, offering substantial discovery upside.

Company Highlights

- The Big One property has uncovered an 11-km gold-rich porphyry system, described as a “highway of gold,” adjacent to Newmont’s $100 billion Galore Creek project.

- Founded by the team behind Goliath Resources, which returned 2,400 percent to early investors in just 20 months. Juggernaut is supported by world-renowned geologist Dr. Quinton Hennigh.

- Crescat Capital is a cornerstone investor, holding a 19.99 percent stake and providing both financial and technical backing.

- The company controls three 100 percent owned projects – Big One, Midas and Bingo – totaling nearly 60,000 hectares in the heart of the Golden Triangle in British Columbia.

- With $11.5 million recently raised, the 2025 field season is fully funded. The upcoming campaign aims to scale and define the scope of the porphyry system discovered in just five days of boots-on-the-ground work.

- Over 70 percent of the company’s shares are held by management, insiders and accredited investors. The company is debt-free.

JUGR:CC

Sign up to get your FREE

Juggernaut Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

05 January

Juggernaut Exploration

Advancing high-grade precious metals assets in northern BC’s Golden Triangle

Advancing high-grade precious metals assets in northern BC’s Golden Triangle Keep Reading...

9h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Sign up to get your FREE

Juggernaut Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00