November 19, 2023

Ionic Rare Earths Limited (ASX: IXR) (“IonicRE” or “the Company”) is pleased to announce it has received firm commitments to raise $5.9 million by way of a share placement at $0.021 (“Placement”). The Placement was oversubscribed and was strongly supported by both key existing shareholders and new institutional investors.

- IonicRE has received firm commitments to raise $5.9 million in a Placement of approximately 280.9 million shares at $0.021 each;

- Placement includes Director participation of $0.4 million;

- Shareholders to be provided with an opportunity to participate through a Security Purchase Plan

- Funds raised will support:

- Completion of the demonstration plant at the Makuutu Ionic Adsorption Clay Rare Earth Project where first rare earth product is on track to be produced in Q1 2024; and

- Ramp up of the Ionic Technologies’ Magnet Recycling Demonstration Plant to 24/7 continuous operation from early January 2024.

IonicRE Managing Director, Tim Harrison, commented; “The strong response to the raise reflected the potential of the Company as a unique magnet and heavy rare earth development opportunity with the potential to become an end to end vertically integrated rare earth and magnet supply chain participant. The recent updates on the Company’s progress of the demonstration plants at Makuutu (ASX: 10 Nov 2023) and the Ionic Technologies' Belfast recycling facility (ASX: 15 Nov 2023) together with continuing advanced discussions to increase its interests in the Makuutu Rare Earth Projects from its current 60% interest augur well for positive news flow in the coming months.”

Placement Details

The Company has received binding commitments from new and existing institutional and sophisticated investors to raise $5.9 million (before costs) through the issue of 280,952,381 fully paid ordinary shares ("Shares") at an issue price of $0.021 per Share, representing a 18.9% discount to the volume weighted average price ("VWAP") over the past 10 trading days. Shares issued under the Placement will be issued utilising the Company’s existing placement capacity pursuant to Listing Rules 7.1 and 7.1A and are expected to be issued on Friday, 24 November 2023. The Shares issued under the Placement will rank equally with IonicRE’s existing Shares quoted on the ASX.

Mr. Sufian Ahmad, a director of the Company, will subscribe for 19,047,619 Shares ($400,000) under the Placement, subject to receiving approval at a General Meeting of Shareholders to be held early in 2024.

Canaccord Genuity (Australia) Limited and MST Financial Services Pty Limited acted as Joint Lead Managers to the Placement.

SPP Details

In addition to the Placement, the Company will offer eligible existing shareholders with a registered address in Australia or New Zealand who were holders of Shares at 7:00pm (AEST) on Friday, 17 November 2023 (the “Record Date”) ("Eligible Shareholders"), the opportunity to apply for New Shares via a non-underwritten Securities Purchase Plan (“SPP”), without incurring brokerage fees. The Company may raise up to $2 million (before costs) under the SPP at the same price as the Placement ($0.021 per Share).

Eligible Shareholders will have the opportunity to apply for up to $30,000 worth of Shares. The Shares issued under the SPP will rank equally with the Company’s existing Shares.

Further information in relation to the SPP, including the terms and conditions, is expected to be made available to Eligible Shareholders on Tuesday, 28 November 2023, together with the SPP Offer Booklet. Eligible Shareholders should review the SPP terms and conditions in full before deciding whether or not to participate in the SPP.

Under the ASX Listing Rules, IonicRE directors are entitled to participate fully in the SPP if they are Australian / New Zealand residents.

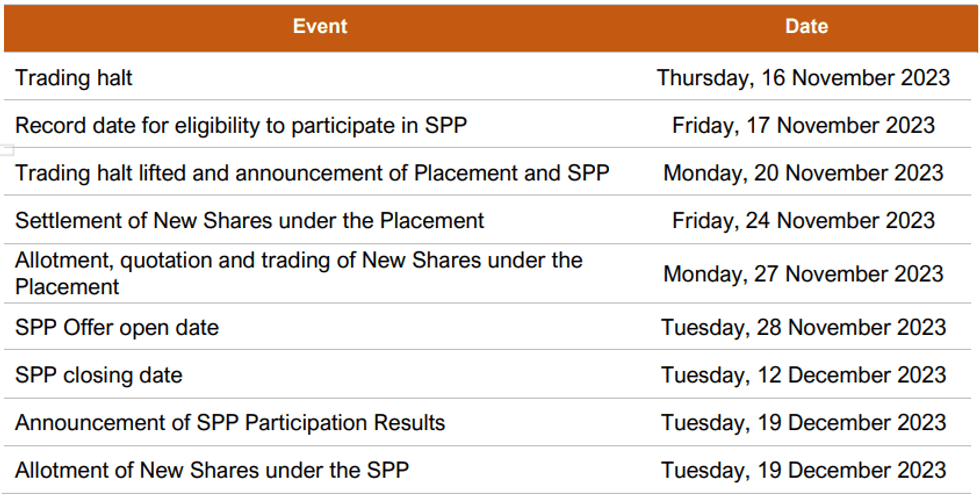

Indicative Timeline

The above timetable is indicative only and subject to change. The Company reserves the right to amend these dates at its absolute discretion, subject to the Corporations Act 2001 (Cth), the ASX Listing Rules and other applicable laws. The quotation of the Shares to be issued pursuant to the SPP is subject to approval from the ASX. The Company reserves the right to withdraw the Placement (or any part of it) or the SPP without notice to you.

Use of Funds

It is the intention of the Company to use the funds raised under both the Placement and the SPP to provide working capital, advance the demonstration plant activities at both the magnet recycling facility in Belfast, Northern Ireland and the Makuutu Rare Earths Project in Uganda, as well as to meet the costs of the issue.

The Joint Lead Managers will receive a fee equal to 6% of the Placement proceeds and 20 million unlisted options with an exercise price of $0.0315 (being a 50% premium to the issue price of Shares under the Placement) and will expire 3 years after the date the options are issued.

All amounts are in Australian dollars unless otherwise specified.

Nothing contained in this announcement constitutes investment, legal, tax or other advice. Investors should seek appropriate professional advice before making any investment decision.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00