November 16, 2023

Antilles Gold Limited (“Antilles Gold”, or the “Company”) (ASX: AAU, OTCQB: ANTMF) is pleased to advise that outstanding copper intercepts have been confirmed by pXRF readings from the latest diamond drill hole into the sulphide mineralization of the El Pilar copper-gold porphyry deposit in central Cuba.

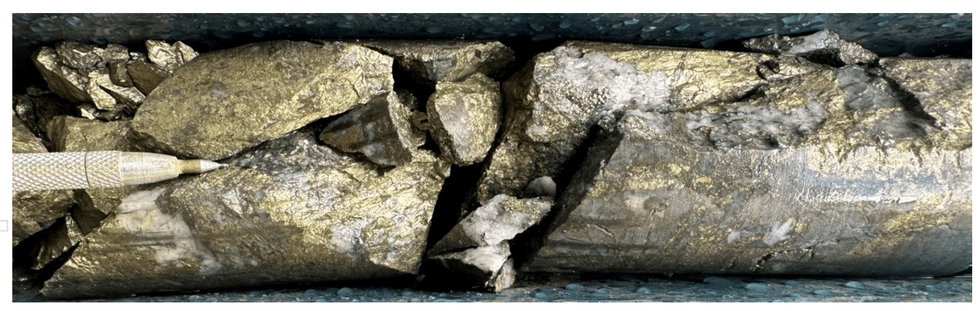

Drillhole PDH 052A has displayed intense porphyry style veining, that is overprinting a mineralized diatreme breccia, located in the extreme SE parts of the El Pilar drilling grid. Copper mineralization is associated with both porphyry style veining and also as breccias within the diatreme and indicates the system is potentially larger to the SE than expected.

HIGHLIGHTS – pXRF Readings29m @ 2.05% Cu from 151m, incl 11m @ 4.70% Cu with 1m interval @ 17.37% Cu

Antilles Gold’s Exploration Director, Dr Christian Grainger, commented, “PDH-052A has shown highly encouraging porphyry style copper mineralization and now we are seeing this associated with diatreme breccia hosted mineralization occurring together, increasing the quantity of mineralization from multiple overprinting hydrothermal events. We are now confident that the system is growing to the SE, where no drilling to date has occurred, and where we are seeing both high grades and widths of mineralization expanding.

The intersection of high grade copper mineralization in sulphides in the southern part of the El Pilar prospect confirmed by the pXRF readings gives us great encouragement for the potential of this prospect. Given the drillhole terminated in chalcopyrite in a fault zone, the porphyry remains open at depth, and future drilling will be aimed at targeting the core of the porphyry body”.

Assays have also been received from seven additional holes in the overlying gold-copper oxide deposit.

HIGHLIGHTS

Gold Domain

PDH-041 | 15m @ 2.10g/t Au from surface |

6m @ 1.19g/t Au from 20m |

Copper Domain

PDH-041 | 5.5m @ 0.6% Cu from 48m |

PDH-042 | 25m @ 0.9% Cu from 45m |

PDH-043 | 5m @ 0.81% Cu from 84m |

PDH-045 | 16m @ 0.71% Cu from 4m |

PDH-046 | 6m @ 0.78% Cu from 53m |

Above results are downhole

Sampling Techniques and Data are set out in the attached JORC Code 2012 Edition Template.

Mr Brian Johnson, Chairman of Antilles Gold, said: “The continuing high copper grades in the El Pilar oxide deposit will be reflected in the MRE for the proposed Nueva Sabana gold-copper mine when published in January 2024, and reinforce the Company’s confidence in commencing construction of the low cap-ex mine in May/June 2024, which is expected to show outstanding returns on funds invested.”

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00