June 10, 2024

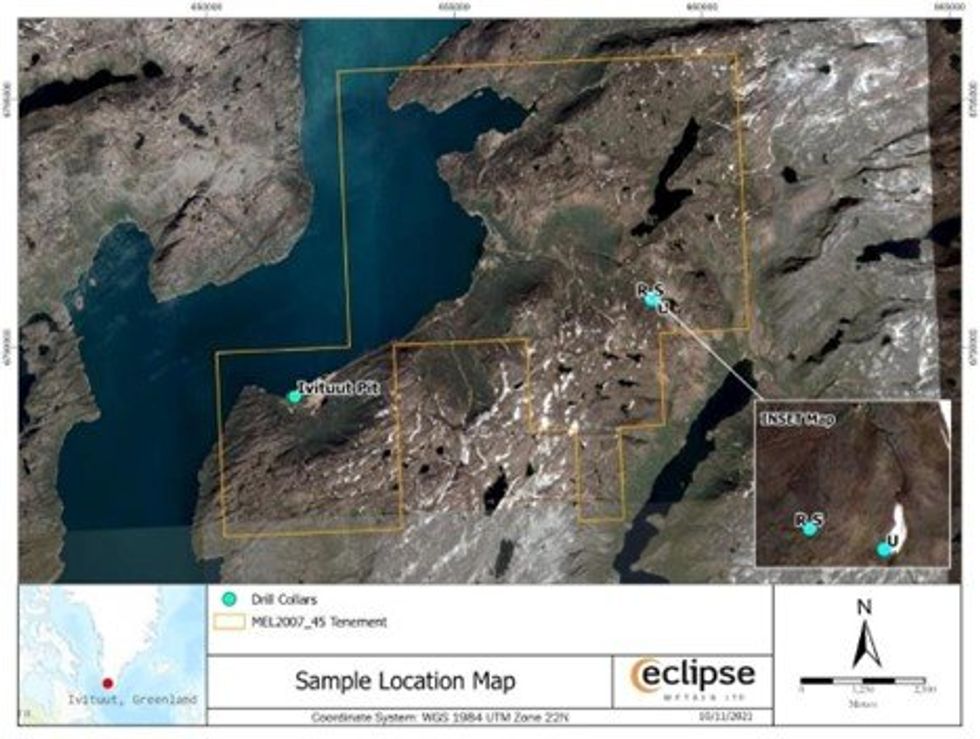

Eclipse Metals Ltd (ASX: EPM) (Eclipse Metals or the Company) is pleased to announce a significant development in its Ivigtût multi-commodity REE Project in southwestern Greenland. The Company has been granted access to 1940s-era archived historical diamond drill core, which has demonstrated high-grade rare earth element (REE) results from initial core samples, as released in November 2021.

Highlights

- Eclipse Metals confirms access to 19,000 metres of historical diamond drill core from the Ivigtût project area in Greenland, including 6 holes drilled to a depth of up to 200m within Gronnedal carbonatite REE mineralisation.

- The company’s access to this drill core will enhance its mineral resource estimation efforts and act as a guide for future drilling within a 3 km by 800 m section of REE carbonatite footprint as well as within the historic Ivigtût mine.

- Previous sampling of historical drill core from Gronnedal carbonatite returned high-grade results of up to 22,695 ppm TREO (Total Rare Earth Oxides), with significant europium values (Eu).

- Assayed samples of drill core from the large quartz target below Ivigtût pit returned silica ranging up to 99.7% SiO2.

- The historical drill core samples will be exported from a Greenland core-shed to European Laboratory for hyperspectral scanning for elemental analysis, to enhance the existing resource size and better understand the deposit at depth.

Core trays carrying about 2,500 metres of the archived drill core from Ivigtût and Gronnedal are in preparation for export from Greenland for comprehensive analytical assessment by a European Laboratory.

This strategic access will enable Eclipse Metals to minimise the costly process of extensive diamond drilling to increase the current mineral resource estimate (MRE) within Gronnedal and allow it to better plan future drilling programs focusing on the 3 km by 800 m section of REE-bearing ferrocarbonatite and the polymetallic Ivigtût pit. Historical holes at Gronnedal were originally drilled to explore magnetite deposits on contact zones of later intrusive dolerite dykes but also intersected carbonatite carrying light and heavy REE.

Modelling of historical exploration data from the Ivigtût cryolite deposit indicates the presence of a 220 m- wide and 90 m-thick cylindrical body of high silica grade, low-impurity quartz below the pit floor as defined by historical drilling (Figure 6). Laboratory analysis of quartz samples determined it can be further purified with a simple acid wash process to substantially increase the grade to 99.9% SiO2. By removing impurities, this has the potential to make this quartz suitable for the high-tech semiconductor industry, further enhancing the value of this industrial mineral project (Figure 7).

Gronnedal REE Carbonatite

Recent work on Eclipse Metals’ Gronnedal rare earth prospect has demonstrated extensive potential for a large mineralised system. Recent findings, including the Gronnedal mineral resource estimate, suggest that rare earth mineralisation extends over a 5 km by 2 km area, with an initial exploration target focusing on a 3 km by 800 m section of ferrocarbonatite. This mineralisation with the presence of significant deposits of rare earth elements, including notably high ratios of neodymium (Nd) and praseodymium (Pr), positions Eclipse’s Ivigtût Project as a potentially vital contributor to the global supply chain of these critical elements within the European territory.

Selected rock-chip samples of core from three of the diamond-cored holes drilled in the Gronnedal carbonatite complex in the 1940s returned very significant analysis for rare earth elements with up to 22,695ppm total rare earth oxides (sample IVT 21 – 3) (Figures 3 and 4), (ASX announcements 15 and 22 November 2021).

Eclipse is now planning to utilise a recently developed, non-destructive procedure to analyse drill core with a cost-effective hyperspectral scan method in Europe. This not only represents substantial future cost- saving but accelerates the timeline for a potential extension of the Gronnedal MRE announced in February 2024, which reported 1.18 million tonnes to a depth of only 9.5 m. The five historical drill holes to be tested range in depth from 58 to 201 m; much deeper than drilling results utilised in the recent MRE.

Recent findings at Gronnedal indicate a large ferrocarbonatite footprint which is significantly mineralised with rare earth elements, including notably high ratios of neodymium (Nd) and praseodymium (Pr) magnetic REE. The grade range for the 3 km by 800 m footprint comprises a notable proportion of magnet REE (neodymium and praseodymium,dysprosium, and terbium), which has the potential to be competitive with other REE projects globally. This positions Eclipse’s Ivigtût project as a potentially vital contributor to the global supply chain of these critical elements.

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00