July 03, 2023

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX Code: AAU, OTCQB: ANTMF, FSE Code: PTJ) is pleased to provide assays from the latest cored drill holes into the El Pilar oxide deposit in central Cuba which, together with previously reported results, reinforce the prospect of developing the proposed Nueva Sabana gold-copper mine.

EL PILAR OXIDE CONCESSION (752 ha)

- The current 7,000m program, together with 1,800m drilled last year, and 24,000m of historic drilling are aimed at establishing the Mineral Resource Estimate ("MRE") for the Nueva Sabana mine for the production of gold, and copper-gold concentrates.

- A total of 24 holes (3,701m) have been drilled by the Company to date, and assays from the latest 5 holes are included in this announcement.

- The collective results support the concept of developing a low cap-ex open pit mine to establish an early cash flow.

HIGHLIGHTS FROM 24 CORED DRILL HOLES

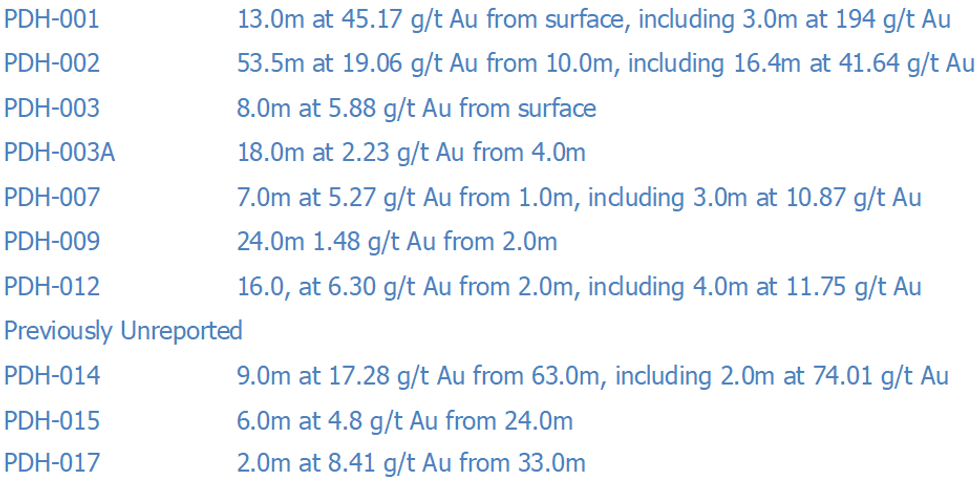

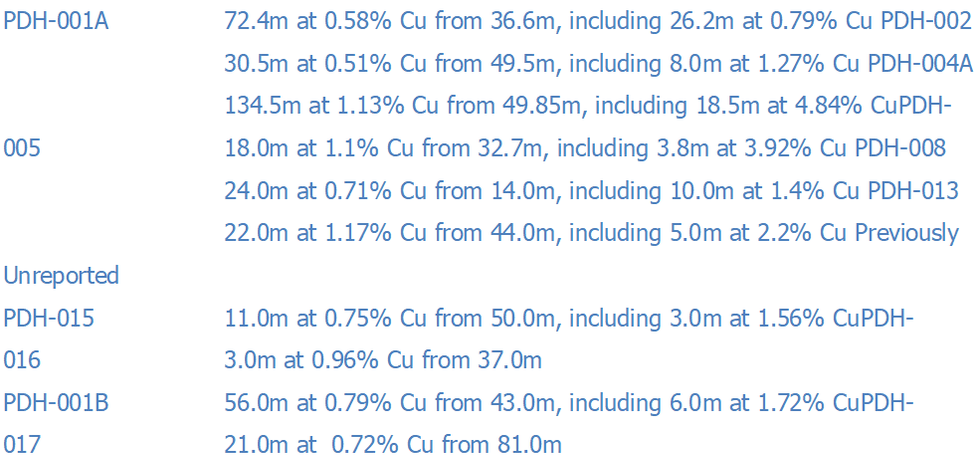

Gold Domain

Copper Domain

Sampling Techniques and Data are set out in the JORC Code 2012 Edition Template attached.

- The gold zones within in the El Pilar oxide deposit are well defined, and the copper zones are increasing in volume both laterally and vertically with continuing exploration, and are expected to project into the underlying porphyry sulphides.

- Metallurgical test work by Blue Coast Research Laboratories in Vancouver has indicated a gold recovery of 85% from a simple rougher flotation circuit, and a concentrate grade of 53.1g/t Au from a 2.11g/t Au head grade.

The development of the Nueva Sabana mine for the El Pilar oxide deposit will benefit from the following;

- Minesite adjacent to HT power mains, water supply, and rail and highway access to the port of Mariel for export of concentrates.

- Flat, unoccupied site close to towns for sourcing workers.

- Resultant low infrastructure costs.

- Initial production of readily saleable gold concentrate from the upper ~50m gold domain.

- Production of in-demand copper-gold concentrate to follow from the lower copper domain, and possibly the underlying copper porphyry halo.

- Flotation circuit achieving excellent recoveries for both gold and copper in current metallurgical test work.

- Mining equipment available from international supplier on a dry-hire basis.

- Estimated development cost of less than US$20 million likely to be financed by concentrate buyer.

- Project could be development ready March 2024, and constructed at the same time as the proposed La Demajagua gold, antimony, silver mine.

The costs of drilling, and other pre-development activities for the proposed Nueva Sabana mine will be credited as part of a US$1.5 million loan from Antilles Gold to the joint venture company, Minera La Victoria SA, which intends to develop the mine.

A US$1.5 million loan has also been provided to Minera La Victoria by the Cuban Government's mining company, GeoMinera SA, resulting from its transfer of the El Pilar oxide concession to the 50:50 joint venture for this amount.

Mr Brian Johnson, Executive Chairman of Antilles Gold, said that the Company would produce an Exploration Target Range for the oxide deposit as soon as possible to provide an indication of the potential size of the Nueva Sabana project, in advance of establishing the MRE.

Click here for the full ASX Release

This article includes content from Antilles Gold Limted, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

1h

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

2h

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

2h

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00