(TheNewswire)

NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC TheNewswire - June 3, 2024 Heritage Mining Ltd. (CSE: HML FRA:Y66) (" Heritage " or the " Company ") is pleased to announce the consolidation of a new land position within the Western Wabigoon totaling ~6,397 Ha through two asset acquisition agreements with PTX Metals Inc. (CSE:PTX) ("PTX Metals") and Shear Gold Exploration Corp. ("Shear Gold"), forming the Scattergood project ("SG"). The Company is also pleased to announce exploration plans for the SG project as well as a corporate update.

Highlights:

-

1) Scattergood Project:

-

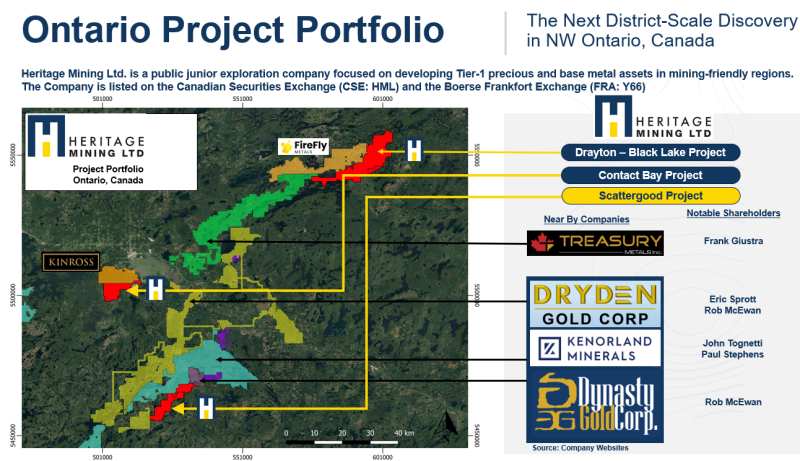

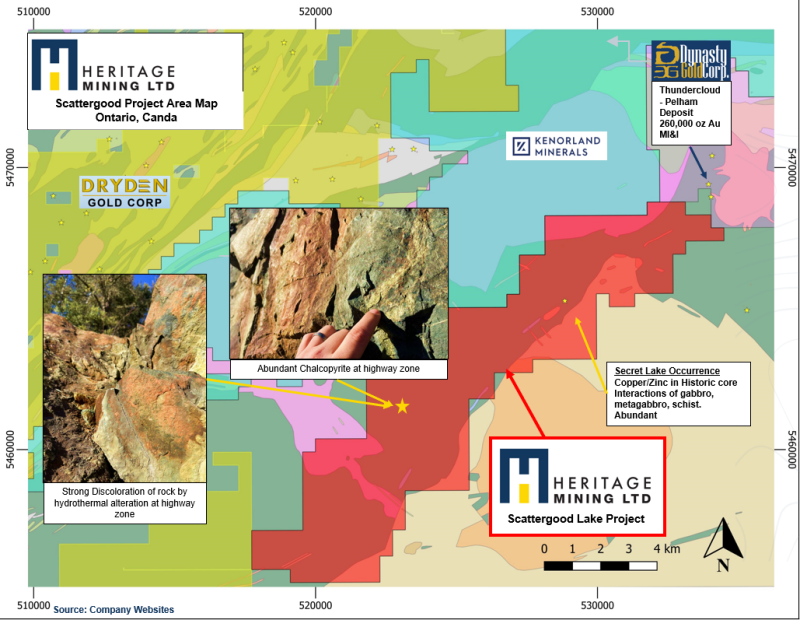

Highly prospective, significant land position along strike of Dynasty Gold's Thundercloud – Pelham Deposit totaling (260,000 oz Au NI 43-101 Resource) totaling ~ 6,397Ha (Figure 1, 2)

-

Numerous intrusives with mineralized contacts in mineralized volcanic host rock effected by complex structural features

-

Discovery potential for Au, Cu, Ni, Zn, PGE

-

Excellent Access by paved highway and logging roads

-

2) Planned 2024 Scattergood Exploration Program:

-

-

Compilation and digitization of historical work, 3D geological model, geophysical interpretation, structural interpretation, prospecting, soil sampling, drill targets, drilling

-

"We are excited to be apart of the rapidly growing Eagle-Wabigoon-Manitou-Stormy Lakes greenstone belt with notable neighbour's such as Dynasty Gold, Dryden Gold and Kenorland Minerals. Our new shareholders by way of acquisition agreement (PTX Metals (CSE:PTX) and Shear Gold Exploration Corp.) chose Heritage Mining to lead the charge on their land packages based on our aggressive and systematic in field programs and experienced technical team.

Furthermore, the structure of the transaction is favorable to current market conditions as there is no minimum spend requirements, enabling Heritage to continue uninterrupted on current priority initiatives while solidifying a new position in a highly sought after area near our current project portfolio.

The Scattergood project has further solidified our position within Northwestern Ontario, Canada totaling over 27,000 Ha within one of the last under explored greenstone belts in Northwestern Ontario, Canada leading into what we believe to be one of the best precious and base metal markets in decades.

We look forward to advancing the project to drill ready status in a systematic manner and providing further updates on our exploration programs in the very near future. Commented Peter Schloo, President, CEO and Director of Heritage.

Figure 1 – Heritage Project Portfolio in Northwestern Ontario, Canada

Figure 2 – Heritage Mining, Scattergood Area Map, Ontario, Canada

Scattergood Project

The Scattergood Project straddles the lower segment of Wapageisi group volcanic rock and felsic intrusive bodies including the Taylor Lake Stock, Meggisi Pluton, and Scattergood Lake stock as well as numerous late stage minor intrusives. Structurally, the project is complex with the north-northeast trending Taylor Lake Fault and Trout River deformation zone running through parts of the property. There is evidence of hydrothermal fluids acting on volcanic rocks indicating an ideal environment for the formation of gold rich ore bodies. This combination of structural features and felsic intrusives within or nearby volcanic rocks are key features to many of the local gold occurrences.

Asset Purchase Agreements Summary – Scattergood Project

Shear Gold Asset Purchase Agreement

Pursuant to an asset purchase agreement with Shear Gold dated May 31, 2024, Heritage agreed to issue C$100,000 in common shares to Shear Gold over an 18 month period ($15,000 on signing, $35,000 in six months from signing and $50,000 in 18 months from signing) together with the grant of a 1.5% NSR (0.5% buyback for C$500,000) for 4,508.28 Ha.

PTX Metals Asset Purchase Agreement

Pursuant to an asset purchase agreement with a subsidiary of PTX Metals dated May 31, 2024, C$100,000 in common shares over an 18 month period ($15,000 on signing, $35,000 in six months from signing and $50,000 in 18 months from signing) together with the grant of a 1.0% NSR (0.5% buyback for C$500,000) for 1,888.72 Ha.

Planned 2024 Scattergood Exploration Program

The 2024 exploration program for this project will include: Compilation and digitization of historical work, 3D geological model, geophysical interpretation, structural interpretation, prospecting, soil sampling, drill targets, drilling.

Corporate Update

The Company has also agreed to issue an aggregate of 1,100,000 common shares, at a deemed price of $0.05 per common share, in full satisfaction of certain contractual obligations.

The Company also signed an agreement with VHLA Media, pursuant to which VHLA Media agreed to provide digital content, marketing, and media distribution services to the Company. Pursuant to the terms of the agreement, such marketing services are to be provided over a one month period, commencing on May 31, 2024, for a fee of $25,000.

Qualified Person

Mitch Lavery P. Geo, Strategic Advisor for the Company, serves as a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has reviewed the scientific and technical information in this news release, approving the disclosure herein.

ABOUT HERITAGE MINING LTD.

The Company is a Canadian mineral exploration company advancing its two high grade gold-silver-copper projects in Northwestern Ontario. The Drayton-Black Lake and the Contact Bay projects are located near Sioux Lookout in the underexplored Eagle-Wabigoon-Manitou Greenstone Belt . Both projects benefit from a wealth of historic data, excellent site access and logistical support from the local community. The Company is well capitalized, with a tight capital structure.

For further information, please contact:

Heritage Mining Ltd.

Peter Schloo, CPA, CA, CFA

President, CEO and Director

Phone: (905) 505-0918

Email: peter@heritagemining.ca

FORWARD-LOOKING STATEMENTS

This news release contains certain statements that constitute forward looking information within the meaning of applicable securities laws. These statements relate to future events of the Company. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "forecast", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe", "outlook" and similar expressions are not statements of historical fact and may be forward looking information. All statements, other than statements of historical fact, included herein are forward-looking statements.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks include, among others, the inherent risk of the mining industry; adverse economic and market developments; the risk that the Company will not be successful in completing additional acquisitions; risks relating to the estimation of mineral resources; the possibility that the Company's estimated burn rate may be higher than anticipated; risks of unexpected cost increases; risks of labour shortages; risks relating to exploration and development activities; risks relating to future prices of mineral resources; risks related to work site accidents, risks related to geological uncertainties and variations; risks related to government and community support of the Company's projects; risks related to global pandemics and other risks related to the mining industry. The Company believes that the expectations reflected in such forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking information should not be unduly relied upon. These statements speak only as of the date of this news release. The Company does not intend, and does not assume any obligation, to update any forward‐looking information except as required by law.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, securities of the Company in Canada, the United States, or any other jurisdiction. Any such offer to sell or solicitation of an offer to buy the securities described herein will be made only pursuant to subscription documentation between the Company and prospective purchasers. Any such offering will be made in reliance upon exemptions from the prospectus and registration requirements under applicable securities laws, pursuant to a subscription agreement to be entered into by the Company and prospective investors.

Copyright (c) 2024 TheNewswire - All rights reserved.