September 20, 2022

GoldHaven Resources (CSE:GOH, OTCQB:GHVNF, FRA:4QS) advances a premium metals portfolio of assets in Canada and Chile. The company has prospective land packages in British Columbia and Newfoundland (Canada) and also holds assets in Chile’s prolific Maricunga Gold Belt. GoldHaven has an experienced management team to efficiently create significant value for investors.

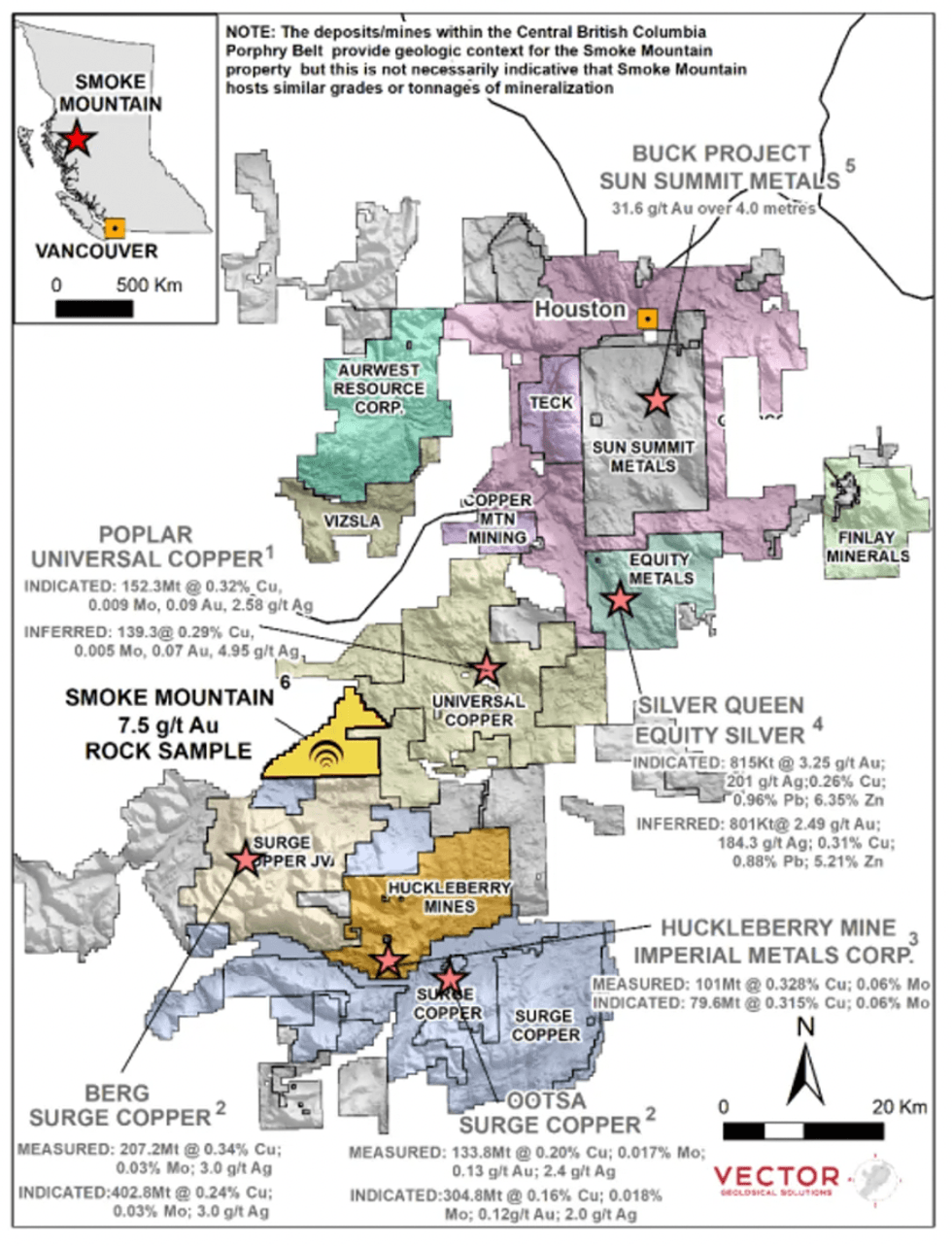

Smoke Mountain is the company’s current flagship project in British Columbia. Smoke Mountain includes a 2.5-kilometre long copper-gold-zinc mineralization trend that has assays of 7.5 g/t gold in initial rock sampling. GoldHaven's claims are contingent on other projects that have already yielded high grades of gold and copper, prompting some to say that this could very well be the next big copper district in North America.

Company Highlights

- GoldHaven Resources is a junior exploration company focusing on gold and copper assets in both Canada and Chile.

- The company’s highly prospective claims neighbour projects with high-grade gold and copper deposits.

- GoldHaven’s projects in British Columbia, Newfoundland and Chile have produced promising, early exploration results, and have the potential to yield significant ore deposits.

- The company’s Smoke Mountain project in BC contains a 2.5-kilometer long copper-gold-zinc mineralization with high-grade assays up to 7.5 g/t gold.

- Pat’s Pond in Newfoundland, located within the province’s prolific Central Gold Belt, had show promising technical indicators and is located in proximity to what will be Atlantic Canada’s largest producing gold mine.

- The company holds claim to some of the most promising ground in the Maricunga Gold Belt in proximity to a number of major discoveries.

- GoldHaven is led by an experienced management team and is supported by a strong technical team of geologists with extensive experience in both Canada and Chile.

This GoldHaven Resources profile is part of a paid investor education campaign.*

GOH:CC

The Conversation (0)

19 September 2022

GoldHaven Resources

Premium Metals Portfolio in Canada & Chile

Premium Metals Portfolio in Canada & Chile Keep Reading...

18h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

23h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00