- Expansion of high-grade gold mineralization at the Mazoa Hill Deposit laterally and to depth: Drill holes will step-out on existing high-grade intercepts.

- Drill-test new exploration prospects: New targets will be drill tested to assess the expansion potential of the Marudi Mountain property.

- Continued Exploration: Induced Polarization (IP) survey will be conducted on the Marudi Mountain property consisting of a minimum of 20-line km, over the Mazoa, Throne and July prospects. Trenching and field mapping will continue throughout the duration of the drill program.

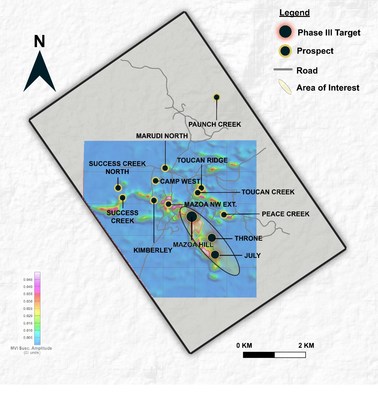

-- (the " Company " or " Golden Shield ") is pleased to announce the commencement of Phase III drilling at the Marudi Mountain property located in southwestern Guyana (the " Marudi Mountain Property "). Drill crews have been mobilized to site, and drilling is underway. Phase III of drilling will target the extension of mineralization at the Mazoa Hill Deposit and the drilling of new exploration targets.

CEO, Hilbert Shields stated, " The continued exploration of the Marudi Mountain Property is currently our priority. Golden Shield's Phase I and Phase II exploration programs confirmed and extended high-grade gold mineralization at the Mazoa Hill deposit. Since June field crews have been working hard to discover new targets, and we are excited by the results, especially at Throne and July ."

Phase III Drilling

The primary objective of the 3000 m , phase III, program of drilling on the Marudi Mountain Property is to extend high-grade gold mineralization at depth and laterally at the Mazoa Hill deposit and test at least two undrilled targets; Throne and July. These new targets were identified by Golden Shield geologists and have been shown to have the same mineralized host lithology, Quartzite-Metachert ('QMC'), as the Mazoa Hill deposit. Prioritization of greenfield drill targets will be based on coincident anomalies in trenching, geophysics, and field exploration data.

Exploration

Field exploration, including trenching, mapping, sampling, and field traverses, will continue while drilling is ongoing at the Marudi Mountain Property. The Company will also be conducting an Induced Polarization (IP) survey. The IP survey aims to map gold-bearing sulfide mineralization on the Marudi Mountain property and will occur between the Mazoa Hill Deposit and the July and Throne prospects. This area has been established as a 1.9 km mineralized trend (see news release dated Sept. 12, 2022 ). The IP survey will be oriented in a NE-SW-direction, perpendicular to the apparent trend of the mineralized host rock. A total of 20-line km are set to be completed on the property. The IP-survey will establish the geophysical signature at depth at Mazoa Hill and based on this, identify similar target areas.

Qualified Person

Leo Hathaway , P. Geo, Executive Chair of Golden Shield , and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified, and approved the scientific and technical information in this news release and has verified the data underlying that scientific and technical information.

About Golden Shield

Golden Shield Resources was founded by experienced professionals who are convinced that there are many more gold mines yet to be found in Guyana . The company is well-financed and has three wholly controlled gold projects: Marudi Mountain, Arakaka and Fish Creek. Golden Shield continues to evaluate other gold opportunities in Guyana .

This news release includes certain "Forward – Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward – looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward – looking statements or information. These forward – looking statements or information relate to, among other things: the exploration and development of the Company's mineral projects; and release of drilling results.

Forward – looking statements and forward – looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Golden Shield , future growth potential for Golden Shield and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Golden Shield's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Golden Shield's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward – looking statements or forward-looking information and Golden Shield has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mineral exploration activities in Guyana ; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company's public disclosure documents available on www.sedar.com . Readers are cautioned against attributing undue certainty to forward – looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated, or intended. The Company does not intend, and does not assume any obligation, to update these forward – looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE Golden Shield Resources

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/20/c2674.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/20/c2674.html