August 12, 2022

Gold Springs Resource Corp. (TSX:GRC)(OTCQB:GRCAF) (the "Company" or "GRC"), has received assays from the final drill holes at South Jumbo as part of the 2022 drill campaign on its large Gold Springs project located in USA, on the border of Nevada and Utah, one of the best mining jurisdictions in the world.

Highlights include:

- 0.83 g/t gold equivalent over 18.3 meters including

1.89 g/t gold equivalent over 6.1 meters in hole E-22-015 - 0.75 g/t gold equivalent over 6.1 meters in hole E-22-017

- 0.53 g/t gold equivalent over 13.8 meters and

0.96 g/t gold equivalent over 6.1 meters in hole E-22-018 - 1.05 g/t gold equivalent over 4.6 meters and

0.74 g/t gold equivalent over 26.0 meters in hole E-22-020

Gold equivalent based on US$1,800/oz gold, US$25/oz silver and 50% for silver recovery.

Randall Moore, Executive Vice President of Exploration, stated:

""These results of our 2022 drill program confirm the significant potential for expansion of our current gold resource at South Jumbo in various directions:

- To the South - hole E-22-015 .

- To the North - hole E-22-020 .

- In the gap zone between the two resource blocks - holes E-22-017 and E-22-018.

GRC has now demonstrated the extension of gold mineralization in three different directions and also at depth. To the North the extension is significant as the hole E-22-020 with 1.05 g/t AuEq over 4.6 meters and 0.74 g/t AuEq over 26 meters is 80 meters north from the existing resource.

Once we update our model, follow-up holes will be planned with the objective to continue to expand gold mineralization in every direction, but especially to the north, towards Central Jumbo."

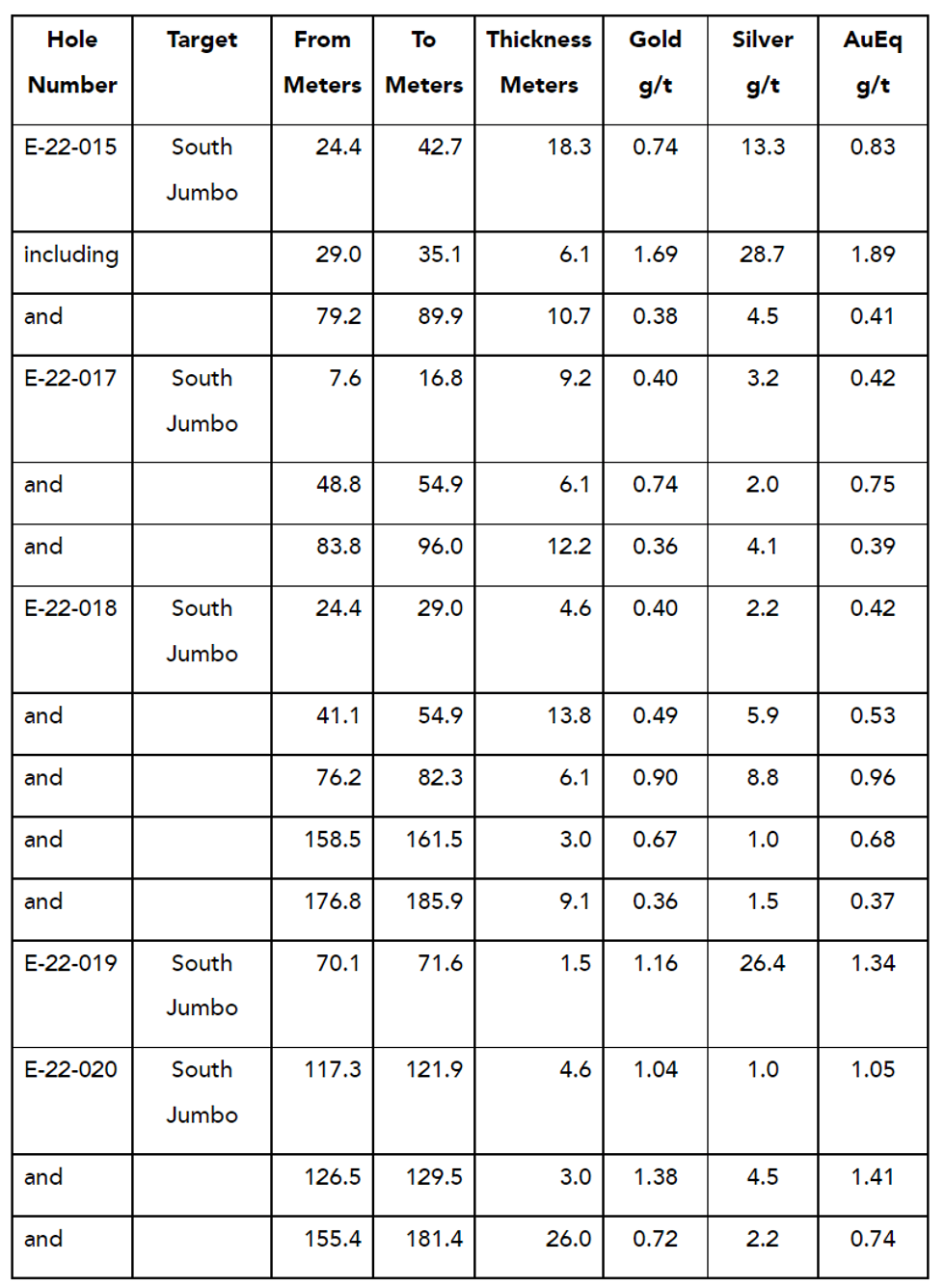

Summary of drill intercepts:

True thickness is estimated to be 70-100% of reported length. Grams per tonne of gold and silver abbreviated as "Au g/t" and "Ag g/t" respectively. Gold equivalent based on US$1,800/oz gold, US$25/oz silver and 50% for silver recovery.

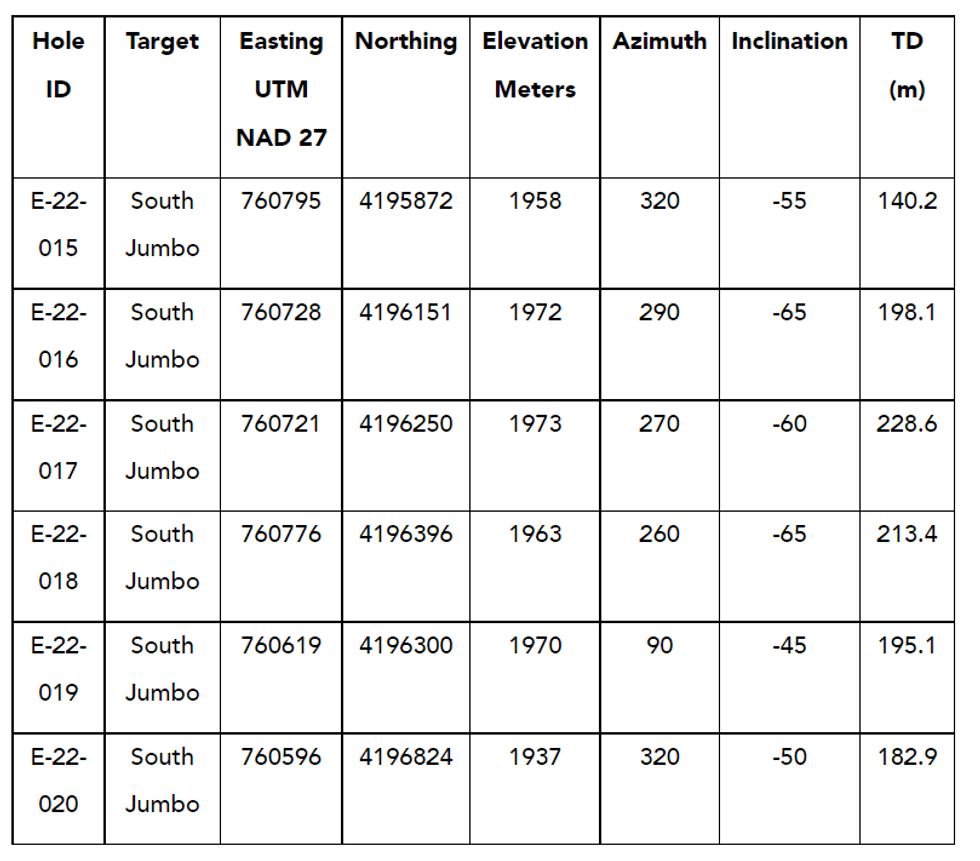

Drill Hole Table

Qualified Person

Randall Moore, Executive Vice-President Exploration, Gold Springs Resource Corp., is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

Quality Assurance and Quality Control

Approximately 7 kg of RC chips were sent to the laboratory for each 1.52 meter drill intervals. Standards and blanks are submitted into the sample stream at the rate of 15% for QA/QC purposes. In addition, the laboratory also includes duplicates of samples, standards and blanks. The results of these check assays are reviewed prior to the release of data. All RC sample assays are also reviewed for their geological context and checked against the drill logs.

Assay Method

Assays were performed in Reno, Nevada by ALS Geochemical, an ISO 9001:2000 certified and independent laboratory. Gold was analyzed by fire assay of a 30-gram sample with an AAS finish with samples assaying greater than 5 g/t re-assayed using a 30-gram sample and a gravity finish. Silver is analyzed by a four-acid leach ICP method.

About Gold Springs Resource Corp.

Gold Springs Resource Corp. (TSX: GRC and OTCQB: GRCAF) is focused on the exploration and expansion of the gold and silver resources of its Gold Springs project located on the border of Nevada and Utah, USA. The project is situated in the prolific Great Basin of Western USA, one of the best mining jurisdictions in the world.

Gold Springs Resource Corp. Contact:

Antonio Canton, President and CEO

acanton@goldspringsresource.com

Forward Looking Statements

Certain statements contained herein constitute "forward-looking information" under applicable Canadian securities laws ("forward-looking statements"). Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements herein include the statement relating to the expansion of the gold resource at South Jumbo and may also include words such as "creating", "believe", "would", "continue", "will", "promising", "should", and similar expressions. These forward-looking statements are based on current expectations and entail various risks and uncertainties. Actual results may materially differ from expectations if known and unknown risks or uncertainties affect our business or if our estimates or assumptions prove inaccurate. Factors that could cause results or events to differ materially from current expectations expressed or implied by the forward-looking statements, include, but are not limited to, risks of the mineral exploration industry which may affect the advancement of the Gold Springs project, including possible variations in mineral resources, grade, recovery rates, metal prices, capital and operating costs, and the application of taxes; availability of sufficient financing to fund planned or further required work in a timely manner and on acceptable terms; availability of equipment and qualified personnel, failure of equipment or processes to operate as anticipated, changes in project parameters, including water requirements for operations, as plans continue to be refined; regulatory, environmental and other risks of the mining industry more fully described in the Company's Annual Information Form and continuous disclosure documents, which are available on SEDAR at www.sedar.com. The assumptions made in developing the forward-looking statements include: the accuracy of current resource estimates and the interpretation of drill, metallurgical testing and other exploration results; the continuing support for mining by local governments in Nevada and Utah; the availability of equipment and qualified personnel to advance the Gold Springs project; execution of the Company's existing plans and further exploration and development programs for Gold Springs, which may change due to changes in the views of the Company or if new information arises which makes it prudent to change such plans or programs.Readers are cautioned not to place undue reliance on the forward-looking statements contained in this press release. Except as required by law, the Company assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or any other reason. Unless otherwise indicated, forward-looking statements in this press release describe the Company's expectations as of the date hereof.

GRC:CA

The Conversation (0)

12h

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

22h

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

02 March

Gold, Silver Prices Spike on US-Iran War

Prices for gold and silver spiked higher over the weekend and in early morning trading on Monday (March 2) as a full-blown war broke out in the Middle East.Tensions between Iran on one side and the US and Israel on the other have been intensifying over the past few weeks. On Sunday (February... Keep Reading...

02 March

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00