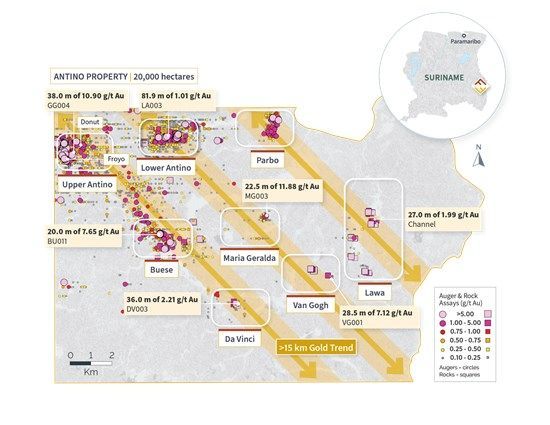

Founders Metals Inc. (TSXV: FDR,OTC:FDMIF) (OTCQX: FDMIF) (FSE: 9DL0) ("Founders" or the "Company") announces significant progress in its surface exploration program at the Antino Gold Project ("Antino" or "Project") in southeastern Suriname. The Company has completed extensive sampling at the Maria Geralda and Parbo targets, setting the stage for upcoming drill programs during the current dry season.

Founders is executing an aggressive exploration strategy targeting high-grade prospects including Maria Geralda, Parbo, Van Gogh, Da Vinci, and Lawa, while systematically expanding known mineralization at Upper Antino, Buese, and Lower Antino.

"Surface exploration continues to build a robust pipeline of high-quality drill targets that our team will systematically test through diamond drilling," said Colin Padget, President and CEO. "The ongoing work at Maria Geralda and Parbo reveals significant opportunities for growth, further validating Antino's Tier 1 potential. Phase two drilling is underway at Maria Geralda, and with the rainy season ending, we're eager to return to Van Gogh, Da Vinci, and Lawa to follow up on earlier drilling success."

Key Surface Exploration Results

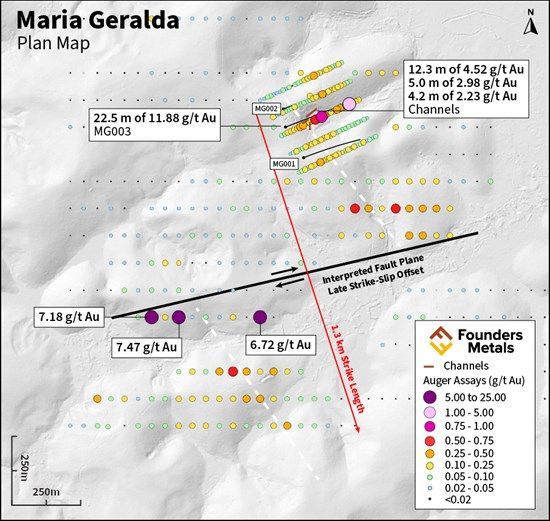

Maria Geralda Target - continues to demonstrate exceptional potential

- 1.3 km strike length of anomalous auger samples with grades reaching up to 7.47 grams per tonne (g/t) gold (Au)

- 516 auger samples collected to-date, including 314 anomalous (≥0.02 g/t Au) results

- Strong hit rate: 61% of samples anomalous, with 25% exceeding 0.1 g/t Au

- Ongoing sampling designed to test the southeastern extension towards Van Gogh

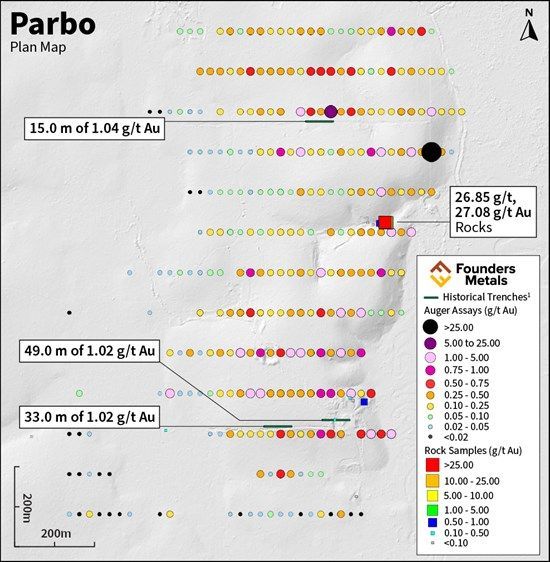

Parbo Target - compelling high-grade vein system within large-scale auger gold anomaly

- Historical1 1,200 x 600-metre (m) auger anomaly with samples up to 51.42 g/t Au

- 1344 historical auger samples with 83% anomalous (>= 0.02 g/t Au) and 46% exceeding 0.1 g/t Au

- Newly discovered 15-metre-wide oxidized shear zone at surface with abundant quartz veining and grab samples grading up to 26.85 g/t Au

- Historical trench results including 49.0 m of 1.02 g/t Au1

- Limited historical drilling intersected up to 12.0 m of 3.36 g/t Au1

- Commencement of auger and trenching programs to refine future Phase 1 drilling targets

Geological Context and Strategy

The Company's exploration strategy targets structures associated with the Central Guiana Shear Zone, a major regional control on gold mineralization. Recent surface work has successfully extended the Maria Geralda anomaly 1.3 kilometres south of the discovery hole (22.5 m core length of 11.88 g/t Au in MG003), with the mineralizing structure remaining open in both directions along strike.

Gold mineralization at Maria Geralda occurs in two distinct styles:

- High-grade shear-hosted mineralization along the contact between metavolcanic-metasedimentary rocks and intrusive complex

- Lower-grade bulk tonnage mineralization within the intrusion itself

At Parbo, surface teams have identified a high-grade vein system within felsic to intermediate intrusive rocks similar to Donut and Lower Antino. Recent mapping and trenching has exposed a 15-metre-wide mineralized shear zone characterized by intense silicification, quartz veining, and sericite alteration, with up to 5% pyrite in brittle fractures—a feature commonly associated with high-grade mineralization elsewhere on the property.

Next Steps

With the dry season now underway, Founders plans to:

- Continue systematic drilling at Maria Geralda with results pending

- Complete auger program at Parbo ahead of Phase 1 diamond drill program in Q4

- Execute surface exploration programs to provide structural context for Phase 2 drilling across other high-priority targets including Van Gogh, Da Vinci and Lawa

The comprehensive exploration approach positions Founders to unlock the full potential of the Antino Gold Project while systematically advancing multiple high-grade targets.

Figure 1: Antino Property Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/263316_4c2278304408e8b9_001full.jpg

Figure 2: Maria Geralda Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/263316_4c2278304408e8b9_002full.jpg

Figure 3: Parbo Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/263316_4c2278304408e8b9_003full.jpg

About Founders Metals Inc.

Founders Metals is a Canadian-based exploration company focused on advancing the Antino Gold Project located in Suriname, South America, in the heart of the Guiana Shield. Antino is 20,000 hectares and has produced over 500,000 ounces of gold from historical surface and alluvial mining to date1. The Company is systematically advancing one of Suriname's most promising gold exploration and development opportunities with drill-confirmed, district-scale potential. Founders is committed to responsible exploration, community engagement, and delivering long-term value to shareholders through technical excellence and strategic growth in the Guiana Shield.

12022 Technical Report - Antino Project; Suriname, South America. K. Raffle, BSc, P. Geo & Rock Lefrançois, BSc, P.Geo.

ON BEHALF OF THE BOARD OF DIRECTORS,

Per: "Colin Padget"

Colin Padget

President, Chief Executive Officer, and Director

Contact Information

Katie MacKenzie, Vice President, Corporate Development

Tel: 306 537 8903 | katiem@fdrmetals.com

Harp Gosal, Director, Investor Relations

Tel: 236 301 4211 | harpg@fdrmetals.com

Qualified Persons

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., an independent qualified person as defined by National Instrument 43-101.

Quality Assurance and Control

Samples were analyzed at FILAB Suriname, a Bureau Veritas Certified Laboratory in Paramaribo, Suriname (a commercial certified laboratory under ISO 9001:2015). Samples are crushed to 75% passing 2.35 mm screen, riffle split (700 g) and pulverized to 85% passing 88 µm. Samples were analyzed using a 50 g fire assay (50 g aliquot) with an Atomic Absorption (AA) finish. For samples that return assay values over 5.0 grams per tonne (g/t), another cut was taken from the original pulp and fire assayed with a gravimetric finish. Founders Metals inserts blanks and certified reference standards in the sample sequence for quality control. External QA-QC checks are performed at ALS Global Laboratories (Geochemistry Division) in Lima, Peru (an ISO/IEC 17025:2017 accredited facility). A secure chain of custody is maintained in transporting and storing of all samples. Drill intervals with visible gold are assayed using metallic screening. Rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding the use of proceeds from the Company's recently completed financings and the Company's prospects. Forward-looking information can generally be identified by words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", or variations indicating that certain actions, events or results "may", "could", "would", "might" or "will" occur or be achieved.

Forward-looking statements are based on management's current expectations and reasonable assumptions but are subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results to differ materially from those expressed or implied, including: general business and economic uncertainties; exploration results; mining industry risks; and other factors described in the Company's most recent annual management discussion and analysis. Although the Company has attempted to identify important factors that could cause actual results to differ materially, other factors may cause results not to be as anticipated. There can be no assurance that forward-looking information will prove accurate, as actual results and future events could differ materially from those anticipated. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All material information on Founders Metals can be found at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263316