- WORLD EDITIONAustraliaNorth AmericaWorld

August 24, 2023

Auric Mining Limited (ASX: AWJ) (Auric or the Company) is pleased to announce that 1,721 ounces of gold has been produced and sold from the first toll milling campaign.

Highlights

- 1,721 ounces gold produced and sold from the first 36,180 tonne ore parcel.

- Average price per ounce of AUD$2,939, generating total gross revenue of $5,057,527.

- Mining of the Stage 1 pit has been completed, ore haulage to the Greenfields Mill ongoing.

- Approximately 145,000 tonnes to be processed in next toll milling program, commencing early September 2023.

- First cash to Auric expected October 2023.

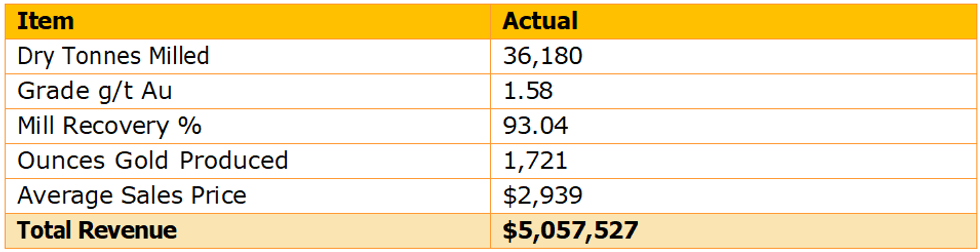

In the first campaign, 36,180 dry tonnes were processed at a reconciled head grade of 1.58g/t for 1,721 ounces gold at a calculated recovery of 93.04%. The head grade in turn reconciles well with estimated mine grade for the ore parcel.

The first stage of mining at Jeffreys Find has been completed. There is approximately 145,000 tonnes of ore remaining to be processed with haulage of ore from Jeffreys Find to the Greenfields Mill ongoing.

The next toll milling campaign is due to start early September 2023. All remaining ore will be processed in one milling program. This is expected to take 6 to 7 weeks.

Production and revenue data:

“This is a tremendous result for Auric, we couldn’t be happier,” said Managing Director Mark English.

“Nevertheless, it’s just the start. The second parcel of approximately 145,000 tonnes will be processed by the Greenfields Mill commencing early September 2023 in one batch, which is also terrific news. We now have confirmation of grade and plant recovery. With a gold price at around AUD$2,950/ounce, Auric will soon receive a substantial cash flow injection”.

“This first phase of mining is playing out well, Jeffreys Find will be very profitable for Auric and BML Ventures Pty Ltd,” said Mr. English.

BML are incurring and paying all mining costs and expenses. After completing the first phase of mining the partners will subtract all costs, including a cash retention for the second stage, before splitting the surplus cash proceeds on a 50:50 basis. This will provide Auric with a substantial cash boost, commencing in October 2023.

The total project life is short and final mining is expected to be completed by the end of 2024/early 2025. The project budgeted for a gold price of AUD$2,600/ounce. A substantially higher gold price, currently AUD$2,950/ounce, has now placed the joint venture in a more favourable position.

Click here for the full ASX Release

This article includes content from Auric Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AWJ:AU

The Conversation (0)

09 August 2024

Auric Mining

Western Australian gold producer, explorer and developer with world-class deposits

Western Australian gold producer, explorer and developer with world-class deposits Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00