Expansionary drilling intersects high-grade silver and gold mineralization near underground mine development. High-grade silver and gold intersection of the new Coronado vein highlights the potential for new Mineral Resource discoveries.

First Majestic Silver Corp. (NYSE: AG) (TSX: AG) (FSE: FMV) (the "Company" or "First Majestic") is pleased to report positive drilling results from its ongoing exploration program at the San Dimas SilverGold Mine, located in Durango, Mexico. The ongoing exploration program was designed to explore for new veins, expand the Mineral Resources, and upgrade Inferred Mineral Resources to Indicated Mineral Resources.

"The 2025 exploration results at San Dimas continue to reinforce its position as a high-quality asset within First Majestic's portfolio of operating mines," stated Keith Neumeyer, President & CEO of First Majestic. "We are realizing strong results from numerous veins at San Dimas near-mine extensions at Elia, Sinaloa, Roberta, and Santa Teresa, and we are excited by the new high-grade silver and gold intercept of the Coronado vein in the West Block. Extensions of historically mined areas remain untested by modern methods, and this speaks to the untapped potential of the district. These new results confirm our view that San Dimas has significant growth opportunities and remains a cornerstone asset for our long-term growth strategy."

KEY DRILLING HIGHLIGHTS

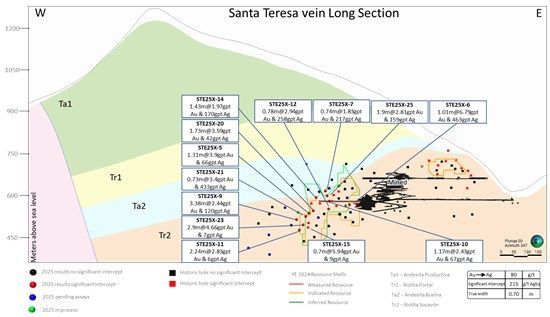

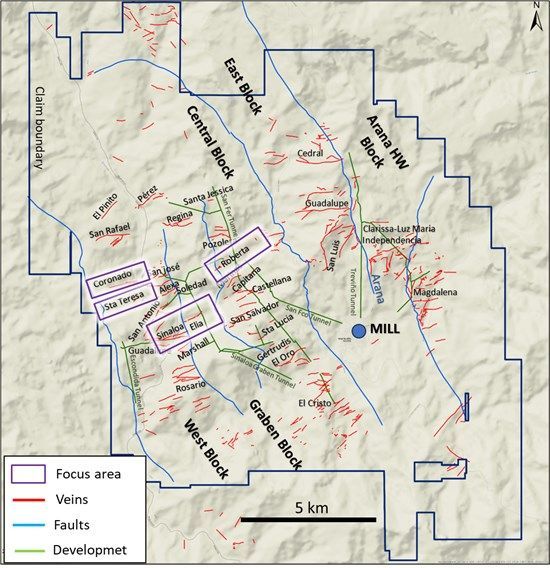

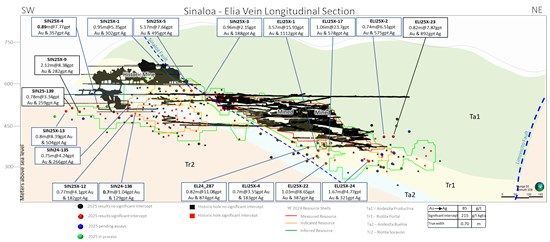

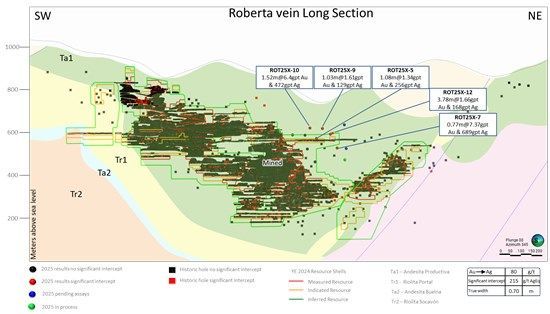

Exploration drilling intersected significant gold ("Au") and silver ("Ag") mineralization in multiple veins across the San Dimas property. A selection of significant drill hole intersections from these veins, namely the Sinaloa-Elia vein, the Roberta vein, the Santa Teresa vein, and the Coronado vein (Figure 1), are highlighted in Table 1 below:

Table 1: Summary of Significant Gold and Silver Drill Hole Intercept Highlights

| Drillhole | Target | Significant Intercept | |||

| From (m) | To (m) | True Length (m) | Metal Grades | ||

| ELI25X-1 | Elia | 273.60 | 279.15 | 3.57 | 15.93 g/t Au and 1,112 g/t Ag |

| SIN25X-5 | Sinaloa | 172.40 | 178.10 | 5.17 | 7.66g/t Au and 495 g/t Ag |

| SJE25-4 | Jessica | 21.75 | 25.55 | 3.20 | 7.86g/t Au and 193 g/t Ag |

| ELI25X-17 | Elia | 312.10 | 313.40 | 1.06 | 23.70 g/t Au and 578 g/t Ag |

| STE25X-20 | Santa Teresa | 220.10 | 224.25 | 2.53 | 9.65 g/t Au and 121 g/t Ag |

| ROT25X-10 | Roberta | 218.75 | 220.55 | 1.52 | 6.40 g/t Au and 472 g/t Ag |

| COR25X-2 | Coronado | 752.60 | 754.75 | 2.12 | 2.59 g/t Au and 327 g/t Ag |

Figure 1: San Dimas District Vein Occurrence Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/262982_68d3f4f994500a33_002full.jpg

Sinaloa-Elia Veins

Drilling at the historic Sinaloa-Elia veins cut multiple intercepts with high-grade gold and silver mineralization. The drill holes expand the known mineralization beyond the current Mineral Resources and confirm the presence of mineralization below historically mined areas along the Sinaloa vein and to the east of the Elia vein (Figure 2). Additional drill holes successfully converted Inferred Mineral Resources to Indicated Mineral Resources effectively de-risking mineralization for near-term mining. Select drill hole assay grades and true width intervals of the vein intersections include:

- ELI25X-1: 3.57 metres ("m") at 15.93 g/t Au and 1,112 g/t Ag;

- SIN25X-5: 5.17 m at 7.66 g/t Au and 495 g/t Ag;

- ELI25X-17: 1.06 m at 23.70 g/t Au and 578 g/t Ag; and

- SIN25X-9: 2.12 m at 8.38 g/t Au and 242 g/t Ag.

Roberta Vein

The Roberta vein is one of the largest past producing veins at San Dimas, and expansionary drilling of the vein explored untested up-dip mineralization continuity outside current Inferred Mineral Resources (Figure 3). Several drillholes yielded significant results, and select assay grades and true width intersections include:

- ROT25X-10: 1.52 m at 6.40 g/t Au and 472 g/t Ag;

- ROT25X-12: 3.78 m at 1.66 g/t Au and 168 g/t Ag; and

- ROT25X-7: 0.77 m at 7.37 g/t Au and 689 g/t Ag.

Santa Teresa Vein

Expansionary drilling to the west of the historic Santa Teresa vein in the Western Block has returned encouraging results along strike, approximately 170 m east of historic mining. The vein projection remains open to the east for ~600 m (Figure 4). Select assay grades and true width vein intersections include:

- STE25X-20: 2.53 m at 9.65 g/t Au and 121 g/t Ag;

- STE25X-9: 3.38 m at 2.44 g/t Au and 120 g/t Ag; and

- STE25X-6: 1.01 m at 6.79 g/t Au and 463 g/t Ag.

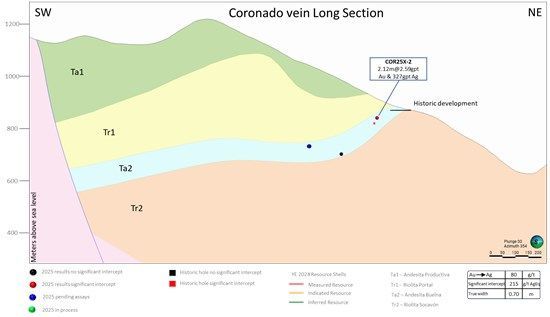

Coronado Vein

The region north of the Santa Teresa vein, within the West Block, is a significant new gold and silver target on the property. The Coronado vein, which trends sub-parallel to the Santa Terea vein, is unexplored by modern methods and represents an important opportunity to identify new Mineral Resources in this area. Early drilling to test the Coronado target in 2025 intersected high-grade gold and silver mineralization and the trend remains open for approximately 1 kilometre to the west (Figure 5). The high-grade true width drill hole intersection includes:

COR25X-2: 2.12 m at 2.59 g/t Au and 327 g/t Ag.

Figure 2: Sinaloa and Elia Veins, Vertical Section. Looking North

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/262982_68d3f4f994500a33_003full.jpg

Figure 3: Roberta Vein, Vertical Section. Looking North

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/262982_68d3f4f994500a33_004full.jpg

Figure 4: Santa Teresa Vein, Vertical Section. Looking North

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/262982_68d3f4f994500a33_005full.jpg

Figure 5: Coronado Vein, Vertical Section. Looking North

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1475/262982_68d3f4f994500a33_006full.jpg

Table 2: Summary of Significant Gold and Silver Drill Hole Intercepts at San Dimas

| Drillhole | Target | Target Type | Significant Intercept | |||||

| From (m) | Length (m) | True length (m) | Au (g/t) | Ag (g/t) | Ag Eq (g/t) | |||

| SIN24_135 | Sinaloa-Elia | Resource conversion | 387.15 | 1.30 | 0.75 | 4.24 | 266 | 626 |

| Include 1 | Resource conversion | 387.15 | 0.45 | 0.26 | 6.63 | 450 | 1014 | |

| Include 2 | Resource conversion | 388.15 | 0.30 | 0.17 | 8.22 | 474 | 1173 | |

| Sinaloa-Elia | Resource conversion | 396.10 | 1.40 | 0.75 | 9.94 | 546 | 1391 | |

| Include 1 | Resource conversion | 397.00 | 1.10 | 0.55 | 12.14 | 658 | 1689 | |

| SIN24_136 | Sinaloa-Elia | Resource conversion | 386.60 | 0.95 | 0.70 | 1.04 | 129 | 217 |

| SIN25_139 | Sinaloa-Elia | Resource addition | 475.60 | 0.95 | 0.78 | 3.34 | 259 | 543 |

| SIN25X-1 | Sinaloa-Elia | Resource conversion | 193.90 | 1.35 | 0.95 | 5.35 | 302 | 757 |

| Include 1 | Resource conversion | 194.45 | 0.80 | 0.57 | 5.95 | 328 | 833 | |

| SIN25X_3 | Sinaloa-Elia | Resource conversion | 67.80 | 1.25 | 0.96 | 2.15 | 188 | 371 |

| SIN25X-4 | Sinaloa-Elia | Resource addition | 407.80 | 1.05 | 0.89 | 7.77 | 357 | 1017 |

| SIN25X-5 | Sinaloa-Elia | Resource conversion | 172.40 | 5.70 | 5.17 | 7.66 | 495 | 1146 |

| Include 1 | Resource conversion | 172.95 | 0.35 | 0.32 | 11.75 | 973 | 1972 | |

| Include 2 | Resource conversion | 174.00 | 0.70 | 0.63 | 7.60 | 686 | 1332 | |

| Include 3 | Resource conversion | 176.35 | 1.75 | 1.59 | 13.07 | 762 | 1873 | |

| SIN25X-9 | Sinaloa-Elia | Resource conversion | 462.95 | 3.00 | 2.12 | 8.38 | 282 | 994 |

| Include 1 | Resource conversion | 462.95 | 2.40 | 1.70 | 9.53 | 325 | 1135 | |

| Vein | Resource conversion | 488.65 | 0.90 | 0.69 | 7.88 | 266 | 936 | |

| SIN25X-12 | Sinaloa-Elia | Resource conversion | 369.10 | 0.85 | 0.77 | 4.10 | 182 | 531 |

| SIN25X-13 | Sinaloa-Elia | Resource addition | 507.60 | 1.40 | 0.80 | 8.39 | 504 | 1217 |

| Include 1 | Resource addition | 508.20 | 0.80 | 0.46 | 11.42 | 646 | 1616 | |

| EL24_287 | HW Vein | Resource conversion | 148.00 | 1.70 | 1.20 | 3.89 | 218 | 549 |

| Include 1 | Resource conversion | 148.00 | 0.85 | 0.60 | 6.22 | 310 | 839 | |

| Sinaloa-Elia | Resource conversion | 244.55 | 0.95 | 0.82 | 11.08 | 874 | 1816 | |

| EL25_297 | HW Vein | Resource addition | 139.30 | 1.15 | 1.00 | 3.12 | 118 | 383 |

| ELI25X-1 | Vein | Resource addition | 2.30 | 1.65 | 1.00 | 2.17 | 148 | 332 |

| HW Vein | Resource addition | 173.60 | 2.20 | 1.75 | 4.38 | 226 | 598 | |

| Include 1 | Resource addition | 174.60 | 1.20 | 0.85 | 5.38 | 333 | 790 | |

| Sinaloa-Elia | Resource addition | 273.60 | 5.55 | 3.57 | 15.93 | 1112 | 2466 | |

| Include 1 | Resource addition | 273.60 | 1.65 | 1.06 | 11.32 | 823 | 1785 | |

| Include 2 | Resource addition | 276.00 | 0.40 | 0.26 | 27.50 | 2218 | 4555 | |

| Include 3 | Resource addition | 277.00 | 2.15 | 1.38 | 25.97 | 1727 | 3935 | |

| FW Vein | Resource addition | 288.05 | 1.55 | 1.05 | 3.34 | 238 | 522 | |

| FW Vein | Resource addition | 297.10 | 1.45 | 1.15 | 6.11 | 219 | 738 | |

| Include 1 | Resource addition | 297.90 | 0.65 | 0.52 | 6.40 | 292 | 836 | |

| ELI25X-2 | Sinaloa-Elia | Resource addition | 406.75 | 1.15 | 0.74 | 6.51 | 575 | 1128 |

| ELI25X-4 | HW Vein | Resource addition | 160.75 | 0.80 | 0.70 | 3.55 | 183 | 485 |

| ELI25X-17 | HW Vein | Resource addition | 185.80 | 5.00 | 2.35 | 4.67 | 289 | 687 |

| Include 1 | Resource addition | 185.80 | 3.60 | 1.69 | 5.71 | 361 | 846 | |

| Sinaloa-Elia | Resource addition | 312.10 | 1.30 | 1.06 | 23.70 | 578 | 2593 | |

| Include 1 | Resource addition | 312.10 | 0.70 | 0.57 | 42.50 | 994 | 4607 | |

| ELI25X-22 | Sinaloa-Elia | Resource addition | 313.00 | 1.80 | 1.03 | 8.65 | 387 | 1122 |

| Include 1 | Resource addition | 313.00 | 0.70 | 0.40 | 19.69 | 809 | 2482 | |

| ELI25X-23 | Sinaloa-Elia | Resource addition | 395.60 | 1.00 | 0.82 | 7.87 | 892 | 1560 |

| ELI25X-24 | HW Vein | Resource conversion | 452.20 | 7.60 | 3.80 | 3.27 | 151 | 429 |

| Include 1 | Resource conversion | 452.20 | 0.80 | 0.40 | 9.30 | 208 | 999 | |

| Sinaloa-Elia | Resource conversion | 469.20 | 2.75 | 1.67 | 4.77 | 321 | 726 | |

| Include 1 | Resource conversion | 470.90 | 1.05 | 0.64 | 6.18 | 440 | 965 | |

| STE25X-4 | Santa Teresa | Resource addition | 78.80 | 1.00 | 0.87 | 1.57 | 107 | 240 |

| Santa Teresa | Resource addition | 82.85 | 1.30 | 1.10 | 1.71 | 118 | 263 | |

| STE25X-5 | Santa Teresa | Resource conversion | 227.45 | 1.60 | 1.31 | 3.90 | 66 | 397 |

| STE25X-6 | Santa Teresa | Resource addition | 96.95 | 1.50 | 1.01 | 6.79 | 463 | 1040 |

| Include 1 | Resource addition | 96.95 | 0.70 | 0.49 | 13.10 | 867 | 1980 | |

| Santa Teresa | Resource addition | 100.05 | 1.25 | 0.88 | 1.59 | 106 | 241 | |

| STE25X-7 | Santa Teresa | Resource addition | 172.75 | 1.05 | 0.74 | 1.83 | 217 | 373 |

| STE25X-9 | Santa Teresa | Resource addition | 268.00 | 3.90 | 3.38 | 2.44 | 120 | 327 |

| Santa Teresa | Resource addition | 276.35 | 2.50 | 2.17 | 2.44 | 78 | 285 | |

| STE25X-10 | Santa Teresa | Resource conversion | 161.10 | 1.35 | 1.17 | 2.43 | 67 | 274 |

| STE25X-11 | Santa Teresa | Resource addition | 279.55 | 3.90 | 2.24 | 2.83 | 6 | 247 |

| STE25X-12 | Santa Teresa | Resource conversion | 163.70 | 0.90 | 0.78 | 2.94 | 258 | 508 |

| STE25X-14 | Santa Teresa | Resource conversion | 198.65 | 1.65 | 1.43 | 1.97 | 170 | 338 |

| STE25X-15 | Santa Teresa | Resource conversion | 252.80 | 0.80 | 0.70 | 5.94 | 9 | 514 |

| STE25X-20 | Santa Teresa | Resource conversion | 209.70 | 2.35 | 1.73 | 3.59 | 42 | 347 |

| Santa Teresa | Resource conversion | 220.10 | 4.15 | 2.53 | 9.65 | 121 | 941 | |

| Include 1 | Resource conversion | 221.25 | 3.00 | 1.85 | 12.00 | 160 | 1180 | |

| STE25X-21 | Santa Teresa | Resource conversion | 172.00 | 0.95 | 0.73 | 3.40 | 433 | 722 |

| STE25X-23 | Santa Teresa | Resource conversion | 271.35 | 4.10 | 2.90 | 4.66 | 7 | 403 |

| Include 1 | Resource conversion | 274.30 | 0.55 | 0.39 | 8.28 | 12 | 716 | |

| STE25X-25 | Santa Teresa | Resource conversion | 167.35 | 2.95 | 1.90 | 2.81 | 159 | 399 |

| ROT25X-2 | HW Roberta | Resource addition | 248.65 | 1.20 | 0.77 | 1.43 | 107 | 229 |

| ROT25X-5 | Roberta | Resource conversion | 187.35 | 1.25 | 1.08 | 1.34 | 256 | 370 |

| ROT25X-6 | Roberta | Resource addition | 831.25 | 0.75 | 0.70 | 1.17 | 175 | 275 |

| ROT25X-7 | Roberta | Resource addition | 231.95 | 1.00 | 0.77 | 7.37 | 689 | 1316 |

| ROT25X-9 | Roberta | Resource addition | 228.95 | 1.60 | 1.03 | 1.61 | 129 | 266 |

| ROT25X-10 | Roberta | Resource addition | 218.75 | 1.80 | 1.52 | 6.40 | 472 | 1016 |

| Include 1 | Resource addition | 218.75 | 0.90 | 0.76 | 9.68 | 693 | 1516 | |

| Roberta | Resource addition | 224.15 | 0.95 | 0.80 | 2.20 | 170 | 357 | |

| ROT25X-12 | Roberta | Resource addition | 231.65 | 5.35 | 3.78 | 1.66 | 168 | 309 |

| Include 1 | Resource addition | 236.30 | 0.70 | 0.49 | 4.78 | 489 | 895 | |

| COR25X-2 | Carme Escobosa | Resource addition | 547.20 | 0.75 | 0.74 | 1.46 | 203 | 327 |

| Coronado | Resource addition | 752.60 | 2.15 | 2.12 | 2.59 | 327 | 547 | |

| Include | Resource addition | 754.00 | 0.75 | 0.74 | 5.64 | 661 | 1140 | |

| COR25X-3 | Carme Escobosa | Resource addition | 485.75 | 1.00 | 0.82 | 1.20 | 209 | 311 |

| SJE25X-4 | Convencion | Resource addition | 41.20 | 2.95 | 1.61 | 0.17 | 307 | 322 |

| Jessica | Resource addition | 222.50 | 1.55 | 0.89 | 2.80 | 451 | 689 | |

| Include 1 | Resource addition | 222.50 | 1.25 | 0.72 | 3.09 | 509 | 772 | |

| SJE25X-5 | Vein | Resource addition | 21.75 | 3.80 | 3.20 | 7.86 | 193 | 861 |

| Include 1 | Resource addition | 22.70 | 2.15 | 1.81 | 11.95 | 253 | 1269 | |

| SJE25X-6 | Convencion | Resource addition | 27.15 | 4.60 | 2.51 | 1.15 | 164 | 262 |

| Jessica | Resource addition | 327.40 | 1.20 | 0.85 | 7.60 | 8 | 653 | |

| SRE25X-3 | Santa Regina | Resource addition | 186.45 | 1.30 | 0.84 | 0.84 | 179 | 250 |

| ROS24_055 | HW Vein-Fault | Resource addition | 102.85 | 1.15 | 0.88 | 7.76 | 1013 | 1673 |

| Include 1 | Resource addition | 102.85 | 0.40 | 0.31 | 18.05 | 2541 | 4075 | |

| Intermedia (Rosario) | Resource addition | 608.35 | 0.95 | 0.75 | 3.10 | 1092 | 1355 | |

| ROS25X-1A | Intermedia (Rosario) | Resource addition | 276.00 | 2.05 | 1.45 | 3.20 | 196 | 468 |

| Include 1 | Resource addition | 276.00 | 0.40 | 0.28 | 6.48 | 380 | 930 | |

| PE24_467 | HW Perez | Resource addition | 545.45 | 1.80 | 1.33 | 0.01 | 283 | 284 |

Notes:

- All holes are Diamond Drill Core; AgEq grade = Ag grade (g/t) + [Au (g/t) * 85].

- From and to length indicated in metres, true width of the intercept is calculated per drill hole and vein angles.

- See Appendix to this news release for details regarding drill hole locations, sample type, azimuth, dip and total depth.

- San Dimas: gold and silver drill hole significant intercepts were composited using the length weighted averages of uncapped sample assays, a 190 g/t AgEq minimum grade (cut-off grade, "COG"), and a minimum composite length of 0.7 m (true width). A maximum of 1 m below the minimum COG was allowed as internal dilution. Where necessary to achieve minimum length, a single sample below the COG but grading >100g/t AgEq was allowed to be composited for short intervals.

- Where present, single samples or intercepts with assay results higher than 700 g/t AgEq are highlighted as "Include" in each intercept.

First Majestic's drill programs follow established Quality Assurance, Quality Control ("QA/QC") insertion protocols with standards, blanks, and duplicates introduced into the sample-stream. After geological logging, all drill core samples are cut in half. One half of the core is submitted to the laboratory for analysis and the remaining half core is retained on-site for verification and reference purposes or for future metallurgical testing.

Core samples are submitted to First Majestic's Central laboratory ("Central laboratory") (ISO 9001:2015). At the Central laboratory, gold is analyzed by 30 g fire assay atomic absorption finish (AU-AA13). Results above 10 g/t are analyzed by 30 g fire assay gravimetric finish (ASAG-14). Silver is analyzed by 3-acid digestion atomic absorption finish (AAG-13). Results above 100 g/t are analyzed by 30 g fire assay gravimetric finish (ASAG-14, ASAG-13).

For further information concerning QA/QC and data verification matters, key assumptions, parameters, and methods used by the Company to estimate Mineral Reserves and Mineral Resources, and for a detailed description of known legal, political, environmental, and other risks that could materially affect the Company's business and the potential development of Mineral Reserves and Mineral Resources, see the Company's most recently filed Annual Information Form available under the Company's SEDAR+ profile at www.sedarplus.ca and the Company's Annual Report on Form 40-F for the year ended December 31, 2024 filed www.firstmajestic.com with the United States Securities and Exchange Commission on EDGAR at www.sec.gov/edgar.

QUALIFIED PERSONS

Gonzalo Mercado, P. Geo., the Company's Vice-President of Exploration and Technical Services and a "Qualified Person" as defined under NI 43-101, has reviewed and approved the scientific and technical information contained in this news release. Mr. Mercado has verified the exploration data contained in this news release, including the sampling, analytical and test data underlying such information.

ABOUT FIRST MAJESTIC

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates four producing underground mines in Mexico: the Los Gatos Silver Mine (the Company holds a 70% interest in the Los Gatos Joint Venture that owns and operates the mine), the Santa Elena Silver/Gold Mine, the San Dimas Silver/Gold Mine, and the La Encantada Silver Mine, as well as a portfolio of development and exploration assets, including the Jerritt Canyon Gold project located in northeastern Nevada, U.S.A.

First Majestic is proud to own and operate its own minting facility, First Mint, LLC, and to offer a portion of its silver production for sale to the public. Bars, ingots, coins and medallions are available for purchase online at www.firstmint.com, at some of the lowest premiums available.

For further information, contact info@firstmajestic.com visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

First Majestic Silver CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking Statements

This news release contains "forward‐looking information" and "forward-looking statements" under applicable Canadian and U.S. securities laws (collectively, "forward‐looking statements"). These statements relate to future events or the Company's future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management's experience and perception of historical trends. Assumptions may prove to be incorrect and actual results and future events may differ materially from those anticipated. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "forecast", "potential", "target", "intend", "could", "might", "should", "believe" and similar expressions) are not statements of historical fact and may be "forward‐looking statements".

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

The Company believes that the expectations reflected in these forward‐looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws.

Cautionary Note to United States Investors

The Company is a "foreign private issuer" as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended, and is eligible to rely upon the Canada-U.S. Multi-Jurisdictional Disclosure System, and is therefore permitted to prepare the technical information contained herein in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the securities laws currently in effect in the United States. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

Technical disclosure contained in this news release has not been prepared in accordance with the requirements of United States securities laws and uses terms that comply with reporting standards in Canada with certain estimates prepared in accordance with NI 43-101.

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning the issuer's material mineral projects.

APPENDIX - DRILL HOLE DETAILS

Table A1: Drill Hole Collar Location, Sample Type, Azimuth, Dip and Total Depth

| Drillhole | East | North | Elev | Azimuth | Dip | Depth (m) | Type |

| SIN24_135 | 399888 | 2666328 | 562 | 273 | -5 | 441 | Core |

| SIN24_136 | 399889 | 2666328 | 562 | 276 | -11 | 486 | Core |

| SIN25_139 | 399740 | 2666103 | 563 | 289 | -6 | 513 | Core |

| SIN25X-1 | 399889 | 2666329 | 562 | 288 | 5 | 309 | Core |

| SIN25X-3 | 399888 | 2666329 | 562 | 285 | 6 | 264 | Core |

| SIN25X-4 | 399739 | 2666103 | 563 | 299 | -7 | 582 | Core |

| SIN25X-5 | 399889 | 2666329 | 562 | 294 | 5 | 207 | Core |

| SIN25X-9 | 399740 | 2666102 | 563 | 293 | -9 | 564 | Core |

| SIN25X-12 | 399740 | 2666104 | 563 | 316 | -12 | 525 | Core |

| SIN25X-13 | 399740 | 2666103 | 563 | 289 | -8 | 534 | Core |

| EL24_287 | 399856 | 2666587 | 450 | 79 | -18 | 429 | Core |

| EL25_297 | 399856 | 2666587 | 450 | 81 | -23 | 321 | Core |

| ELI25X-1 | 399854 | 2666587 | 451 | 70 | -19 | 420 | Core |

| ELI25X-2 | 400317 | 2667087 | 550 | 172 | -19 | 438 | Core |

| ELI25X-4 | 399855 | 2666587 | 450 | 75 | -22 | 429 | Core |

| ELI25X-17 | 399855 | 2666587 | 450 | 66 | -20 | 345 | Core |

| ELI25X-22 | 399855 | 2666587 | 450 | 63 | -25 | 432 | Core |

| ELI25X-23 | 400317 | 2667086 | 550 | 169 | -21 | 423 | Core |

| ELI25X-24 | 399855 | 2666588 | 450 | 64 | -17 | 570 | Core |

| STE25X-4 | 397882 | 2667262 | 578 | 336 | -6 | 114 | Core |

| STE25X-5 | 397881 | 2667260 | 578 | 287 | -10 | 273 | Core |

| STE25X-6 | 397881 | 2667261 | 578 | 320 | -6 | 180 | Core |

| STE25X-7 | 397882 | 2667260 | 578 | 296 | 13 | 237 | Core |

| STE25X-9 | 397881 | 2667260 | 577 | 283 | -14 | 315 | Core |

| STE25X-10 | 397881 | 2667261 | 578 | 300 | 0 | 201 | Core |

| STE25X-11 | 397881 | 2667260 | 577 | 284 | -22 | 330 | Core |

| STE25X-12 | 397881 | 2667260 | 578 | 300 | -9 | 198 | Core |

| STE25X-14 | 397881 | 2667260 | 578 | 290 | 4 | 270 | Core |

| STE25X-15 | 397624 | 2667576 | 577 | 169 | -24 | 351 | Core |

| STE25X-20 | 397881 | 2667260 | 577 | 284 | -14 | 237 | Core |

| STE25X-21 | 397881 | 2667260 | 577 | 286 | -13 | 291 | Core |

| STE25X-23 | 397881 | 2667260 | 577 | 284 | -19 | 315 | Core |

| STE25X-25 | 397881 | 2667260 | 578 | 297 | 7 | 225 | Core |

| ROT25X-2 | 401987 | 2669157 | 431 | 354 | 29 | 321 | Core |

| ROT25X-5 | 401987 | 2669157 | 432 | 18 | 48 | 300 | Core |

| ROT25X-6 | 399596 | 2668348 | 559 | 352 | 12 | 1050 | Core |

| ROT25X-7 | 401988 | 2669157 | 431 | 36 | 25 | 291 | Core |

| ROT25X-9 | 401987 | 2669156 | 432 | 30 | 54 | 276 | Core |

| ROT25X-10 | 401987 | 2669156 | 432 | 5 | 58 | 279 | Core |

| ROT25X-12 | 401987 | 2669156 | 432 | 36 | 44 | 321 | Core |

| COR25X-2 | 397700 | 2667560 | 579 | 339 | 20 | 882 | Core |

| COR25X-3 | 397700 | 2667558 | 578 | 321 | 17 | 522 | Core |

| SJE25X-4 | 401290 | 2671294 | 940 | 341 | -24 | 408 | Core |

| SJE25X-5 | 401286 | 2671292 | 941 | 330 | 30 | 228 | Core |

| SJE25X-6 | 401291 | 2671294 | 940 | 16 | -28 | 459 | Core |

| SRE25X-3 | 399547 | 2670734 | 853 | 179 | 10 | 639 | Core |

| ROS24_055 | 399812 | 2665307 | 951 | 147 | -5 | 663 | Core |

| ROS25X-1A | 399812 | 2665307 | 951 | 158 | -34 | 600 | Core |

| PE24_467 | 400748 | 2671795 | 807 | 342 | -12 | 1050 | Core |

Notes:

- San Dimas: All drill hole collar coordinates are determined using total station equipment after hole completion with UTM WGS84, Zone 13 (metres) as the reference system.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262982